SPIRE GLOBAL, INC.

8000 TOWERS CRESCENT DRIVE

SUITE 1100

VIENNA, VIRGINIA 22182

PRELIMINARY COPY DATED APRIL 12, 2024, SUBJECT TO COMPLETION

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☒ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under §240.14a-12 |

Spire Global, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check all boxes that apply):

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

|

|

|

|

|

SPIRE GLOBAL, INC. 8000 TOWERS CRESCENT DRIVE SUITE 1100 VIENNA, VIRGINIA 22182 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held at 10:00 am Eastern Time on Tuesday, June 4, 2024

Dear Stockholders of Spire Global, Inc.:

We cordially invite you to attend the 2024 annual meeting of stockholders (the “Annual Meeting”) of Spire Global, Inc., to be held on June 4, 2024 at 10:00 am Eastern Time. The Annual Meeting will be conducted virtually via live audio webcast. You will be able to attend the Annual Meeting virtually by visiting www.proxydocs.com/SPIR, where you will be able to listen to the meeting live, submit questions and vote online.

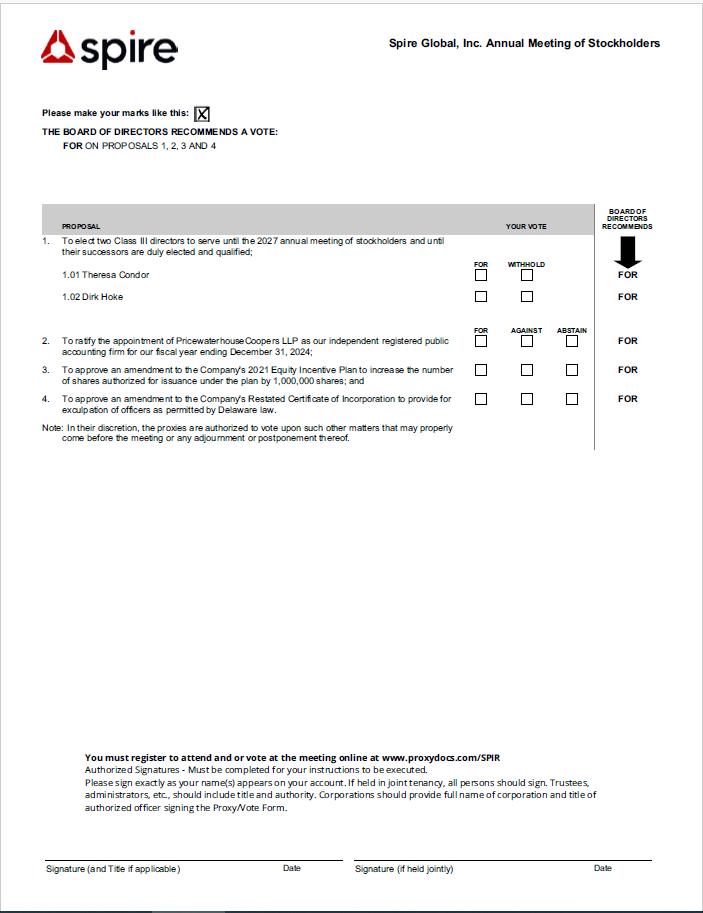

We are holding the Annual Meeting for the following purposes, as more fully described in the accompanying proxy statement:

|

1. |

To elect two Class III directors, Theresa Condor and Dirk Hoke, to serve until the 2027 annual meeting of stockholders and until their successors are duly elected and qualified; |

|

2. |

To ratify the appointment of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for our fiscal year ending December 31, 2024; |

|

3. |

To approve an amendment to the Company's 2021 Equity Incentive Plan to increase the number of shares authorized for issuance under the plan by 1,000,000 shares; |

|

4. |

To approve an amendment to the Company's Restated Certificate of Incorporation to provide for exculpation of officers as permitted by Delaware law; and |

|

5. |

To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

Our board of directors has fixed the close of business on April 15, 2024 as the record date for the Annual Meeting. Stockholders of record on April 15, 2024 are entitled to notice of and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting, we urge you to submit your vote via the Internet, telephone or mail as soon as possible to ensure your shares are represented. Returning the proxy does not deprive you of your right to attend the Annual Meeting and to vote your shares at the Annual Meeting.

By order of the Board of Directors,

Peter Platzer

Chief Executive Officer, President and Chairperson of the Board

Vienna, Virginia

April 23, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 4, 2024: THE 2024 PROXY STATEMENT AND 2023 ANNUAL REPORT ON FORM 10-K ARE AVAILABLE AT www.proxydocs.com/SPIR

TABLE OF CONTENTS

40 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

40 |

42 |

|

42 |

|

42 |

|

Pre-Merger Related Party Transactions of NavSight Holdings, Inc. |

42 |

43 |

|

43 |

|

43 |

|

43 |

|

45 |

|

66 |

SPIRE GLOBAL, INC.

