SIF AGREEMENT NO. 811-811217

Exhibit 10.15

STRATEGIC INNOVATION FUND

Satellite Monitoring for Advanced Real Time - Maritime Information

This Agreement made

Between: |

|

|

|

|

HER MAJESTY THE QUEEN IN RIGHT OF CANADA (“Her Majesty”) |

|

|

|

|

|

as represented by the Minister of Industry |

|

|

|

|

|

(the “Minister”) |

|

|

|

And: |

|

|

|

|

exactEarth Ltd., a corporation duly incorporated under the laws of Canada, having its head office located at 260 Holiday Inn Drive, Unit 30, Building B, Cambridge, ON, N3C 4E8. |

|

|

|

|

|

(the “Recipient”) |

RECITALS

WHEREAS

I- The Strategic Innovation Fund (“SIF”) is designed to encourage research and development, and accelerate the technology transfer and commercialization of innovative products, services, and processes; facilitate the growth and expansion of firms; secure economically significant mandates within or to Canada; and, advance industrial research and technology demonstration activities through collaboration;

II- Neither the entering into this Agreement nor the provision by the Minister of the Contribution is contingent upon export performance on the part of the Recipient;

III- the Project is in respect of SIF’s research and development (“R&D”) and commercialization (Stream 1);

IV- the Project involves:

1

SIF AGREEMENT NO. 811-811217

V- The Minister has agreed to make a repayable contribution to the Recipient in support of the Recipient’s Eligible Costs (as defined herein) of the Project;

NOW, THEREFORE in accordance with the mutual covenants and agreements herein, Her Majesty and the Recipient agree as follows:

The purpose of this Agreement is to set out respective obligations and the terms and conditions under which the Minister will provide funding in support of the Project (as defined herein).

2.1 Definitions.

In this Agreement, a capitalized term has the meaning given to it in this section, unless otherwise specified:

“Acquisition or Divestiture” means an acquisition of a business, the sale of a business or a merger or amalgamation.

“Activity” means a significant task that must take place in order to complete the Project. It has duration, during which time the work of that task is performed, and may have resources and costs associated with that task as set out in Form C1- ELIGIBLE COSTS BREAKDOWN of Schedule 1 - Statement of Work.

“Agreement” means this contribution agreement including all the schedules attached hereto, as such may be amended, restated or supplemented, from time to time.

“Affiliated Person” means an affiliated person as defined in the Income Tax Act, as amended.

“Background Intellectual Property” means Intellectual Property that is not Project Intellectual Property and that is required for the carrying out of the Project or the exploitation of the Project Intellectual Property.

“Background Intellectual Property Rights” means the Intellectual Property Rights in Background Intellectual Property.

“Benefits Phase” means the period from the Project Completion Date to and including the last day of the Term.

“Change in Control” of the Recipient means:

2

SIF AGREEMENT NO. 811-811217

“Claim Period” means the following quarters of a calendar year: January 1 to March 31, April 1 to June 30, July 1 to September 30 and October 1 to December 31.

“Contribution” means the funding, in Canadian dollars, made available by the Minister under this Agreement.

“Dispose” means, as regards a Project Asset, the transferring outside Canada, use for a purpose other than research and development by the Recipient, selling, leasing or otherwise disposing including, in the case of a prototype or pilot plant, the transfer to commercial production, but in any event, shall not include abandoning the Project Asset for legitimate business reasons, such as the disposal of obsolete or disused equipment or materials.

“Eligibility Date” means February 13, 2018.

“Eligible Costs” means the costs associated with work performed in Canada, or outside of Canada to the extent explicitly permitted in this Agreement that are incurred and paid by the Recipient in respect of the Project, and in accordance with Schedule 3 - Cost Principles, excluding:

“Event of Default” means the events of default listed in Subsection 14.1 of this Agreement.

“Execution Date” means the date of the last signature to this Agreement such that the Agreement is signed and dated by all Parties.

“Fair Market Value” means the price that would be agreed to in an open and unrestricted market between knowledgeable and willing parties dealing at arm’s length, who are fully informed and not under any compulsion to transact.

“Force Majeure” means any cause which is unavoidable or beyond the reasonable control of the Recipient, including war, riot, insurrection, strikes, or any act of God or other similar circumstance and which could not have been reasonably circumvented by the Recipient without incurring unreasonable cost.

“FTE” or “Full Time Equivalent” means an employee or, where applicable, intern, who works on a full-time basis who works on average 32 hours a week over a 52 week period and, in the case of hourly paid employees or interns who are responsible to work for the Recipient less than on a full-time basis, each equivalent to such a full-time worker, where the number of such

3

SIF AGREEMENT NO. 811-811217

equivalents is calculated by dividing (a) by (b) where (a)= the aggregate of all hours worked by such individuals for the Recipient calculated on an annual basis, and (b) 1668 hours.

“Government Fiscal Year” means the period from April 1 of one year to March 31 of the following year.

“Highly Skilled Jobs” requires specialized training in order to operate, manage or participate in the Project and includes without limitation, software developers, analysts, engineers, and managers.

“Intellectual Property” means all inventions, whether or not patented or patentable, all commercial and technical information, whether or not constituting trade secrets, and all copyrightable works, industrial designs, integrated circuit topographies, and distinguishing marks or guises, whether or not registered or registrable.

“Intellectual Property Rights” means all rights recognized by law in or to Intellectual Property, including but not limited to Intellectual Property rights protected through legislation. These shall include patents, copyrights, industrial design rights, integrated circuit topography rights, rights in trademarks and trade names, all rights in applications and registrations for any of the foregoing, and all rights in trade secrets and confidential information.

“Interest Rate” means the Bank Rate, as defined in the Interest and Administrative Charges Regulations, in effect on the due date, plus 300 basis points, compounded monthly. The Interest Rate for a given month can be found at: http://www.tpsgc-pwgsc.gc.ca/recgen/txt/taux-rates-eng.html

“Master Schedule” means a summary-level Project schedule that identifies the major Activities and work breakdown structure components and Milestones as reflected in Form A of Schedule 1 - Statement of Work.

“Material Change” is a significant change in the scope, objectives, outcomes or benefits of the Project including without limitation, the following:

“Maximum Amount to be Repaid” means 1.3 times the actual amount paid by the Minister to the Recipient under this Agreement.

“Milestone” means a significant point or event in the Project as set forth in Form B of Schedule 1 - Statement of Work.

4

SIF AGREEMENT NO. 811-811217

“Party” means the Minister, or the Recipient, and “Parties” means both of them.

“Post Project Activities” means those activities described in section 6 of this Agreement that will generate benefits to Canada.

“Project” means the project as described in Schedule 1 - Statement of Work.

“Project Asset” means an asset which, in whole or in part, has been acquired, created, developed, advanced and/or contributed to by the Contribution.

“Project Completion Date” means February 12, 2021

“Project Intellectual Property” means all Intellectual Property conceived, produced, developed or reduced to practice in carrying out the Project by the Recipient and/or any Affiliated Persons of the Recipient, or any of their employees, agents, contractors or assigns.

“Project Intellectual Property Rights” means the Intellectual Property Rights in the Project Intellectual Property.

“Public Office Holder” means a public office holder as defined in the Lobbying Act, as amended.

“Resulting Products” means all products, services or processes produced using the Project Intellectual Property or that incorporate any of the Project Intellectual Property.

“Recipient Fiscal Year” means the period for which the Recipient’s accounts in respect of its business or property are prepared for purposes of assessment under the Income Tax Act, as amended.

“Repayment Period” means the repayment period set out in Section 2 of Schedule 5 -Repayments to the Minister.

“Schedule” means a schedule to this Agreement, including any amendments or supplements.

“Similar Goods” means goods or services that closely resemble the goods or services being transferred, in respect of their component materials, form, function and characteristics, and are capable of performing an equivalent function as, and of being commercially interchangeable with, the goods being transferred.

5

SIF AGREEMENT NO. 811-811217

“Technology Readiness Level” or “TRL” means technology readiness according to the Technology Readiness Level scale described below.

Technology Readiness Level |

|

Description |

|

|

|

TRL 1-Basic principles observed and reported |

|

Lowest level of technology readiness. Scientific research begins to be translated into applied research and development (R&D). Examples might include paper studies of a technology’s basic properties. |

|

|

|

TRL 2-Technology concept and/or application formulated |

|

Invention begins. Once basic principles are observed, practical applications can be invented. Applications are speculative, and there may be no proof or detailed analysis to support the assumptions. |

|

|

|

TRL 3-Analytical and experimental critical function and/or characteristic proof of concept |

|

Active R&D is initiated. This includes analytical studies and laboratory studies to physically validate the analytical predictions of separate elements of the technology. |

|

|

|

TRL 4-Product and/or process validation in laboratory environment |

|

Basic technological products and/or processes are tested to establish that they will work. |

TRL 5-Product and/or process validation in relevant environment |

|

Reliability of product and/or process innovations increases significantly. The basic products and/or processes are integrated so they can be tested in a simulated environment. |

|

|

|

TRL 6-Product and/or process prototype demonstration in a relevant environment |

|

Prototypes are tested in a relevant environment. Represents a major step up in a technology's demonstrated readiness. Examples include testing a prototype in a simulated operational environment. |

|

|

|

TRL 7-Product and/or process prototype demonstration in an operational environment |

|

Prototype near or at planned operational system and requires demonstration of an actual prototype in an operational environment (e.g. in a vehicle). |

|

|

|

TRL 8-Actual product and/or process completed and qualified through test and demonstration |

|

Innovation has been proven to work in its final form and under expected conditions. In almost all cases, this TRL represents the end of true system development. |

|

|

|

TRL 9-Actual product and/or process proven successful |

|

Actual application of the product and/or process innovation in its final form or function. |

6

SIF AGREEMENT NO. 811-811217

“Term” means the duration of this Agreement as set out in Subsection 3.2 of this Agreement.

“Work Phase” means the period of time from the Eligibility Date to and including the Project Completion Date.

“Years to Repay” means fifteen (15) years.

2.2 Singular/Plural. Wherever from the context it appears appropriate, each term stated in either the singular or plural shall include the singular and the plural.

2.3 Entire Agreement. Unless amended in writing by the Parties, this Agreement comprises the entire agreement between the Parties in relation to the Project. No prior document, negotiation, provision, undertaking or agreement in relation to the subject matter of this Agreement has legal effect. No representation or warranty, whether express, implied or otherwise, has been made by the Minister to the Recipient, except as expressly set out in this Agreement.