PROXY STATEMENT

FOR 2024 ANNUAL MEETING OF STOCKHOLDERS

to be held at 10:00 am Eastern Time on Tuesday, June 4, 2024

GENERAL INFORMATION

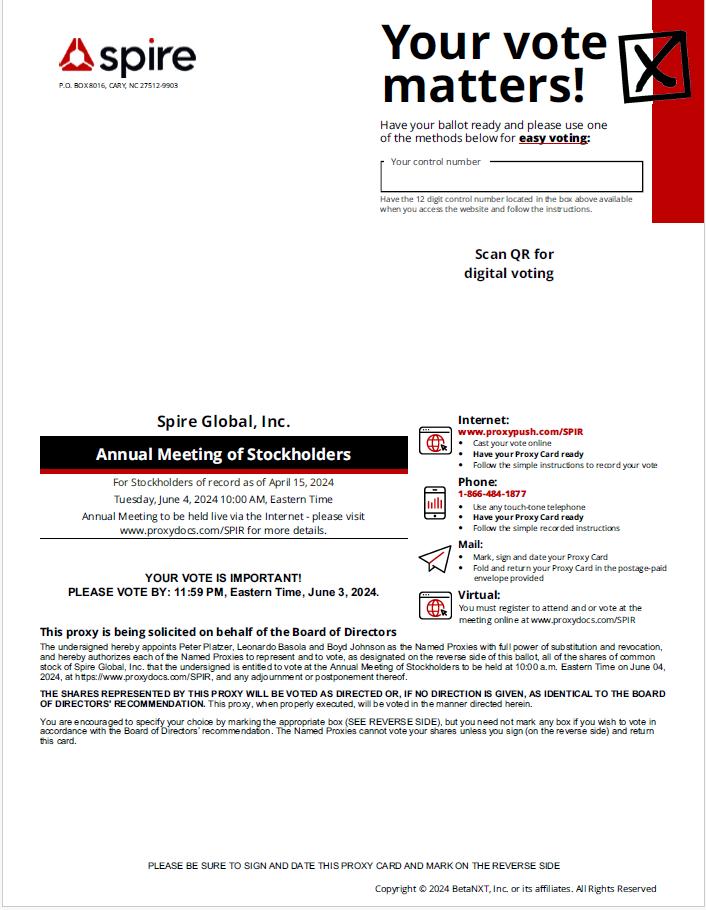

This proxy statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the 2024 annual meeting of stockholders of Spire Global, Inc. (“Spire,” the “Company,” “we,” “us” or similar terms), and any postponements, adjournments, or continuations thereof (the “Annual Meeting”).

The Annual Meeting will be held on Tuesday, June 4, 2024 at 10:00 am Eastern Time. The Annual Meeting will be conducted virtually via live audio webcast. You will be able to attend the Annual Meeting virtually by visiting www.proxydocs.com/SPIR, where you will be able to listen to the meeting live, submit questions and vote online. The Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this proxy statement and our 2023 Annual Report on Form 10-K (our “2023 Annual Report”) is first being mailed on or about April 23, 2024 to all stockholders entitled to vote at the Annual Meeting. The proxy materials and our 2023 Annual Report can be accessed by following the instructions in the Notice.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

On August 16, 2021, Spire Global Subsidiary (formerly known as Spire Global, Inc.) (“Legacy Spire”) closed its previously announced merger with NavSight Holdings, Inc. (“NavSight”), a special purpose acquisition company. As a result, Legacy Spire continued as the surviving corporation and a wholly owned subsidiary of NavSight (the “Merger”, and such consummation, the (“Closing”). NavSight then changed its name to Spire Global, Inc. and Legacy Spire changed its name to Spire Global Subsidiary, Inc.

On August 31, 2023, we effected a reverse stock split at a ratio of 1-for-8 (the “Reverse Stock Split”) of our common stock. In connection with the Reverse Stock Split, every eight shares of our Class A and Class B common stock issued and outstanding as of the effective date were automatically combined into one share of Class A or Class B common stock, as applicable. Unless otherwise indicated, all historical share and per share amounts for periods prior to the Reverse Stock Split in this proxy statement have been adjusted to reflect the Reverse Stock Split. Proportionate adjustments were made to the per share exercise price and the number of shares of Class A common stock that may be purchased upon exercise of outstanding stock options, the number of shares of Class A common stock that will be issued upon the vesting of outstanding restricted stock units (“RSUs”) and the number of shares of Class A common stock reserved for issuance under our 2021 Equity Incentive Plan (the “2021 Plan”) and our 2021 Employee Stock Purchase Plan.

What matters am I voting on?

You are being asked to vote on:

1

How does the board of directors recommend I vote on these proposals?

Our board of directors recommends a vote:

Who is entitled to vote?

Holders of our Class A and Class B common stock as of the close of business on April 15, 2024, the record date for the Annual Meeting, may vote at the Annual Meeting. As of the record date, there were [_______] shares of our Class A common stock outstanding and [______] shares of our Class B common stock outstanding. Our Class A common stock and Class B common stock will vote as a single class on all matters described in this proxy statement for which your vote is being solicited. Stockholders are not permitted to cumulate votes with respect to the election of directors. Each share of Class A common stock is entitled to one vote on each proposal and each share of Class B common stock is entitled to nine votes on each proposal. Our Class A common stock and Class B common stock are collectively referred to in this proxy statement as our “common stock.”

Stockholders of Record. If shares of our common stock are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares. Throughout this proxy statement, we refer to these registered stockholders as “stockholders of record.”

Street Name Stockholders. If shares of our common stock are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name,” and the proxy materials were forwarded to you by your broker or nominee. As the beneficial owner, you have the right to direct your broker, bank, or other nominee as to how to vote your shares. Beneficial owners are also invited to attend the Annual Meeting. However, you may not vote your shares of our common stock live at the Annual Meeting unless you follow your broker’s procedures for obtaining a legal proxy. Throughout this proxy statement, we refer to stockholders who hold their shares through a broker, bank, or other nominee as “street name stockholders.”

How many votes are needed for approval of each proposal?

Proposal No. 1: A director is elected by a plurality of the votes cast with respect to the election of directors at the Annual Meeting. A plurality of votes cast means that the director nominee receiving the greatest number of “For” votes at the Annual Meeting will be elected. You may vote “For” or “Withhold” for the nominee for election as a director. Withhold votes and broker non-votes will have no effect on the outcome of the vote.

Proposal No. 2: The ratification of the appointment of PwC as our independent registered public accounting firm for our fiscal year ending December 31, 2024, requires the affirmative “For” vote of a majority of the voting power of the shares of our common stock present virtually or represented by proxy at the Annual Meeting and entitled to vote thereon to be approved. Abstentions are considered shares present and entitled to vote on this proposal, and thus, will have the same effect as a vote “Against” this proposal. Any broker non-votes will have no effect on the outcome of this proposal.

Proposal No. 3: The approval of an amendment to the 2021 Plan to increase the number of shares authorized for issuance under the plan by 1,000,000 shares requires the affirmative “For” vote of a majority of the voting power of the shares of our common stock present virtually or represented by proxy at the Annual Meeting and entitled to vote thereon to be

2

approved. Abstentions are considered shares present and entitled to vote on this proposal, and thus, will have the same effect as a vote “Against” this proposal. Broker non-votes will have no effect on the outcome of this proposal.

Proposal No. 4: The approval of an amendment to our Restated Certificate of Incorporation to provide for exculpation of officers as permitted by Delaware law requires the affirmative “For” vote of a majority of the voting power of the outstanding shares of our Class A and Class B common stock entitled to vote, voting together as a single class. Abstentions and broker non-votes will have the same effect as a vote “Against” this proposal.

What does it mean if I receive more than one proxy card or voting instruction form?

If you received more than one proxy card or voting instruction form, your shares are registered in more than one name or are registered in different accounts. Please follow the voting instructions included in each proxy card and voting instruction form to ensure that all of your shares are voted.

Are a certain number of shares required to be present at the Annual Meeting?

A quorum is the minimum number of shares required to be present at the Annual Meeting to properly hold an annual meeting of stockholders and conduct business under our amended and restated bylaws and Delaware law. The presence, virtually or by proxy, of a majority of the voting power of all issued and outstanding shares of our common stock entitled to vote at the Annual Meeting will constitute a quorum at the Annual Meeting. Abstentions are counted as shares present and entitled to vote for purposes of determining a quorum.

How do I vote?

If you are a stockholder of record, there are four ways to vote:

Even if you plan to attend the Annual Meeting, we recommend that you also vote by proxy so that your vote will be counted if you later decide not to attend the Annual Meeting.

If you are a street name stockholder, you will receive voting instructions from your broker, bank, or other nominee. You must follow the voting instructions provided by your broker, bank, or other nominee in order to direct your broker, bank, or other nominee on how to vote your shares. Street name stockholders should generally be able to vote by returning a voting instruction form, or by telephone or on the Internet. However, the availability of telephone and Internet voting will depend on the voting process of your broker, bank, or other nominee. As discussed above, if you are a street name stockholder, you may not vote your shares live at the Annual Meeting unless you obtain a legal proxy from your broker, bank, or other nominee.

How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?

Brokerage firms and other intermediaries holding shares of our common stock in street name for their customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker will generally have discretion to vote your shares on the “routine” proposal to ratify the appointment of PwC as our independent registered public accounting firm for our fiscal year ending December 31, 2024. Your broker will not have discretion to vote on any other proposals, which are “non-routine” matters, absent direction from you (and failure to provide instructions on these matters will result in a “broker non-vote”).