2.4 Inconsistency. In case of inconsistency or conflict between a provision contained in the part of the Agreement preceding the signatures and a provision contained in any of the Schedules to this Agreement, the provision contained in the part of the Agreement preceding the signatures will prevail.

2.5 Schedules. This Agreement contains the following Schedules as described below, which form an integral part of this Agreement:

Schedule 1 |

- |

Statement of Work |

Schedule 2 |

- |

Communications Obligations |

Schedule 3 |

- |

Cost Principles |

Schedule 4 |

- |

Reporting Requirements |

Schedule 5 |

- |

Repayments to the Minister |

3.1 Execution. This Agreement must be signed by the Recipient and received by the Minister within thirty (30) days of its signature by the Minister, failing which it will be null and void.

3.2 Duration of Agreement. This Agreement will commence on the Execution Date and will expire, subject to Subsection 3.3, on the date of the last repayment to the Minister unless terminated earlier in accordance with the terms of this Agreement.

3.3 Survival Period. Notwithstanding the provisions of Subsection 3.2 above, the rights and obligations described in the following Sections or Subsections will survive for a period of One (1) year beyond the Term or early termination of the Agreement:

7

SIF AGREEMENT NO. 811-811217

Section 7 |

|

- |

|

Government Financial Support |

Subsection 8.5 |

|

- |

|

Overpayment by Minister |

Section 9 |

|

- |

|

Reporting, Monitoring, Audit and Evaluation |

Subsection 10.2(c) |

|

- |

|

Disposal of Assets |

Subsection 13.1 |

|

- |

|

Indemnification |

Subsection 13.2 |

|

- |

|

Limitation of Liability |

Section 14 |

|

- |

|

Default and Remedies |

Subsection 17.2 |

|

- |

|

Interest |

Subsection 17.3 |

|

- |

|

Set-off Rights of Minister |

Subsection 17.8 |

|

- |

|

Applicable Law |

4. The Contribution

4.1 Contribution. Subject to the terms and conditions of this Agreement, the Minister agrees to make a repayable Contribution to the Recipient in respect of the

Project in an amount not exceeding the lesser of (a) and (b) as follows:

4.2 Funding Period. The Minister will not contribute to any Eligible Costs incurred by the Recipient prior to the Eligibility Date or after the Project Completion Date. In no event will Eligible Costs incurred prior to the Execution Date exceed twenty percent (20%) of the “Total Estimated Eligible Costs” set out in Form C2 - ESTIMATED COST BREAKDOWN BY FISCAL YEAR of Schedule 1 - Statement of Work.

4.3 Fiscal Year. The payment of the Contribution per Government Fiscal Year is estimated at amounts specified in Form C2 - ESTIMATED COST BREAKDOWN BY FISCAL YEAR of Schedule 1 -Statement of Work. The Minister will have no obligation to pay any amounts in any Government Fiscal Year other than those specified in Form C2 -ESTIMATED COST BREAKDOWN BY FISCAL YEAR of Schedule 1 -Statement of Work. If, for a given Government Fiscal Year, the Recipient claims an amount less than the estimated Contribution for that Government Fiscal Year specified in Form C2 -ESTIMATED COST BREAKDOWN BY FISCAL YEAR of Schedule 1 -Statement of Work, the Minister may consider any request to re-profile the excess funds to future Government Fiscal Years before the Project Completion Date.

4.4 Overruns. The Recipient shall be responsible for all costs of the Project, including cost overruns, if any.

4.5 Holdbacks. Notwithstanding any other provisions of this Agreement, the Minister may, at the Minister’s sole discretion, withhold up to ten percent (10%) of the Contribution until:

8

SIF AGREEMENT NO. 811-811217

5.1 Project Completion Date. The Recipient agrees to carry out the Project in a diligent and professional manner using qualified personnel, and complete same on or before the Project Completion Date.

5.2 Project Location. Except as otherwise permitted as set out in Form D (PROJECT LOCATION AND COSTS) of Schedule 1 - Statement of Work the Recipient agrees to carry out the Project exclusively in Canada.

5.3 Post Project Activities. The Recipient agrees to conduct Post Project Activities exclusively in Canada, until the expiry of the Term.

5.4 Repayment. The Recipient agrees to make all repayments due to the Minister as set out in Schedule 5 - Repayments to the Minister.

5.5 Compliance. The Recipient agrees to satisfy and comply with all other terms, conditions and obligations contained in this Agreement.

6.1 The Recipient agrees and covenants to the following:

9

SIF AGREEMENT NO. 811-811217

6.2 Annual Pre-disbursement Condition. Prior to the first disbursement by the Minister in each Fiscal Year, the Recipient shall confirm in writing to the Minister’s satisfaction, that it has its portion of the Project funding for that Fiscal Year.

7.1 The Recipient represents that the list below states all funding from federal, provincial, territorial or municipal governments in Canada (“Government Funding”), except for investment tax credits (including scientific research and experimental development credits), requested or received by the Recipient or that the Recipient currently expects to request or receive to cover any of the Eligible Costs.

Federal |

$ |

7,206,190 |

Provincial |

$ |

0 |

Territorial |

$ |

0 |

Municipal |

$ |

0 |

|

|

|

Total |

$ |

7,206,190 |

7.2 The Recipient shall inform the Minister of any change to the amount of Government Funding identified in Subsection 7.1 except for tax credits (other than scientific research and experimental development credits), received or expected to be received by the Recipient for the Eligible Costs. Such notice must be made promptly in writing, and in any case not later than thirty (30) days following any change. In the event of additional assistance, the Minister will have the right to

10

SIF AGREEMENT NO. 811-811217

either reduce the Contribution to the extent of any additional funding received by the Recipient or require the Recipient to repay the Contribution hereunder equal to the amount of any such additional funding received by the Recipient in accordance with Subsection 8.5.

7.3 In no instance will the total Government Funding towards Eligible Costs of the Project be allowed to exceed seventy five percent (75%) of total Eligible Costs.

Claims and Payments

8.1 Separate Records. The Recipient shall maintain accounting records that account for the Contribution paid to the Recipient and the related Project costs, separate and distinct from any other sources of funding.

8.2 Claims Procedures. The Minister will reimburse claims for Eligible Costs submitted for a Claim Period, provided there is no Event of Default and the claims are:

11

SIF AGREEMENT NO. 811-811217

8.3 Final Claim Procedures.

The Recipient shall submit, within sixty (60) days after the Project Completion Date, the final claim along with:

8.4 Payment Procedures.

8.5 Overpayment by Minister. Where the Minister determines that the amount of the Contribution disbursed exceeds the amount to which the Recipient is entitled, the Recipient shall repay to the Minister, promptly and no later than thirty (30) days from notice from the Minister, the amount of the overpayment together with interest at the Interest Rate from the date of the

12

SIF AGREEMENT NO. 811-811217

notice to the day of payment to the Minister in full. Any such amount is a debt due to Her Majesty and is recoverable as such.

9.1 Reports. The Recipient agrees to provide the Minister with the reports as described in Schedule 4- Reporting Requirements, to the Minister’s satisfaction.

9.2 Additional Information. Upon request of the Minister and at no cost to the Minister, the Recipient shall promptly elaborate upon any report submitted or provide such additional information as may be requested.

9.3 Minister’s Right to Audit Accounts and Records. The Recipient shall, at its own expense, maintain and preserve in Canada and make available for audit and examination by the Minister or the Minister’s representatives all books, accounts and records relating to this Agreement or the Project held by the Recipient, its Affiliated Persons, agents and contractors and of the information necessary to ensure compliance with the terms and conditions of this Agreement, including repayment to the Minister. The Minister will have the right to conduct such audits at the Minister’s expense as may be considered necessary.

Unless otherwise agreed to in writing by the Minister, the Recipient and its Affiliated Persons, agents and contractors shall maintain and preserve all books, accounts, invoices, receipts and records and all other documentation related to this Agreement until the end of the Recipient Fiscal Year that ends seven (7) years after the fiscal year of the date on which they were created.

9.4 Auditor General Rights. The Recipient recognizes, acknowledges and accepts that the Auditor General of Canada may, at the Auditor General’s cost, after consultation with the Recipient, conduct an inquiry under the authority of subsection 7.1 ( 1) of the Auditor General Act in relation to any funding agreement (as defined in subsection 42 (4) of the Financial Administration Act) with respect to the use of the Contribution received.

For the purposes of any such inquiry undertaken by the Auditor General, the Recipient shall provide, upon request and in a timely manner, to the Auditor General or anyone acting on behalf of the Auditor General,

9.5 Access to Records. The Recipient shall, at all times, ensure that its agents, employees, assigns, contractors, and Affiliated Persons are obligated to provide to the Minister or the Auditor General or their authorized representatives records and other information that are in possession of those agents, employees, assigns, contractors, and Affiliated Persons and that relate to this Agreement or to the use of the Contribution.

13

SIF AGREEMENT NO. 811-811217

9.6 Access to Premises. The Recipient and its Affiliated Persons shall provide the representatives of the Minister reasonable access to premises to inspect and assess the progress of the Project or any element thereof and supply promptly on request such data as the Minister may reasonably require for statistical or Project evaluation purposes.

9.7 Evaluation. The Recipient shall, at its own expense, participate in the preparation of case studies reporting on the outcomes of the Project, to be completed by the Minister or the Minister’s agents, in order to assist in the Minister’s preparation of an overall evaluation of the value and effectiveness of SIF.

10.1 Representations. The Recipient represents and warrants that:

14

SIF AGREEMENT NO. 811-811217

10.2 Covenants. The Recipient covenants and agrees that:

(ii) In the case where the Recipient is a public company, the Recipient shall notify the Minister in writing of any Change in Control no later than thirty (30) days following any Change in Control, and as a result of such Change in Control, the Minister may, at the Minister’s discretion, terminate the Agreement and may require that the Recipient pay to the Minister up to the Maximum Amount to be Repaid;

15

SIF AGREEMENT NO. 811-811217

10.3 Renewal of Representations. It is a condition precedent to any disbursement under this Agreement that the representations, warranties and covenants contained in this Agreement are true at the time of payment and that the Recipient is not in default of compliance with any terms of this Agreement.

11.1 Background Intellectual Property. The Recipient must own the Background Intellectual Property or hold sufficient Background Intellectual Property Rights to permit the Project to be carried out and the Project Intellectual Property to be exploited by the Recipient.