3

Can I change my vote?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by:

If you are a street name stockholder, your broker, bank or other nominee can provide you with instructions on how to change your vote or revoke your proxy.

How can I participate in the Annual Meeting?

You will be able to attend the Annual Meeting virtually and vote your shares electronically at the meeting by visiting www.proxydocs.com/SPIR. To participate in the Annual Meeting, you will need the control number included on your Notice or proxy card. The Annual Meeting webcast will begin promptly at 10:00 am Eastern Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 9:45 am Eastern Time, and you should allow ample time for the check-in procedures.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. Peter Platzer, Leonardo Basola and Boyd Johnson have been designated as proxy holders by our board of directors. When proxies are properly submitted, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder.

If the proxy is properly submitted, but no specific instructions are given, the shares will be voted in accordance with the recommendations of our board of directors as described above. If any matters not described in this proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned, the proxy holders can vote the shares on the new Annual Meeting date as well, unless you have properly revoked your proxy, as described above.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we have elected to furnish our proxy materials, including this proxy statement and our 2023 Annual Report, primarily via the Internet. The Notice containing instructions on how to access our proxy materials is first being mailed on or about April 23, 2024 to all stockholders entitled to vote at the Annual Meeting. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact and cost of our annual meetings of stockholders.

How are proxies solicited for the Annual Meeting?

Our board of directors is soliciting proxies for use at the Annual Meeting. All expenses associated with this solicitation will be borne by us. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending our proxy materials to you if a broker, bank, or other nominee holds shares of our common stock on your behalf. In addition, our directors and employees may also solicit proxies by telephone, by electronic communication, or by other means of communication. Our directors and employees will not be paid any additional compensation for soliciting proxies.

Where can I find the voting results of the Annual Meeting?

We will disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting.

4

I share an address with another stockholder, and we received only one paper copy of the Notice or, if applicable, proxy materials. How may I obtain an additional copy of the Notice or, if applicable, proxy materials?

We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we deliver a single copy of the Notice and, if applicable, our proxy materials, to multiple stockholders who share the same address, unless we have received contrary instructions from one or more of such stockholders. This procedure reduces our printing costs, mailing costs, and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice and, if applicable, our proxy materials, to any stockholder at a shared address to which we delivered a single copy of any of these materials. To receive a separate copy, or, if a stockholder is receiving multiple copies, to request that we only send a single copy of the Notice and, if applicable, our proxy materials, such stockholder may contact us at:

Spire Global, Inc.

Attention: Corporate Secretary

8000 Towers Crescent Drive, Suite 1100

Vienna, Virginia 22182

(202) 301-5127

Street name stockholders may contact their broker, bank, or other nominee to request information about householding.

What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

Stockholder Proposals

Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at next year’s annual meeting of stockholders by submitting their proposals in writing to our Corporate Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for the 2025 annual meeting of stockholders, our Corporate Secretary must receive the written proposal at our principal executive offices not later than December 24, 2024. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 regarding the inclusion of stockholder proposals in Company-sponsored proxy materials. Stockholder proposals should be addressed to:

Spire Global, Inc.

Attention: Corporate Secretary

8000 Towers Crescent Drive, Suite 1100

Vienna, Virginia 22182

(202) 301-5127

Our amended and restated bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our amended and restated bylaws provide that the only business that may be conducted at an annual meeting of stockholders is business that is (i) specified in our proxy materials with respect to such annual meeting, (ii) otherwise properly brought before such annual meeting by or at the direction of our board of directors, or (iii) properly brought before such meeting by a stockholder of record entitled to vote at such annual meeting who has delivered timely written notice to our Corporate Secretary, which notice must contain the information specified in our amended and restated bylaws. To be timely for the 2025 annual meeting of stockholders, our Corporate Secretary must receive the written notice at our principal executive offices:

In the event that we hold the 2025 annual meeting of stockholders more than 30 days before or more than 60 days after the one-year anniversary of the Annual Meeting, a notice of a stockholder proposal that is not intended to be included in our proxy statement must be received no earlier than the close of business on the 120th day before the 2025 annual meeting of stockholders and no later than the close of business on the later of the following two dates:

5

If a stockholder who has notified us of his, her, or its intention to present a proposal at an annual meeting of stockholders does not appear to present his, her, or its proposal at such annual meeting, we are not required to present the proposal for a vote at such annual meeting.

Recommendation or Nomination of Director Candidates

Our stockholders may recommend director candidates for consideration by our nominating and corporate governance committee. Any such recommendations should include the nominee’s name and qualifications for membership on our board of directors and should be directed to our Corporate Secretary or legal department at the address set forth above. For additional information regarding stockholder recommendations for director candidates, see the section titled “Board of Directors and Corporate Governance—Stockholder Recommendations and Nominations to the Board of Directors.”