11.2 Project Intellectual Property. Ownership, exploitation and commercialization of the Project Intellectual Property to which the Minister has contributed, and the ownership of Project Intellectual Property Rights therefor, shall remain in Canada for the Term of this Agreement unless otherwise agreed to by the Minister.

11.3 License of Project Intellectual Property. The Recipient agrees not to grant any right or license to, any of the Project Intellectual Property without the prior written consent of the Minister, except in respect of an end-user licensee in conjunction with the sale of Resulting Products.

11.4 Protection of Project Intellectual Property. The Recipient shall take appropriate steps to protect and enforce the Project Intellectual Property. The Recipient shall provide information to the Minister in that regard, upon request.

11.5 Crown Ownership of Intellectual Property. The Crown will not have an ownership interest in the Project Intellectual Property nor will the Crown acquire new rights in Background Intellectual Property by virtue solely of having provided the Contribution. Rights attributed to the Crown in any other way including under the Public Servants Inventions Act are not in any way affected by this Agreement.

12.1 The Recipient represents that the Project is not a “designated project” and is not being carried out on “federal lands” as such terms are defined in the Canadian Environmental Assessment Act, 2012 (“CEAA”).

12.2 The Recipient shall, in respect of the Project, comply with all federal, provincial, territorial, municipal and other applicable laws, including but not limited to, statutes, regulations, by-laws, rules, orders, ordinances and decrees governing the Recipient or the Project, or both, relating to environmental protection and the successful implementation of and adherence to any mitigation measures, monitoring or follow-up program that may be prescribed by the Minister or other

16

SIF AGREEMENT NO. 811-811217

federal, provincial, territorial, municipal tribunals or bodies, and certifies to the Minister that it has done so to date.

12.3 The Recipient will provide the Minister with reasonable access to any Project site for the purpose of ensuring that the terms and conditions of any environmental approval are met, and that any mitigation, monitoring or follow-up measure required has been carried out.

12.4 If as a result of changes to the Project or otherwise, an assessment is required in accordance with CEAA for the Project, the Minister and the Recipient agree that the Minister’s obligations under this Agreement will be suspended from the moment that the Minister informs the Recipient, until (i) a decision statement has been issued to the Recipient or, if applicable, the Minister has decided that the Project is not likely to cause significant adverse environmental effects or the Governor in Council has decided that the significant adverse environmental effects are justified in the circumstances, and (ii) if required, an amendment to this Agreement has been signed, setting out any conditions included in the decision statement.

12.5 Aboriginal consultation. The Recipient acknowledges that the Minister’s obligation to pay the Contribution is conditional upon Her Majesty satisfying any obligation that Her Majesty may have to consult with or to accommodate any Aboriginal groups, which may be affected by the terms of this Agreement.

12.6 Official Languages. The Recipient agrees that any public acknowledgement of the Minister’s public support for the Project will be expressed in both official languages.

13.1 Indemnification. Except for any claims arising from the gross negligence of, or willful misconduct by, the Minister’s employees, officers, agents or servants, the Recipient agrees, at all times, to indemnify and save harmless, the Minister and any of his officers, servants, employees or agents from all and against all claims and demands, actions, suits or other proceedings (and all losses, costs and damages relating thereto) by whomsoever made, brought or prosecuted (all of the foregoing collectively, the “Claims”), where such Claims are asserted or arise from the Minister being a Party to this Agreement and exercising his rights and performing his obligations under this Agreement, to the extent such Claims result from:

13.2 Limitation of Liability. Notwithstanding anything to the contrary contained herein, the Minister shall not be liable for any indirect, special or consequential damages of the Recipient

17

SIF AGREEMENT NO. 811-811217

nor for the loss of revenues or profits arising from, based upon, occasioned by or attributable to the execution of this Agreement, regardless of whether such a liability arises in tort (including negligence), contract, fundamental breach or breach of a fundamental term, misrepresentation, breach of warranty, breach of fiduciary duty, indemnification or otherwise.

13.3 Her Majesty, her agents, employees and servants will not be held liable in the event the Recipient enters into a loan, a capital or operating lease or other long-term obligation in relation to the Project for which the Contribution is provided.

14.1 Event of Default. The Minister may declare that an Event of Default has occurred if:

14.2 Notice and Rectification Period. Except in the case of an Event of Default under paragraphs (d), (e) and ( t) of Subsection 14.1 above, the Minister will not declare that an Event of Default has occurred unless the Minister has given written notice to the Recipient of the occurrence which, in the Minister’s opinion, constitutes an Event of Default and the Recipient fails, within thirty (30) days of receipt of the notice, either to correct the condition or event or demonstrate, to the satisfaction of the Minister that it has taken such steps as are necessary to correct the condition, failing which the Minister may declare that an Event of Default has occurred.

18

SIF AGREEMENT NO. 811-811217

14.3 Remedies on Default. Subject to any requirements of notice set out in section

14.2, if an Event of Default has occurred, the Minister may immediately exercise one or more of the following remedies, in addition to any remedy available at law:

14.4 The Recipient acknowledges the policy objectives served by the Minister’s agreement to make the Contribution, that the Contribution comes from the public monies, and that the amount of damages sustained by Her Majesty in an Event of Default is difficult to ascertain and therefore, that it is fair and reasonable that the Minister be entitled to exercise any or all of the remedies provided for in this Agreement and to do so in the manner provided for in this Agreement, if an Event of Default occurs.

15.1 Compliance with Lobbying Act. The Recipient warrants and represents:

19

SIF AGREEMENT NO. 811-811217

15.2 Members of Parliament. The Recipient represents and warrants that no member of the House of Commons will be admitted to any share or part of this Agreement or to any benefit to arise therefrom. No person who is a member of the Senate will, directly or indirectly, be a party to or be concerned in this Agreement.

15.3 Compliance with Post-Employment Provisions. The Recipient confirms that no current or former public servant or public office holder to whom the Values and Ethics Code for the Public Service, the Values and Ethics Code for the Public Sector, the Policy on Conflict of Interest and Post-Employment or the Conflict of Interest Act apply, will derive a direct benefit from this Agreement unless the provision or receipt of such benefits is in compliance with such legislation and codes.

15.4 The Recipient acknowledges that the representations and warranties in this section are fundamental terms of this Agreement. In the event of breach of these, the Minister may exercise the remedies set out in Subsection 14.3.

16.1 Consent Required. Subject to Schedule 2 - Communications Obligations, the Access to Information Act, the Privacy Act and the Library and Archives Act of Canada, each Party shall keep confidential and shall not without the consent of the other Party disclose the contents of the Agreement and the documents pertaining thereto, whether provided before or after the Agreement was entered into, or of the transactions contemplated herein.

16.2 International Dispute. Notwithstanding Subsection 16.1 of this Agreement, the Recipient waives any confidentiality rights to the extent such rights would impede Her Majesty from fulfilling her notification obligations to a world trade panel for the purposes of the conduct of a dispute, in which Her Majesty is a party or a third party intervener. The Minister is authorized to disclose the contents of this Agreement and any documents pertaining thereto, whether predating or subsequent to this Agreement, or of the transactions contemplated herein, where in the opinion of the Minister, such disclosure is necessary to the defense of Her Majesty’s interests in the course of a trade remedy investigation conducted by a foreign investigative authority, and is protected from public dissemination by the foreign investigative authority. The Minister shall notify the Recipient of such disclosure.

16.3 Financing, Licensing and Subcontracting. Notwithstanding Subsection 16.1 of this Agreement, the Minister hereby consents to the Recipient disclosing this Agreement, and any portion or summary thereof, for any of the following purposes:

20

SIF AGREEMENT NO. 811-811217

16.4 Repayments. Notwithstanding Subsection 16.1 of this Agreement, the Minister may disclose any information relating to the amount of each repayment made by the Recipient whether due or paid.

17.1 Debt due to Canada. Any amount owed to Her Majesty under this Agreement shall constitute a debt due to Her Majesty and shall be recoverable as such. Unless otherwise specified herein, the Recipient agrees to make payment of any such debt forthwith on demand.

17.2 Interest. Debts due to Her Majesty will accrue interest in accordance with the Interest and Administrative Charges Regulations, in effect on the due date, compounded monthly on overdue balances payable, from the date on which the payment is due, until payment in full is received by Her Majesty. Any such amount is a debt due to Her Majesty and is recoverable as such.

17.3 Set-off Rights of Minister. Without limiting the scope of the set-off rights provided for under the Financial Administration Act, it is understood that the Minister may set off against the Contribution any amounts owed by the Recipient to the Minister under legislation or contribution agreements and the Recipient shall declare to the Minister all amounts outstanding in that regard when making a claim under this Agreement.

17.4 No Assignment of Agreement. No Party shall assign the Agreement or any part thereof without the prior written consent of the Minister. Any attempt by a Party to assign this Agreement or any part thereof, without the express written consent of the Minister, is void.

17.5 Annual Appropriation. Any payment by the Minister under this Agreement is subject to there being an appropriation for the Government Fiscal Year in which the payment is to be made; and to cancellation or reduction in the event that departmental funding levels are changed by Parliament. If the Minister is prevented from disbursing the full amount of the Contribution due to a lack or reduction of appropriation or departmental funding levels, the Minister and the Recipient agree to review the effects of such a shortfall in the Contribution on the implementation of this Agreement.

17.6 Successors and Assigns. This Agreement is binding upon the Recipient, its successors and permitted assigns.

17.7 Event of Force Majeure. The Recipient will not be in default by reason only of any failure in the performance of the Project in accordance with Schedule 1 -Statement of Work if such failure arises without the fault or negligence of the Recipient and is caused by any event of Force Majeure.

17.8 Applicable Law. This Agreement will be interpreted in accordance with the laws of the province of Ontario and federal laws of Canada applicable therein. The word “law” used herein has the same meaning as in the Interpretation Act, as amended.

21

SIF AGREEMENT NO. 811-811217

17.9 Dispute Resolution. If a dispute arises concerning the application or interpretation of this Agreement, the Parties will attempt to resolve the matter through good faith negotiation, and may, if necessary and the Parties consent in writing, resolve the matter through mediation or arbitration by a mutually acceptable mediator or by arbitration in accordance with the Commercial Arbitration Code set out in the schedule to the Commercial Arbitration Act (Canada), as amended, and all regulations made pursuant to that Act.

17.10 No Amendment. No amendment to this Agreement shall be effective unless it is made in writing and signed by the Parties hereto.