In addition, our amended and restated bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our amended and restated bylaws. In addition, the stockholder must give timely notice to our Corporate Secretary in accordance with our amended and restated bylaws, which, in general, require that the notice be received by our Corporate Secretary within the time periods described above under the section titled “Stockholder Proposals” for stockholder proposals that are not intended to be included in a proxy statement.

In addition to satisfying the foregoing requirements, in order to comply with the universal proxy rules, a stockholder who intends to solicit proxies in support of director nominees for election at the 2025 annual meeting of stockholders, other than the Company’s nominees, must provide notice that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) no later than April 7, 2025. If the date of the 2025 annual meeting of stockholders is more than 30 days before or after the first anniversary of the 2024 Annual Meeting, then such notice must be provided by the later of the 60th day prior to the date of such meeting or the 10th day following the day on which public announcement of the date of such meeting is first made.

Availability of Bylaws

A copy of our amended and restated bylaws is available via the SEC’s website at http://www.sec.gov. You may also contact our Corporate Secretary at the address set forth above for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

6

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business affairs are managed under the direction of our board of directors. Our board of directors currently consists of six directors, four of whom are “independent” under the listing standards of the New York Stock Exchange (“NYSE”). We have a classified board of directors consisting of three classes, each serving staggered three-year terms. Only one class of directors is elected at each annual meeting of stockholders, with the other classes continuing for the remainder of their respective three-year terms. Each director’s term will continue until the end of such director’s three-year term and the election and qualification of their successor, or their earlier death, resignation, or removal.

The following table sets forth the names, ages as of April 12, 2024, and certain other information for each of the directors with terms expiring at the Annual Meeting (both of whom are also nominees for election as a director at the Annual Meeting) and for each of the continuing members of our board of directors:

Name |

|

Class |

|

Age |

|

Position |

|

Current Term Expires |

|

Expiration of Term for Which Nominated |

Directors with Term Expiring at the |

|

|

|

|

|

|

|

|

|

|

Theresa Condor |

|

III |

|

43 |

|

Chief Operating Officer and Director |

|

2024 |

|

2027 |

Dirk Hoke (1) |

|

III |

|

55 |

|

Director |

|

2024 |

|

2027 |

|

|

|

|

|

|

|

|

|

|

|

Continuing Directors |

|

|

|

|

|

|

|

|

|

|

Peter Platzer |

|

I |

|

54 |

|

Chief Executive Officer and Chair |

|

2025 |

|

|

Stephen Messer (2)(3) |

|

I |

|

52 |

|

Director |

|

2025 |

|

|

Joan Amble (1) |

|

I |

|

70 |

|

Director |

|

2025 |

|

|

William Porteous (1)(2)(3) |

|

II |

|

51 |

|

Director |

|

2026 |

|

|

_____________

(1) Member of our audit committee.

(2) Member of our compensation committee.

(3) Member of our nominating and corporate governance committee.

Nominees for the Board of Directors

Theresa Condor has served as our Chief Operating Officer since October 2021 and as one of our directors since August 2021. Prior to her role as Chief Operating Officer, Ms. Condor served as Executive Vice President, General Manager of Space Services and Earth Intelligence since August 2021. Ms. Condor also served as Executive Vice President, General Manager of Space Services and Earth Intelligence at Legacy Spire, in addition to serving in a variety of other roles, since February 2013, and served as one of Legacy Spire’s directors since November 2015. From August 2008 to February 2012, Ms. Condor was with Citigroup Inc., an investment bank and financial services company, where she served most recently as Vice President of Trade Risk Distribution at the Latin America Desk and previously as a Rotating Management Associate. Ms. Condor holds a B.A. in Government from Cornell University and an M.I.A. in International Finance and Policy from the School of International and Public Affairs at Columbia University.

Ms. Condor was selected to serve on our board of directors because of her industry, business, and leadership experience.

Dirk Hoke has served as one of our directors since November 2021. Mr. Hoke is currently the Chief Executive Officer of Volocopter GmbH, the pioneer of Urban Air Mobility. Prior to joining us, Mr. Hoke served as the Chief Executive Officer of the Airbus Defence and Space division of Airbus SE and served as a member of the Airbus Executive Committee from January 2016 to August 2021. Before joining Airbus, he worked at Siemens AG, where he held various executive-level positions including General Manager for the Transrapid Propulsion and Power Supply, President of Siemens Transportation Systems China, the first Chief Executive Officer of Siemens Africa and the Chief Executive Officer of

7

Industrial Solutions, Customer Services and Large Drives in Germany from May 2005 to December 2015. Mr. Hoke currently serves on the Board of Directors of SolarEdge Technologies, Inc. He holds a degree in Mechanical Engineering from the Technical University of Brunswick, Germany and is an Alumni of the Young Global Leader Program of the World Economic Forum.

Mr. Hoke was selected to serve on our board of directors because of his in-depth experience and leadership in the aerospace industry.