17.11 Contribution Agreement Only. This Agreement is a contribution agreement only, not a contract for services or a contract of service or employment, and nothing in this Agreement, the Parties relationship or actions is intended to create, or be construed as creating, a partnership, employment or agency relationship between them. The Recipient is not in any way authorized to make a promise, agreement or contract and to incur any liability on behalf of Her Majesty or to represent itself as an agent, employee or partner of Her Majesty, including in any agreement with a third party, nor shall the Recipient make a promise, agreement or contract and incur any liability on behalf of Her Majesty, and the Recipient shall be solely responsible for any and all payments and deductions required by the applicable laws.

17.12 No Waiver. The rights and remedies of the Minister under this Agreement shall be cumulative and not exclusive of any right or remedy that he or she would otherwise have. The fact that the Minister refrains from exercising a remedy he or she is entitled to exercise under this Agreement will not constitute a waiver of such right and any partial exercise of a right will not prevent the Minister in any way from later exercising any other right or remedy under this Agreement or other applicable law.

17.13 Consent of the Minister; Opinion of the Minister. Whenever this Agreement provides for the Minister to render a decision or for the Recipient to obtain the consent or agreement of the Minister, such decision shall be reasonable on the facts and circumstance and such consent or agreement will not be unreasonably withheld but the Minister may make the issuance of such consent or agreement subject to reasonable conditions. Whenever this Agreement provides for the “Minister is of the opinion” or “in the opinion of the Minister” or words to similar effect, it will be read to require an opinion reasonably formed by the Minister on the basis of conditions, circumstances, and facts that are reasonably known to the Minister.

17.14 No conflict of interest. The Recipient and its Affiliated Persons, consultants and any of their respective advisors, partners, directors, officers, shareholders, employees, agents and volunteers shall not engage in any activity where such activity creates a real, apparent or potential conflict of interest in the sole opinion of the Minister, with the carrying out of the Project. For greater certainty, and without limiting the generality of the foregoing, a conflict of interest includes a situation where anyone associated with the Recipient owns or has an interest in an organization that is carrying out work related to the Project.

17.15 Disclose Potential Conflict of Interest. The Recipient shall disclose to the Minister without delay any actual or potential situation that may be reasonably interpreted as either a conflict of interest or a potential conflict of interest.

22

SIF AGREEMENT NO. 811-811217

17.16 Severability. Any provision of this Agreement which is prohibited by law or otherwise deemed ineffective will be ineffective only to the extent of such prohibition or ineffectiveness and will be severable without invalidating or otherwise affecting the remaining provisions of the Agreement.

17.17 Signature in Counterparts. This Agreement may be signed in counterparts and such counterparts may be delivered by acceptable electronic transmission, including portable document format (PDF), each of which when executed and delivered is deemed to be an original, and when taken together, will constitute one and the same Agreement.

17.18 Currency. Unless otherwise indicated, all dollar amounts referred to in this Agreement are to the currency of Canada.

17.19 Tax. The Recipient acknowledges that financial assistance from government programs may have tax implications for its organization and that advice should be obtained from a qualified tax professional.

18.1 Form and Timing of Notice. Any notice or other communication under this Agreement shall be made in writing. The Minister or the Recipient may send any written notice by any pre-paid method, including regular or registered mail, courier or email. Notice will be considered as received upon delivery by the courier, upon the Party confirming receipt of the email or one (1) day after the email is sent, whichever the sooner or five (5) calendar days after being mailed.

18.2 Any notices to the Minister in fulfillment of obligations such as claims, reporting, and any other documents stipulated under this Agreement, will be addressed to:

Strategic Innovation Fund

Attn: Senior Director

8th Floor

235 Queen Street

Ottawa, Ontario KIA OH5

Fax No: (613) 954-5649

Email address: to be provided by SIF upon request from the Recipient.

Notwithstanding the foregoing, claims forms will not be sent by email unless otherwise agreed to in writing by the Minister.

18.3 Any notices to the Recipient will be addressed to:

exactEarth Ltd.

Attn: Peter Dorcas, Vice President Business Development

260 Holiday Inn Drive, Unit 30, Building B

Cambridge, ON, N3C 4E8

Fax No: (519) 623-8575

Email address: to be provided by the Recipient to SIF.

23

SIF AGREEMENT NO. 811-811217

18.4 Change of Contact Information. Each of the Parties may change the address, which they have stipulated in this Agreement by notifying in writing the other Party of the new address, and such change shall be deemed to take effect fifteen (15) calendar days after receipt of such notice.

19.1 The Parties hereto confirm that it is their wish that this Agreement as well as all other documents relating thereto, including notices, have been and will be drawn up in English only.

Les parties aux presentes confirment que c’est leur volonte que cette convention de meme que tousles documents, y compris les avis s’y rattachant, soient rediges en anglais seulement.

[REMAINDER OF THIS PAGE INTENTIONALLY LEFT BLANK]

24

SIF AGREEMENT NO. 811-811217

IN WITNESS WHEREOF the Parties hereto have executed this Agreement through duly authorized representatives.

HER MAJESTY THE QUEEN IN RIGHT OF CANADA

as represented by the Minister of Industry

|

|

|

|

|

|||

|

|

|

|

EXACTEARTH LTD.

|

|

|

|

Per: |

|

|

|

|

Peter Mabson, Chief Executive Officer exactEarth Ltd. |

|

Date |

|

|

|

|

|

I have the authority to bind the Corporation. |

|

|

25

SIF AGREEMENT NO. 811-811217

SCHEDULE 1 -STATEMENT OF WORK (SOW)

Satellite Monitoring for Advanced Real Time - Maritime Information

The project is a critical upgrade and expansion to integrate new powerful capabilities into exactEarth's existing satellite network, processing environments, and data service products. The new system will allow exactEarth to take advantage of a new market segment (persistent real-time services) and maintain its global leadership position in maritime surveillance.

The new capabilities will include new high detection spectrum satellite assets (Maritime Monitoring and Messaging Microsatellite and Paz satellite), new real-time hosted payloads on the Iridium NEXT satellites and advanced real-time big data analytics to uniquely exploit information from the vast quantity of maritime data collected by satellites. The new system will collect information across the entire maritime frequency band and provide a unique persistent real-time global coverage designed to meet current and growing needs of governments and the maritime community for the next 15 years.

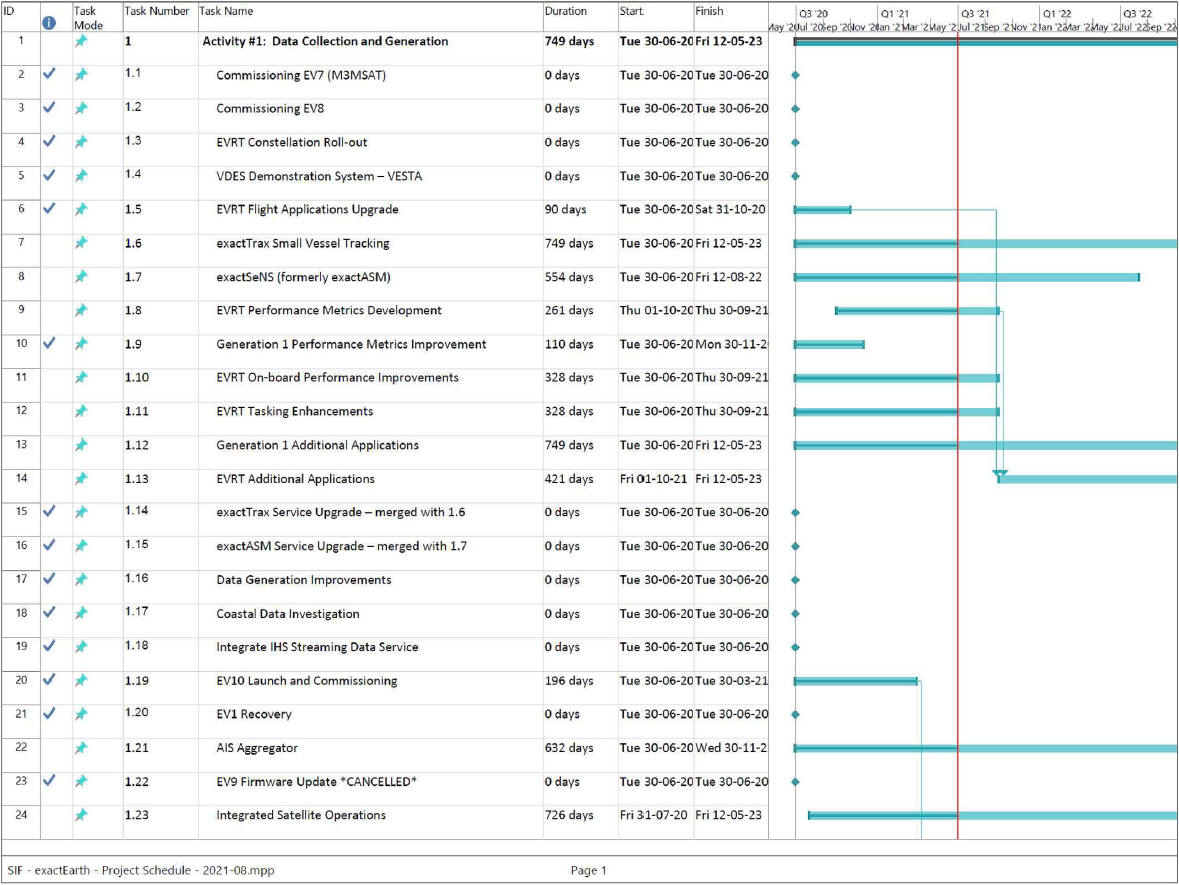

2.1 Activity #1: Data Collection and Generation

Description: exactEarth’s ability to provide service to customers is directly related to its ability to collect and generate valuable data in a timely and accurate fashion. Data Collection and Generation covers the continuing development of network infrastructure, which includes space satellites, ground stations and data processing centres (DPC). All these network elements are controlled from exactEarth’s network operations centre (NOC) in Cambridge, Ontario. The NOC determines how the infrastructure assets are deployed, scheduled, maintained and monitored.

For this Activity, the scope of the work would include adding new assets to the space segment (satellites) and improving the effectiveness of the system, including increasing the number of unique vessels being detected via satellite, improving detection rates in varying conditions of ship density, reducing the latency (the time required for a detected AIS message to reach the overall data feed) and increasing the refresh/revisit rates for vessels (that is, increasing the number of messages per vessel to better track its movement more frequently through more frequent overhead satellite passes and better probability of message detection).