Continuing Directors

Peter Platzer has served as our President, Chief Executive Officer, and as one of our directors since August 2021. Mr. Platzer served as the co-founder and Chief Executive Officer of Legacy Spire and as one of its directors from September 2012 through the Closing of our merger with NavSight. Prior to this, Mr. Platzer served as Senior Portfolio Manager at Vegasoul Capital, LLC, an asset management firm, from September 2010 to September 2011, and as Director, Proprietary Trader at Deutsche Bank AG, an investment bank and financial services company, from July 2007 to December 2010. Mr. Platzer also served as Head of Quantitative Research at TRG Management LP, also known as The Rohatyn Group, an asset management firm, from May 2003 to July 2007. Mr. Platzer holds a Dipl. Ing (equivalent to B.S., M.S., and Ph.D. qualification exam) in Physics from the Technical University of Vienna, an M.Sc. cum laude in Space Science and Management from the International Space University, and an M.B.A. summa cum laude from Harvard Business School.

Mr. Platzer was selected to serve on our board of directors because of the perspective and experience he brings as our President and Chief Executive Officer.

Stephen Messer has served as one of our directors since August 2021. Mr. Messer served as one of the directors of Legacy Spire from May 2014 through the Closing. Mr. Messer has served as Member at Zephir Worldwide LLC, a venture capital firm, since 2012. Mr. Messer has served as Vice Chairman and Co-Founder at Collective[i], a foundation AI model for Commerce, since January 2008 and as President and Co-Founder of World Evolved Services, LLC, a venture capital firm, since January 2006. Prior to this, Mr. Messer served as Chief Executive Officer and Co-Founder at LinkShare Corporation, an affiliate marketing service company acquired by Rakuten, Inc., from 1996 to 2005. Mr. Messer currently serves on the board of directors of several private companies and on the advisory boards for multiple venture capital firms. Mr. Messer holds a B.A. in Government and Law, History from Lafayette College and a J.D. from Benjamin N. Cardozo School of Law, Yeshiva University.

Mr. Messer was selected to serve on our board of directors because of his extensive business and leadership experience and his experience in technology, AI, and growth companies.

Joan Amble has served as one of our directors since August 2022. She has an extensive career in finance, most recently serving as Executive Vice President, Finance, and Comptroller for American Express. Prior to holding senior leadership positions at American Express, Ms. Amble spent more than a decade at General Electric, most recently serving as Chief Operating Officer and Chief Financial Officer for GE Capital markets, overseeing securitizations, debt placement, and syndication, as well as structured equity transactions. She has extensive experience in corporate governance, having served on the Board of Directors of Broadcom Corp, Brown-Forman, Sirius XM Holdings Inc., and as an independent advisor to the Executive Committee of the U.S. affiliate of Societe Generate S.A. Ms. Amble currently serves on the Board of Directors of Zurich Insurance Group AG and Booz Allen Hamilton Holding Corp. Until May 2023, she was a board member, audit committee chair and member of the nomination and governance committee at BuzzFeed, Inc. She is currently the president of JCA Consulting, LLC. Throughout her career, Ms. Amble has been a tremendous advocate for the professional development of women in business. She is the co-founder of W.O.M.E.N in America, a leadership program launched in the fall of 2009.

Ms. Amble was selected to serve on our board of directors because of her extensive business experience and leadership in finance, accounting, and corporate governance.

William D. Porteous has served as one of our directors since August 2021. Mr. Porteous served as one of the directors of Legacy Spire from May 2014 through the Closing. Since August 2000, Mr. Porteous has been with RRE Ventures, LLC, a venture capital firm, where he currently serves as a General Partner and the firm’s Chief Operating Officer. Over the course of his career, Mr. Porteous has served on the board of directors of more than 20 companies. In addition to Spire, Mr. Porteous currently serves as Chairman of the Board of Directors of BlackSky Technology Inc., (NYSE: BKSY)

8

as well as Nanit, Paperless Post, Pattern, Pilot Fiber, Ursa, and Wave. Mr. Porteous has also served as Co-Chairman and Founder at the Dockery Farms Foundation, a non-profit dedicated to preserving the historic property and heritage of Dockery Farms. Mr. Porteous served as an Adjunct Professor at Columbia University from January 2003 to May 2018. Mr. Porteous holds a B.A. in English from Stanford University, an M.B.A. from the Harvard Business School, and an M.Sc. in Economics and Industrial Relations from the London School of Economics and Political Science.

Mr. Porteous was selected to serve on our board of directors because of his extensive business and leadership experience.

Family Relationships

Mr. Platzer and Ms. Condor, each a director and executive officer of the Company, are husband and wife. There are no other family relationships among any of the directors or executive officers of the Company.

Director Independence

Under the listing standards of the NYSE, independent directors must comprise a majority of a listed company’s board of directors. In addition, NYSE listing standards require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent. Under NYSE listing standards, a director will only qualify as an “independent director” if the board of directors affirmatively determines that the director has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company).

Our board of directors has undertaken a review of the independence of each director. Based on information provided by each director concerning their background, employment, and affiliations, our board of directors has determined that Messrs. Hoke, Messer and Porteous, and Ms. Amble, do not have a material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) and that each of these directors is “independent” as that term is defined under the listing standards of the NYSE. In making these determinations, our board of directors considered the current and prior relationships that each non-employee director has with our Company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving them described in the section titled “Certain Relationships, Related Party and Other Transactions.”

Board Leadership Structure and Role of the Lead Independent Director

We believe that the structure of our board of directors and its committees provides strong overall management of our Company. Mr. Platzer currently serves as both the chairperson of our board of directors and as our Chief Executive Officer. As our Chief Executive Officer, Mr. Platzer is best positioned to identify strategic priorities, lead critical discussion, and execute our business plans.

Our board of directors has adopted Corporate Governance Guidelines that provide that one of our independent directors will serve as our lead independent director at any time when the chair of our board of directors is not independent, including when our Chief Executive Officer serves as the chair of our board of directors. Our board of directors has appointed Mr. Porteous to serve as our lead independent director. The board of directors considered Mr. Porteous’ demonstrated leadership during his tenure as a member of the board and also his contributions as a member of the compensation committee, nominating and corporate governance committee and audit committee, and the board of directors believes that Mr. Porteous’ ability to act as a strong lead independent director provides balance in our leadership structure and is in the best interests of Spire and its stockholders. As our lead independent director, Mr. Porteous presides over periodic meetings of our independent directors, serves as a liaison between Mr. Platzer and our independent directors, and performs such additional duties as our board of directors may otherwise determine and delegate.

Only independent directors serve on the audit committee, the compensation committee, and the nominating and corporate governance committee of our board of directors. As a result of the board of directors’ committee system and the existence of a majority of independent directors, the board of directors believes it maintains effective oversight of our business operations, including independent oversight of our financial statements, executive compensation, selection of director candidates, and corporate governance programs. We believe that the leadership structure of our board of directors, including Mr. Porteous’ role as lead independent director, as well as the strong independent committees of our board of

9

directors, is appropriate and enhances our board of directors’ ability to effectively carry out its roles and responsibilities on behalf of our stockholders, while Mr. Platzer’s combined role enables strong leadership, creates clear accountability, and enhances our ability to communicate our message and strategy clearly and consistently to stockholders.

Board Meetings and Committees

During our fiscal year ended December 31, 2023, our board of directors held six meetings. Each director attended at least 75% of the aggregate of (i) the total number of meetings of our board of directors held during the period for which he or she served as a director and (ii) the total number of meetings held by all committees of our board of directors on which he or she served during the periods that he or she served.

Although we do not have a formal policy regarding attendance by members of our board of directors at annual meetings of stockholders, we strongly encourage, but do not require, our directors to attend. Each director then on the board attended our 2023 annual meeting of stockholders.

Our board of directors has established an audit committee, a compensation committee, and a nominating and corporate governance committee. The composition and responsibilities of each of the committees of our board of directors is described below.

Audit Committee

Our audit committee consists of Ms. Amble and Messrs. Porteous and Hoke, with Mr. Porteous serving as chairperson. Each member of the audit committee meets the requirements for independence under the listing standards of the NYSE and SEC rules and regulations and the financial literacy and sophistication requirements of the listing standards of the NYSE. In addition, our board of directors has determined that Mr. Porteous is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K under the Securities Act of 1933, as amended (“Securities Act”). Our audit committee is responsible for, among other things:

|

• |

|

selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; |

|

• |

|

helping to ensure the independence and oversee the performance of the independent registered public accounting firm; |

|

• |

|

reviewing and discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent registered public accounting firm, our interim and year-end results of operations; |

|

• |

|

reviewing our financial statements and our critical accounting policies and estimates; |

|

• |

|

overseeing and monitoring the integrity of our financial statements, accounting and financial reporting processes, and internal controls; |

|

• |

|

overseeing the design, implementation, and performance of our internal audit function; |

|

• |

|

overseeing our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters; |

|

• |

|

developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

|

• |

|

overseeing our policies on risk assessment and risk management; |

|

• |

|

overseeing compliance with our code of business conduct and ethics; |

|

• |

|

reviewing and approving related party transactions; and |

|

• |

|

approving or, as required, pre-approving, all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm. |

No member of our audit committee may serve on the audit committee of more than three public companies, including Spire, unless our board of directors determines that such simultaneous service would not impair the ability of such member

10

to effectively serve on our audit committee and we disclose such determination in accordance with the listing standards of the NYSE.

Our audit committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NYSE. A copy of the charter for our audit committee is available on our website at ir.spire.com. During 2023, our audit committee held six meetings.