Related to the scope of adding more network assets to collect data is the generation of more data from that collected, specifically from the ASM channels (application specific messages), which are used for ClassB vessels (small ships). For instance, one method of

AIS data collection from satellites is the digitization of frequency spectrum in which the AIS messages are embedded. ExactEarth has patented decollision technology which extracts the AIS messages from the spectrum files that are downlinked from the satellite to the DPCs. The spectrum files have no value to our customers but the extracted AIS messages certainly do. Thus, the scope from a data generation perspective is to improve the decollision performance- process

26

SIF AGREEMENT NO. 811-811217

data faster and with high accuracy. There are also remote terminals that operate as part of our ‘extended’ network. These remote terminals allow satellite tracking of Class B vessels, which cannot be adequately tracked using means used for conventional Class-A ships, mainly because the allowed transmit power of these Class B remote terminals is much lower. The development of exactEarth technology for Class B terminals are to use special data-coding schema and specifications that exactEarth owns and shares with our hardware partners (terminal equipment). The coding is used to overcome the lack of transmit power). exactEarth defines the content of the messages (using the ITU standard) so that upon detection, exactEarth’s network can properly process (decode) and route the generated data to customers. The scope of the work will seek improvements to the Class B detection system including alternative approaches to the coding scheme and how this is implemented in better remote terminals.

Investigations in how the technology principles behind satellite based AIS detection to small vessels can be applied to related (or adjacent) applications for additional commercial exploitation. For instance, developing two-way communication for maritime vessels using small sats (AIS technology is one-way communication). To control the network infrastructure, the NOC uses software tools to task and monitor the network infrastructure. As the network will evolve and grow based on the scope already described above, the NOC’s, the tool set must be updated so that it is always capable of controlling the network. Monitoring of the network is necessary to determine the data throughput (how much and how fast), the quality of the data (minimizing gaps in coverage and preventing erroneous data), and the effectiveness of the network in its purpose of sending collected data to customers. The scope of monitoring within this major activity seeks improvements such as data recording and reviewing satellite telemetry. It also includes creating new tools to measure and track key performance metrics which are designed to help in evaluating the impacts of network scheduling and any related tasking changes that are required to be made.

Expected Outcomes: The scope of work would include the tasks given in the following table. As the tasks planned at the beginning of the proposal will be subject to external factors, such as market conditions, identification of new technologies, etc., there will be periodic reviews conducted to ensure that any necessary adjustments are made to the specific tasks of this major activity while keeping aligned with the original objectives to improve and grow the ability to collect and generate data using our evolving infrastructure.

27

SIF AGREEMENT NO. 811-811217

Adjustments may include adding to (or reducing) the scope of a particular sub-activity, creating (or abandoning) sub-activities to take advantage of new opportunities.

ID |

Sub Activity |

Description |

Expected Outcome |

|

|

|

|

1 |

Commissioning exactView-7 (EV7/M3MSat |

Complete The Commissioning Steps necessary to make EV7 production- ready and integrated (added)into the Generation 1 constellation. |

EV7 demonstrate all performance requirements and collected EV7 data is permitted into our production data feed |

2 |

Commissioning exactView-8 (EV8/PAZ) |

Complete the commissioning steps necessary to make EV8 production- ready and integrated (added) into the Generation 1 constellation. |

EV8 demonstrates all performance requirements and collected EV8 data is permitted into our production data feed |

3 |

Complete exactView Real Time (EVRT) Constellation Deployment |

Full complement of EVRT payloads are launched into orbit in final configuration ready for full Generation 2 AIS service. |

EVRT meets requirements for full deployment with all payloads tested and characterized

Data collected from the full constellation is permitted into our production data feed. |

4 |

Complete VOES demonstration system |

Simplified two-way ship-to-station communication to demonstrate VOES technology capability using CubeSat technology and remote (ship-based) terminal station |

Use cases in test document are satisfactorily demonstrated

Final report is accepted by stakeholders. |

5 |

EVRT Flight Applications Upgrade |

Design, development and implementation of applications to be uploaded as firmware upgrades to the EVRT constellation. Applications may be improvements on existing functionality (for example, detection improvement of AIS signals) or new applications defined by business needs. |

Flight apps are released for production use after following a defined design process including testing. |

6 |

Establish exactTrax Initial Service |

Roll-out exactTrax service through use of exactEarth defined technology in partnership with key vendors providing remote terminals. Targeted at small vessels (Class B) with for location detection |

ExactEarth coding algorithms integrated into vendor units for detecting Class B vessels.

Field trials completed.

Service fully introduced |

28

SIF AGREEMENT NO. 811-811217

7 |

Establish exactASM Initial Service |

Roll-out exactASM service through use of exactEarth defined technology in partnership with key vendors providing remote terminals. Upscaling of exactTrax service, targeted at small vessels (Class B) with increased messaging capability. |

ExactEarth coding algorithms integrated into vendor units for detecting Class B vessels.

Field trials completed.

Service fully introduced. |

8 |

EVRT Performance Metrics Development |

Develop a system of reporting metrics to determine the operating performance of EVRT by building upon existing tools and ephemeris data and detected messages. Automate the tool set |

Accepted roll-out of the metrics tool kit |

9 |

Generation 1 Performance Metrics Improvement |

Improve the measurement metrics used to determine the operating performance of Generation 1 constellation. Use ephemeris data and detected messages. Automate the tool set. |

Accepted roll-out of the metrics tool kit |

10 |

EVRT On Board Performance Improvements |

Improve EVRT payloads through satellite system optimization with our EVRT partners. This seeks to improve on satellite system parameters such as duty cycle, data rate, etc., that allow the payloads to increase performance |

Satellite system budget to EVRT payloads are increased/improved such that data generation from the system is increased |

11 |

EVRT Tasking Enhancements |

Using knowledge of the EVRT applications and performance metrics, implement improvements to the tasking system for EVRT. |

Tasking Process is updated and approved for use: System to be closed loop with changes formally review and controlled |

12 |

Generation 1 Additional Applications |

Exploit the Generation 1 payloads initially developed for AIS signal detection for adjacent uses to increase the utilization of the Generation 1 constellation |

Roll-out of new uses for Generation 1. |

29

SIF AGREEMENT NO. 811-811217

13 |

EVRT Additional Applications |

Exploit EVRT payloads initially developed for AIS signal detection for adjacent uses to increase the utilization. |

Roll-out of new uses for EVRT |

14 |

exactTrax Service Upgrade |

Improve exactTrax through upgrades to technology used to deliver the service, such as changes to remote terminals, changes to data generation (i.e., modulation, coding schema, etc.) |

Successful introduction of the next generation of exactTrax Service with demonstrated performance improvements in data generation. |

15 |

exactASM Service Upgrade |

Improve exactASM through upgrades to technology used to deliver the service, such as changes to remote terminals, changes to data generation (i.e., modulation, coding schema, etc.) |

Successful introduction of the next generation of exactTrax Service with demonstrated performance improvements in data generation. |

16 |

Data Generation Improvements |

Improve capability to extract AIS data from raw AIS spectrum files collected by satellites (i.e., signal decollision). |

Successful introduction of next version of data generation software (decollider) with demonstrated performance improvements. |

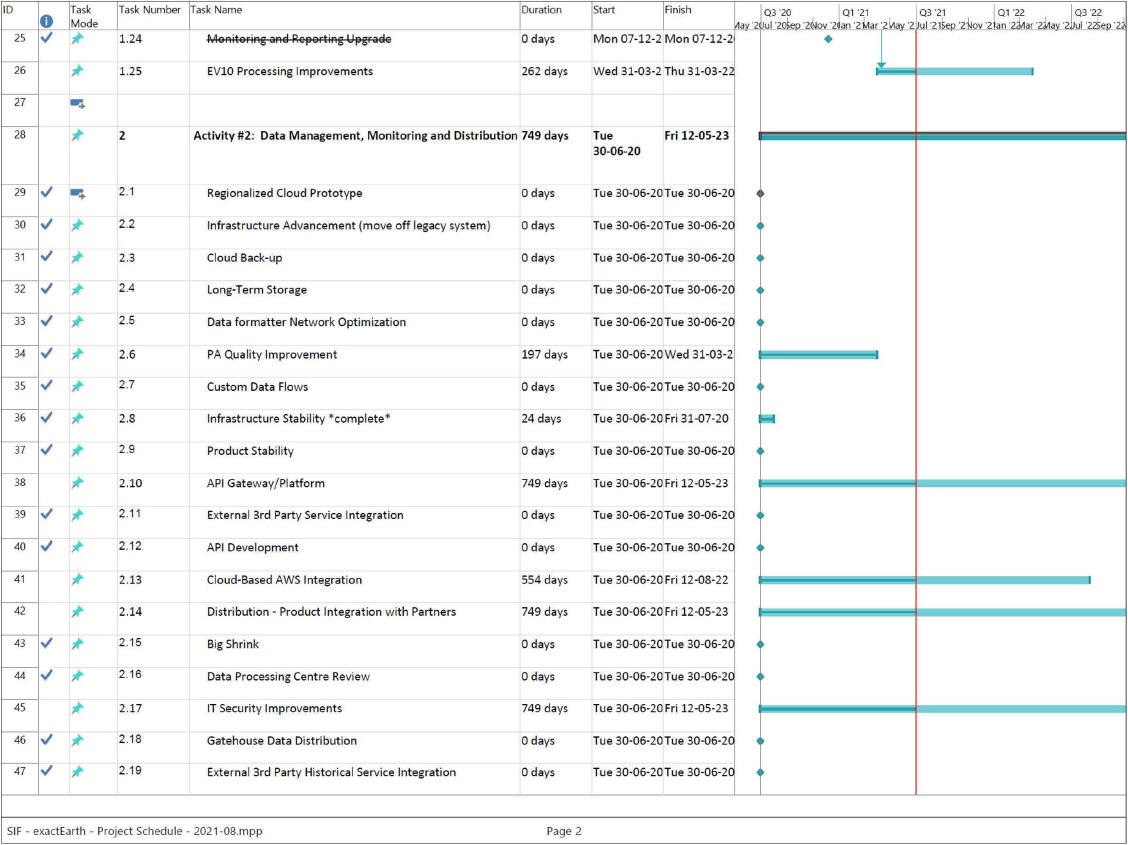

2.2 Activity #2: Data Management, Monitoring and Distribution

Description:

This Activity covers the scale-up of exactEarth’s data infrastructure to accommodate planned new incoming data flows from Major Activity #1 along with flows from existing incoming sources. As new assets are brought online and new services introduced (including data exploitation products which introduce new and variable demands) the data management becomes more complex.

The primary goal overall is to ensure that stable High Reliability Data Management & Distribution platforms, networks and systems are in place. Specifically, exactEarth would be investing to scale-up a highly automated data factory with high throughput and flexible storage; automated monitoring, alerting and escalation systems; globally distributed systems for world-wide responsiveness; a high-reliability and fault tolerant software and hardware architecture; and scalable front-end data delivery services.

Upgraded systems would provide customers with a high confidence that the data they rely on is secure from tampering. Cloud and in-house architectures would be compared to identify a cost effective and environmentally friendly deployment strategy. Software development activities in this work package center on providing scalable AP is and delivery mechanisms for the increased volume of data, and on enhancing visualization tools to improve both the handling of big data and their responsiveness from all areas of the globe.

30

SIF AGREEMENT NO. 811-811217

Expected Outcomes: The scope of work would include the tasks given in the following table. Adjustments may include adding to (or reducing) the scope of a particular sub-activity, creating (or abandoning) sub-activities to take advantage of new opportunities.

ID |

Sub-activity |

Description |

Expected Outcome |

1 |

Planning Phase |

The main tasks are broken out into more detail following the scope, cost and schedule constraints set forth in this proposal. |

• 99.97% uptime for all products, encompassing the entire processing chain from data reception to product delivery • <IO second transfer time for real- time data from time of data reception to product delivery • < 5-minute delivery for derived analytic data from time of data reception to availability of analytic data • Flat energy costs in data processing centers (DPC) to achieve both cost and energy efficiency goals • High security computing environment with zero loss of company IP or customer data • Data access and visualization technologies which provide low- impedance, highly responsive access all maritime data and analytics • Updated document set of processes and procedures to control changes and maintain performance (cost, reliability and security). |

2 |

Requirements Phase |

Determining how the upgraded facility (or facilities) will look based on defined need (including consideration from Major Activities #1 and #3), constraints identified during Planning and technology trade-offs that consider throughput, reliability, operating metrics and security. |

|

3 |

Upgrade Development Phase |

Establish the data infrastructure in test environments and focussed implementation. Review of the results and plans is a necessary step before moving to the next stage (Operational readiness review). |

|

4 |

Upgrade Roll-out |

Move from test environments to production environments on a full- scale basis while addressing all requirements. Buy-off required from Operations Management is the key controlling factor (Production Hand- over) |

|

5 |

Operational Monitoring |

Performing careful oversight of the upgraded system during the initial timeframe of being rolled-out and in service. Perform minor adjustments as required and determine the performance effectiveness (Operations Upgrade Performance Review). |

31

SIF AGREEMENT NO. 811-811217

6 |

Process and Procedures |

Document or update operational procedures developed during the upgrade to formalize their ongoing application. This includes such items as issue reporting (ticketing, escalation) and performance management (dashboard) reporting |

|

7 |

New Service Introduction |

As the outputs from the other major activities come into being, update the process for formal introduction into the updated data factory |

|

8 |

Operational Adjustments |

Using a controlled change process (existing or updated), identify adjustments to be made to the new data infrastructure based on the cumulative effect of improvements made during this major activity. This is analogous to fine-tuning the system. The tasks will be broken down into the next level detail during the planning stage of the program and in coordination with the other major activities to ensure upgrade timing does not conflict the other scheduled events. It may be determined to segment the upgrade into smaller subsegments (addressing main elements of the data factory as focussed main tasks instead of tackling the entire system as a whole enterprise, which may prove too large in overall scope to address without taking unnecessary risks). |

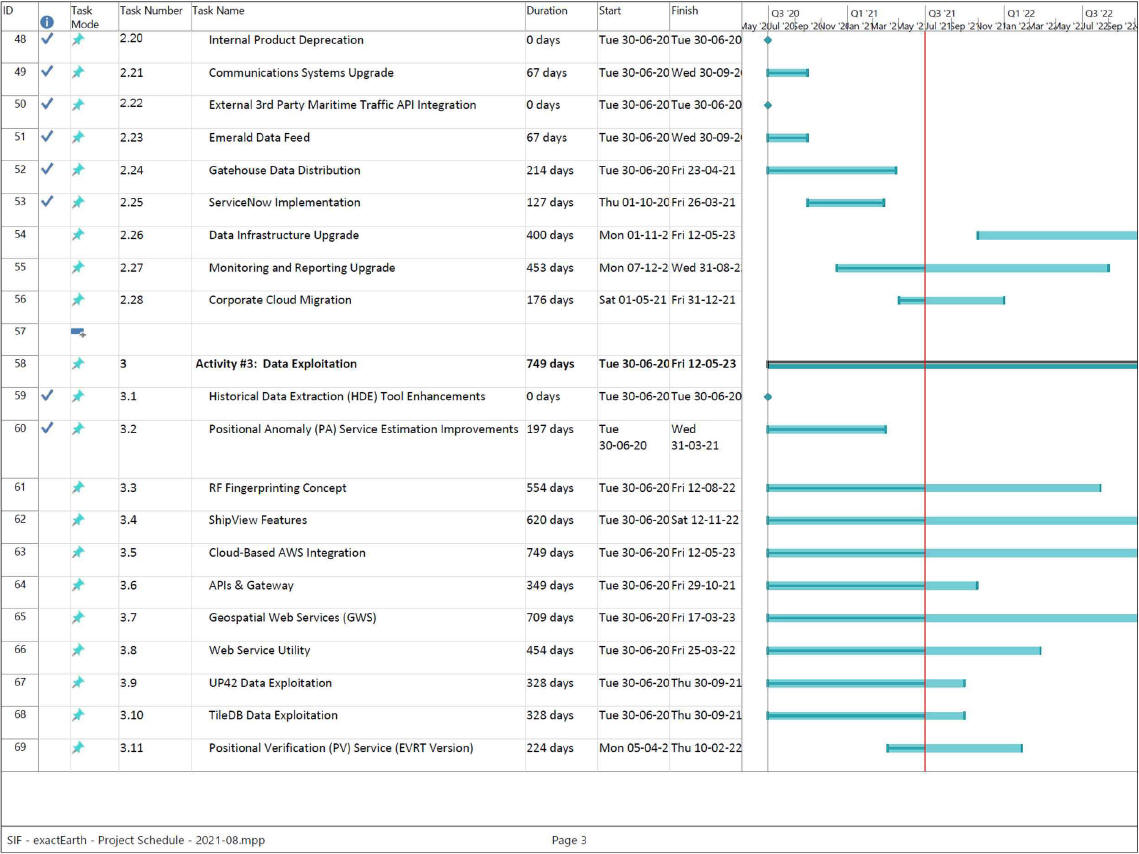

2.3 Activity #3: Data Exploitation

Description: The objective of Data Exploitation is to take advantage of the outcomes from Activity #1 (Data Collection and Generation) to extend exactEarth’s competitive advantage into new and existing markets through intelligent analysis and synthesis with other datasets. The scope of work is to extract further information from the raw data, derive new and useful products from the dataset and synthesize the exactEarth data with other data sources such as radar, optical imagery and environmental data (such as temperature, current, wave height, weather) to create hybrid data products and derived products.

32

SIF AGREEMENT NO. 811-811217

exactEarth would carry out this activity using a combination of internal development and partnerships with Canadian subcontractors who bring either domain expertise (e.g. illegal fishing, commercial route planning) or technological expertise (e.g. big data, deep learning). The range of possible data enhancements is large and exactEarth expects to pursue other forms of data exploitation as new market opportunities present themselves.

Expected Outcomes: The scope of work includes the tasks given in the following table. Adjustments may include adding to (or reducing) the scope of a particular sub-activity, creating (or abandoning) sub-activities to take advantage of new opportunities.

ID |

Sub-activity |

Description |

Expected Outcome |

1. AIS Augmentation |

|||

1.1 |

Doppelganger Segregation |

Identify vessels that are sharing common transponder identifiers and automatically associate incoming data with the correct hull, ensuring that the data is appropriate segregated to a real vessel and not intermingled |

Distribution, search, filter and display tools all provide access to data appropriately segregated to a single vessel |

1.2 |

Positional anomaly detection |

Identify incoming messages where the reported position is incorrect. Identify vessels with a recurring pattern of reporting incorrect positions. |

Anomalous messages are identified automatically and flagged in the search database to support analysis. Automated analysis summarizes message details and generates vessel anomaly metrics, which are available to customers |

1.3 |

Position verification |

Compute an independent assessment for the vessel position which can be used to corroborate the report position, or to provide an estimated position when the reported position is |

Estimated vessel positions are calculated automatically and stored in the database for analysis. Results available to customers through searchable services |

1.4 |

Integration of high- res and low-res AIS position reports |

Integrate AIS position reports of differing accuracy and resolution into a common vessel history |

Customers can access complete vessel histories without confusion about the quality of individual data points. |

33

SIF AGREEMENT NO. 811-811217

2 Vessel Behavioural Analysis |

|||

2.1 |

Use of illegal fuels |

Identify vessels which burn green fuels within monitor areas, but switch to illegal fuels to save costs in open ocean. |

Customers can access reports of illegal fuel usage and include historical events of illegal fuel usage in vessel history reports. |

2.2 |

Illegal fishing |

Identify vessels which are engaged in illegal fishing activities |

Customers can access reports of illegal fishing and include historical events of illegal fishing in vessel history reports. |

2.3 |

Encroachment |

Identify vessels which are encroaching on restricted areas such as Marine Protected Areas |

Customers can access reports of encroachment and include historical events of encroachment in vessel history reports. |

3. Route Analytics |

|||

3.1 |

Vessel location prediction |

Predict the location of a vessel at a given point in time, either interpolating a location between historical observations or forecasting a position into the future. |

Customers can access estimated vessel positions on demand with associated metrics of estimated variance and likely error. |

3.2 |

ETA analysis |

Predict the likely arrival time of a vessel at a given port or in its stated destination |

Customers can perform ETA analysis through user interfaces or APis. ETA information is presented automatically in association with vessels that have a stated destination |

4. Route Optimization |

|||

4.1 |

Weather avoidance |

Calculate routes for vessels to avoid inclement weather |

Customers can perform route calculations in different scenarios |

4.2 |

Fuel Optimization |

Calculate routes for vessels to optimize fuel consumption, including environmental factors such as currents, weather, traffic |

Customer can predict their fuel consumption and plan routes that are most economical thereby providing operational cost savings |

5. Data Synthesis |

|||

5.1 |

Radar fusion |

Integrate exactEarth data with radar imagery to augment detected vessels with additional metadata (name, course, heading, destination, etc.) |

Customers have access to exactEarth services for combining radar and exactEarth data |

34

SIF AGREEMENT NO. 811-811217

5.2 |

Optical fusion |

Integrate exactEarth data with optical imagery to augment detected vessels with additional metadata (name, course, heading, destination, etc.) |

Customers have access to exactEarth services for combining optical imagery and exactEarth data |

5.3 |

Environmental fusion (temperature, current, wave height) |

Integrate exactEarth data with environmental data to present a comprehensive view of the maritime environment situation |

Customers have access to data representing the maritime environmental picture |

35

SIF AGREEMENT NO. 811-811217

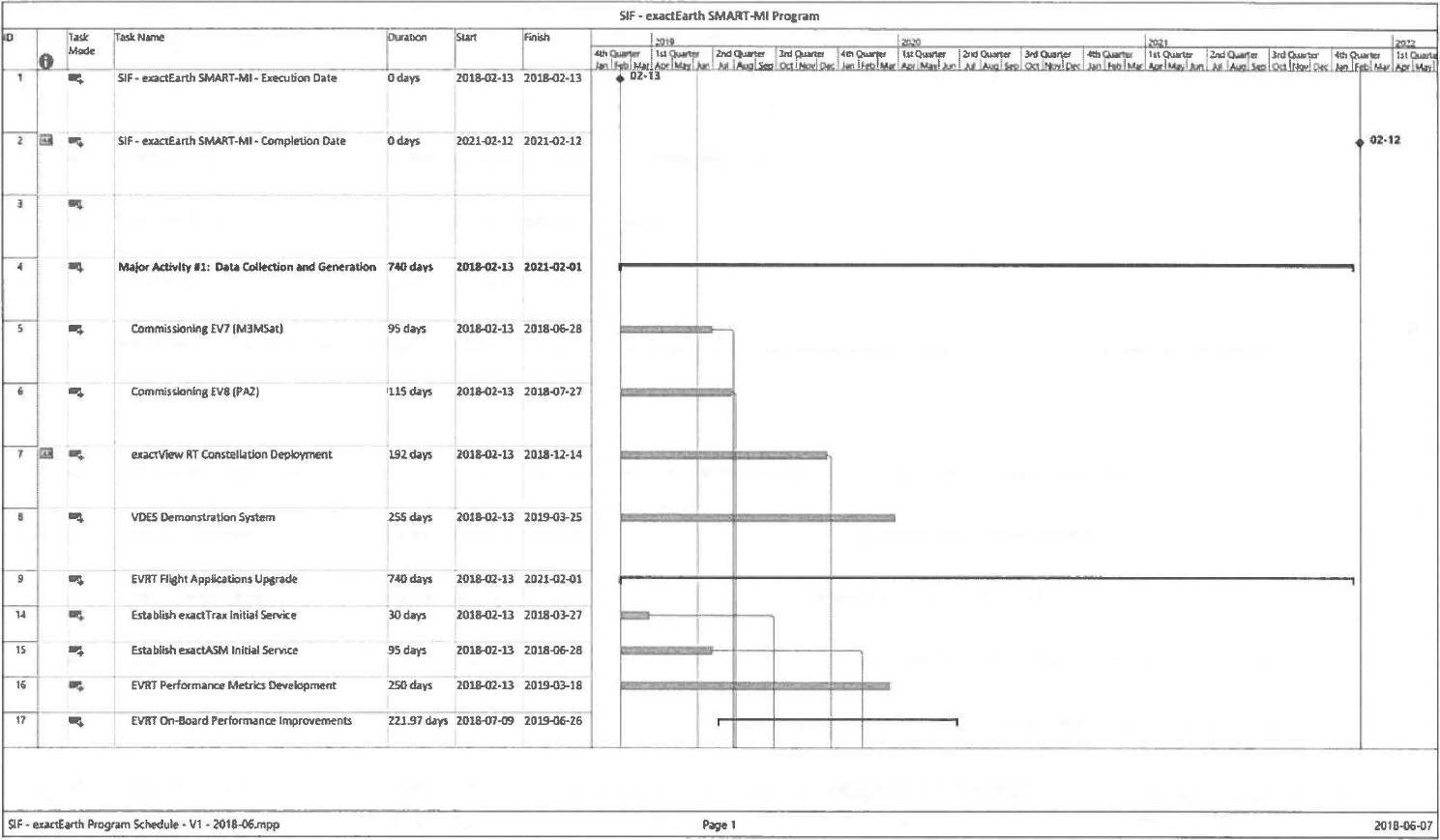

FORM A - Master Schedule (Gantt Chart)

36

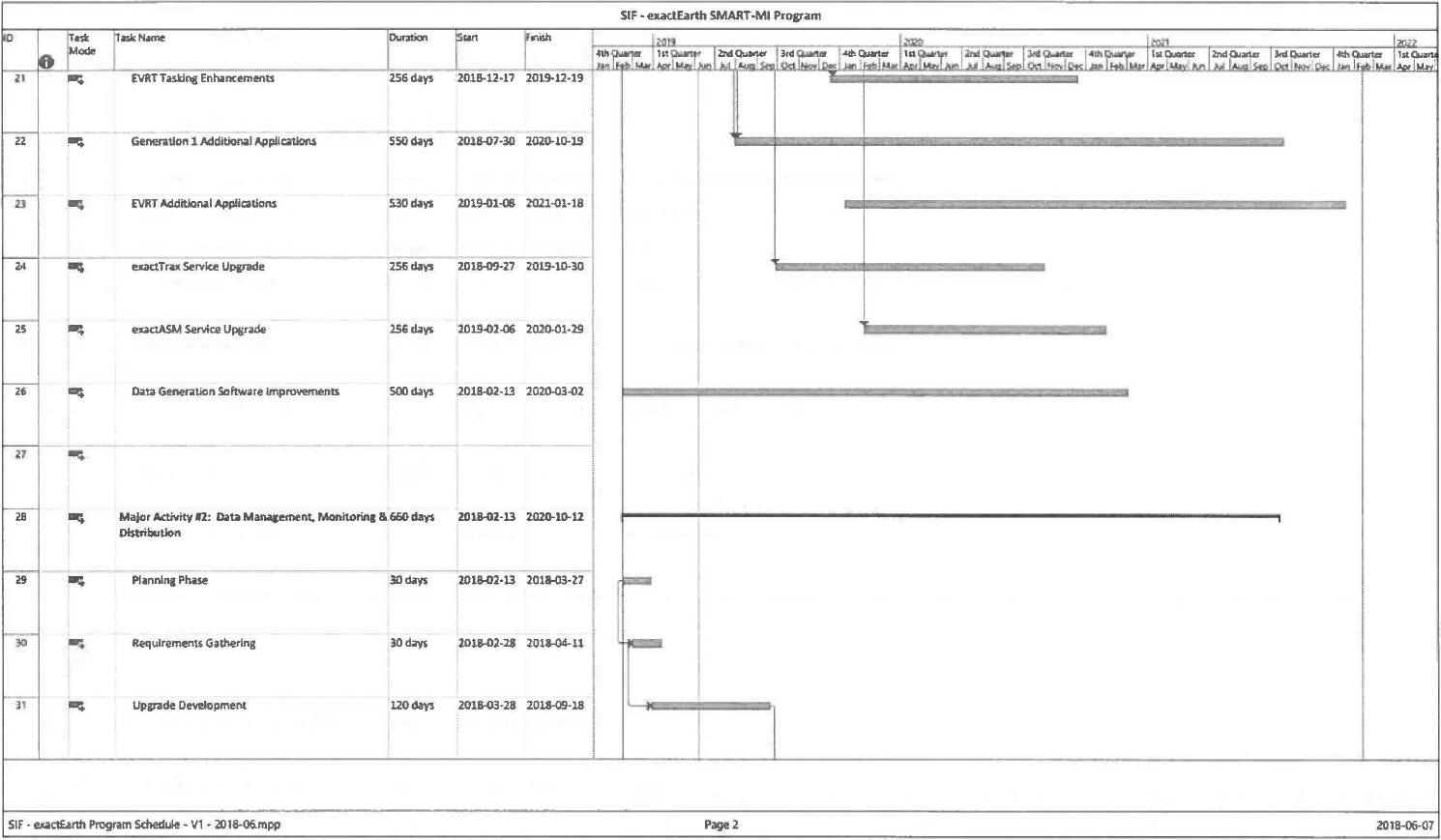

SIF AGREEMENT NO. 811-811217

37

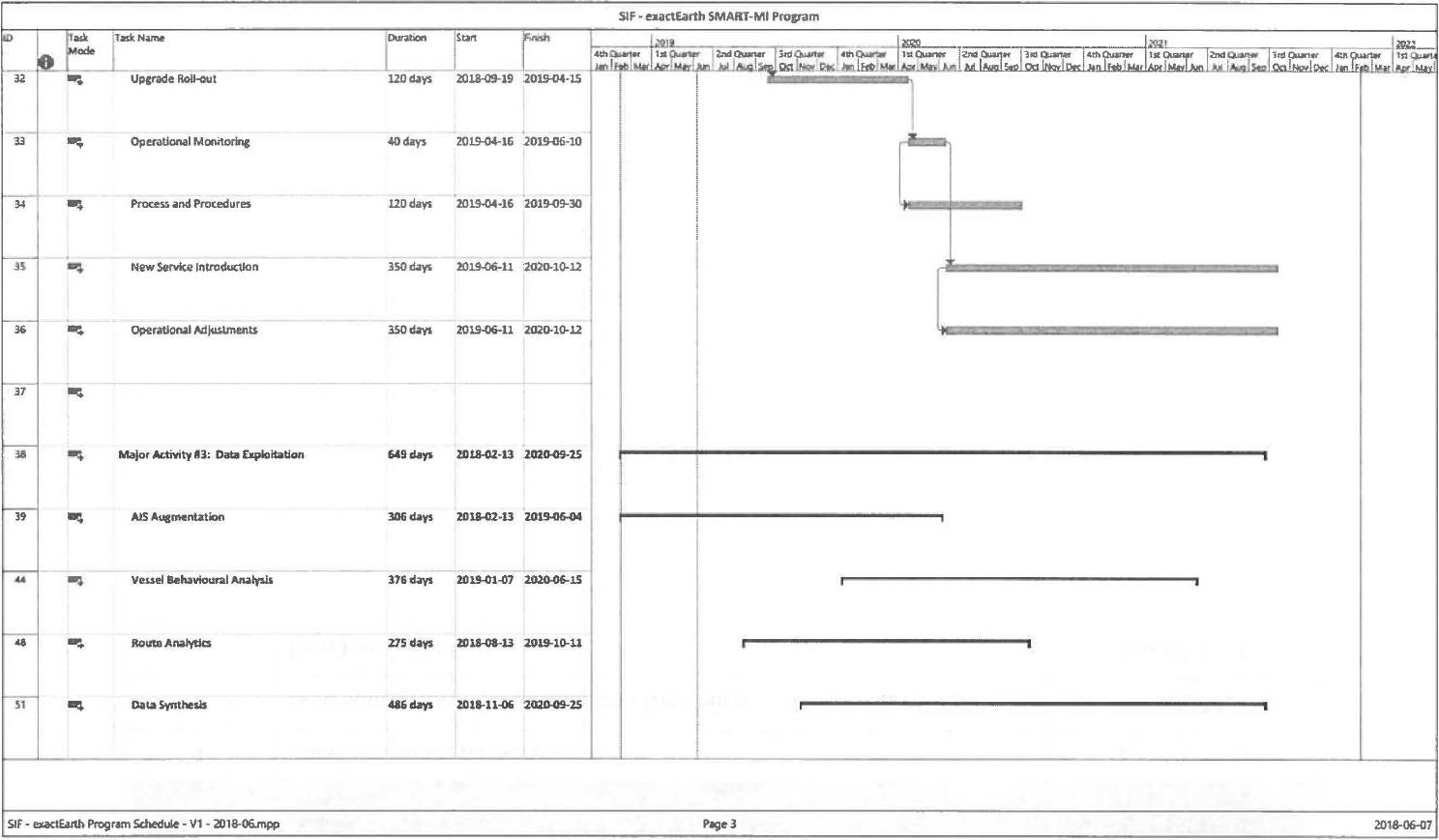

SIF AGREEMENT NO. 811-811217

38

SIF AGREEMENT NO. 811-811217

FORM B - MILESTONES

Project Phases and Major Milestone Groups |

Anticipated Date |

|

1 |

Data Collection and Generation |

Feb 12, 2021 |

2 |

Data Management, Monitoring and Distribution |

Feb 12, 2021 |

3 |

Data Exploitation |

Feb 12, 2021 |

FORM Cl -ELIGIBLE COSTS BREAKDOWN

Description of Activity Area* |

Estimated Eligible Costs ($) |

||||||||

Direct Costs |

Indirect Costs (Overhead)** |

Total |

|||||||

Direct Labour Costs |

Direct Materials |

Subcontracts and Consultants |

Other Direct Costs |

Equipment |

Land& Buildings |

||||

1 |

Data Collection and Generation |

1,644,477 |

0 |

2,155,238 |

|

|

0 |

473,997 |

4,273,712 |

2 |

Data Management, Monitoring, and Distribution |

3,297,705 |

0 |

118,868 |

|

1,200,000 |

0 |

950,515 |

6,567,088 |

3 |

Data Exploitation |

2,558,134 |

0 |

276,101 |

|

|

0 |

737,345 |

3,571,580 |

|

Total Eligible Costs |

7,500,316 |

0 |

3,550,207 |

0 |

1,200,000 |

0 |

2,161,857 |

14,412,380 |

*Note: Titles of Activity areas enumerated and described in the SOW.

All claims and costs are to be in accordance with Schedule 3 - Cost Principles and Schedule 4 -Reporting Requirements.

**Indirect Costs (overhead) shall be calculated at a fixed rate of 55% ofDirect Labour Costs and will not exceed 15% of Eligible Costs.

39

SIF AGREEMENT NO. 811-811217

FORM C2- ESTIMATED COST BREAKDOWN BY FISCAL YEAR

Fiscal Year (Ending March 31) |

Total Estimated Eligible Costs ($) |

SIF Contribution cash flow to the Project ($) |

2018-2019 |

6,349,923 |

3,174,962 |

2019-2020 |

4,225,368 |

2,112,684 |

2020-2021 |

3,837,089 |

1,918,544 |

Total |

14,412,380 |

7,206,190 |

40

SIF AGREEMENT NO. 811-811217

FORM D- PROJECT LOCATION AND COSTS

Project Location |

Work Performed |

Estimated % of Total Eligible Costs

|

Cambridge, ON |

Activities #1 to 3 except subcontract work and services outside of Canada |

90% |

Florida, USA |

Subcontract work and services, not available in Canada or cannot be performed in Canada. |

10% |

Total Eligible Costs |

All Activities |

100% |

41

SIF AGREEMENT NO. 811-811217

SCHEDULE 2- COMMUNICATIONS OBLIGATIONS

Nothing in this Agreement shall be interpreted as preventing the fulfilment by the Recipient of its reporting obligations under applicable securities laws.

SECTION A: RECIPIENT’S RELEASE OF INFORMATION RELATED TO THE PROJECT AT TIME OF ANNOUNCEMENT OF PROJECT FUNDING

SECTION B: RELEASE OF INFORMATION RELATED TO THE AGREEMENT THROUGHOUT ITS TERM

The following subsections apply to public announcements concerning this Agreement throughout the Term:

42

SIF AGREEMENT NO. 811-811217

SCHEDULE 3 - COST PRINCIPLES

SIF PROJECT COST PRINCIPLES

The Eligible Costs of the Project are the sum of the applicable direct and indirect costs which are non-recurring and, in the opinion of the Minister, are, or must reasonably and necessarily be, incurred and/or allocated in the carrying out of the Project by the Recipient. These costs must be determined in accordance with the Recipient’s cost accounting practices as accepted by the Minister and applied consistently over time. The cost accounting system should clearly establish an audit trail that supports all cost claims, in particular, the Direct Labour Costs, as described below, should clearly indicate the allocation of an employee’s hours worked on the Project.

A cost is reasonable if the nature and amount do not exceed what would be incurred by an ordinary prudent person in the conduct of a competitive business.

In determining the reasonableness of a particular cost, consideration will be given to:

2.1 AFFILIATED PERSONS

In the case of Eligible Costs for goods or services incurred with an Affiliated Person, the amount of the costs incurred must:

43

SIF AGREEMENT NO. 811-811217

There are six categories of direct costs:

44

SIF AGREEMENT NO. 811-811217

Direct costs do not include any allocation for profit nor any allocation of general and administrative expenses.

Indirect Costs, also called “Overhead”, are those costs which, though necessarily having been incurred during the Work Phase for the conduct of the business in general of the Recipient, cannot be identified and measured as directly applicable to the carrying out of the Project.

Indirect Costs include:

Notwithstanding the definition of Indirect Costs above, Overhead will be calculated at a fixed rate of 55% of Direct Labour Costs and will not exceed 15% of Eligible Costs.

45

SIF AGREEMENT NO. 811-811217

Certain costs are not eligible for reimbursement (“Ineligible Costs”), regardless of whether they are reasonably and properly incurred by the Recipient in the carrying out of the Project.

Ineligible Costs include:

46

SIF AGREEMENT NO. 811-811217

47

SIF AGREEMENT NO. 811-811217

SCHEDULE 4- REPORTING REQUIREMENTS

1.1 Project Launch Meeting

At the request of the Minister, the Recipient shall host a Project launch meeting within thirty (30) days of the Execution Date to introduce the key personnel involved with the Project and to discuss this Agreement, its expected outcomes and benefits and the work plan.

1.2 Progress Report

Within sixty (60) days of the end of each Claim Period, the Recipient will provide a report on the progress of the Project (a “Progress Report”), which is in addition to the report required by Paragraph 8.2(t). The Progress Report will include information in support of the Recipient’s claim submission.

The Progress Report will include at a minimum:

No claim request will be processed unless and until such Progress Report is provided to the Minister, to the Minister’s satisfaction. The Minister may request periodic updates and status reports relating to any aspect of Schedule 1 - Statement of Work and the Recipient shall provide such a report within a period of thirty (30) days from the date of the request.

48

SIF AGREEMENT NO. 811-811217

1.3 Final Progress Report

Within sixty (60) days after the Project Completion Date, the Recipient will provide a final Progress Report on the Project. The Progress Report for the final Claim Period will also provide a summary for the entire Project, addressing the following areas:

Project Completion - The Recipient will demonstrate that the Project has been completed and the Milestones reached in accordance with Schedule 1 -Statement of Work. The Recipient will also summarize how the Project’s goals and objectives were achieved.

Benefits - The report will summarize the benefits achieved during the Work Phase and expected during the Benefits Phase, including innovation, public and economic benefits.

Repayment forecast - The report will provide a three year forecast of expected repayments and/or revenues. If applicable, a summary of the market, sales or business plan associated with the Project’s outcomes should also be provided.

Commercialization Efforts - The report will describe the efforts being undertaken to commercialize the product(s) or processes developed during the Work Phase and/or to continue their development.

1.4 Attestation Letter

Within sixty (60) days after the Project Completion Date, the Recipient will provide an attestation letter from its Chief Financial Officer to certify that all expenses have been paid and that all Eligible Costs were incurred and paid in compliance with this Agreement.

1.5 Project Management Reviews

The Minister and Recipient will conduct a project review (“Project Management

Review”) in the frequency and form as deemed necessary by the terms and conditions of SIF.

Project Management Reviews are meetings between the Recipient and the Minister to review progress as documented in the Progress Reports. Unless otherwise agreed to, a site visit will occur each year to discuss progress related to this Agreement, at a mutually agreeable time, and to review progress against each of the Project Activities and Project Milestones contained in Schedule 1 - Statement of Work. The Minister may also request additional Project Management Reviews by telephone or in person with the Recipient.

At least two (2) weeks prior to the date set for a Project Management Review, an agenda for the meeting will be set which will include, but not be limited to, a review of the technical progress of the Project including achievement of Milestones, of the Project

costs incurred and forecasted for future years, of the Project risks and mitigation plans, of any significant corporate or management changes related to the Recipient, of the financial capability of the Recipient to complete the Project, of its forecasted repayments and repayment risks and potential economic benefits to Canada in the longer term.

49

SIF AGREEMENT NO. 811-811217

1.6 Payable At Year End (PAYE) Set-up form

No later than seven (7) calendar days prior to the end of the Government Fiscal Year, the Recipient will provide an estimate of the Contribution amount that will be required in respect of such Government Fiscal Year so that funds for that fiscal year can be set-aside for the Recipient’s upcoming claim(s) for that year.

1.7 Work Phase Close-Out Meeting