Compensation Committee

Our compensation committee consists of Messrs. Messer and Porteous, with Mr. Messer serving as chairperson. Each member of our compensation committee meets the requirements for independence under the listing standards of the NYSE and SEC rules and regulations and is a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act. Our compensation committee is responsible for, among other things:

|

• |

|

reviewing, approving, and determining, or making recommendations to our board of directors regarding, the compensation of our executive officers, including our Chief Executive Officer; |

|

• |

|

administering our equity compensation plans and incentive compensation plans; |

|

• |

|

establishing and periodically reviewing general policies and plans relating to compensation and benefits of our employees, and overseeing our overall compensation philosophy; |

|

• |

|

reviewing and making recommendations regarding non-employee director compensation to our full board of directors; and |

|

• |

|

evaluating the performance, or assisting in the evaluation of the performance, of our executive officers, including our Chief Executive Officer. |

Our compensation committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NYSE. A copy of the charter for our compensation committee is available on our website at ir.spire.com. During 2023, our compensation committee held four meetings.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Messrs. Porteous and Messer, with Mr. Porteous serving as chairperson. Each member of the nominating and corporate governance committee meets the requirements for independence under the listing standards of the NYSE and SEC rules and regulations. Our nominating and corporate governance committee is responsible for, among other things:

|

• |

|

identifying, evaluating, and selecting, or making recommendations to our board of directors regarding, nominees for election to our board of directors; |

|

• |

|

considering and making recommendations to our board of directors regarding the composition of our board of directors and its committees; |

|

• |

|

evaluating the performance and attendance of our board of directors and of individual directors; |

|

• |

|

overseeing and reviewing developments in our corporate governance practices; |

|

• |

|

evaluating the adequacy of our corporate governance practices and reporting; |

|

• |

|

periodically reviewing and discussing with our board of directors the corporate succession and development plans for our executive officers and certain key employees; and |

|

• |

|

developing and making recommendations to our board of directors regarding corporate governance guidelines and matters. |

Our nominating and corporate governance committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NYSE. A copy of the charter for our nominating and corporate

11

governance committee is available on our website at ir.spire.com. During 2023, our nominating and corporate governance committee held four meetings.

Considerations in Evaluating Director Nominees

Our nominating and corporate governance committee is responsible for reviewing with the board of directors the appropriate characteristics, skills, and experience required for the board of directors as a whole and its individual members. Our nominating and corporate governance committee uses a variety of methods to identify and evaluate director nominees. Some of the qualifications that our nominating and corporate governance committee considers include, without limitation, issues of character, integrity, judgment, corporate experience, and diversity and other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on the board of directors, potential conflicts of interest, and other commitments. Nominees must also have the highest personal and professional ethics and integrity, have proven achievement and competence in their field and the ability to exercise sound business judgment, have skills that are complementary to those of the existing board of directors, the ability to assist and support management and make significant contributions to our success, and understand the fiduciary responsibilities that are required of a member of our board of directors and have sufficient time and energy necessary to diligently carry out those responsibilities. Members of our board of directors are expected to prepare for, attend, and participate in all board of directors and applicable committee meetings. Our nominating and corporate governance committee may also consider such other factors as it may deem, from time to time, are in our and our stockholders’ best interests.

In its evaluation of director candidates, our nominating and corporate governance committee considers the suitability of each director candidate, including current directors, in light of current size and composition, organization, and governance of our board of directors and the needs of our board of directors and the respective committees of our board of directors. In making determinations regarding nominations of directors, our nominating and corporate governance committee may take into account the benefits of diverse viewpoints.

Our nominating and corporate governance committee also considers the above factors and other factors as it oversees the annual board of director and committee evaluations. After completing its review and evaluation of director candidates, including incumbent directors, our nominating and corporate governance committee recommends to our full board of directors the director nominees for selection.

Stockholder Recommendations and Nominations to the Board of Directors

Our nominating and corporate governance committee will consider director candidates recommended by stockholders, so long as such recommendations comply with our Restated Certificate of Incorporation, amended and restated bylaws, and applicable laws, rules and regulations, including those promulgated by the SEC. Our nominating and corporate governance committee will evaluate such recommendations in accordance with its charter, our amended and restated bylaws and our policies and procedures for director candidates, as well as the regular director nominee criteria described above.

Eligible stockholders wishing to recommend a candidate for nomination should direct the recommendation in writing by letter, attention of the Chief Legal Officer, at 8000 Towers Crescent Drive, Suite 1100, Vienna, Virginia 22182. Such recommendations must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a statement of support by the recommending stockholder, a signed letter from the candidate confirming willingness to serve on our board of directors, information regarding any relationships between the candidate and our Company, evidence of the recommending stockholder’s ownership of our capital stock, and any other information required by our amended and restated bylaws. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors.

Under our amended and restated bylaws, stockholders may also directly nominate persons for our board of directors. Any nomination must comply with the requirements set forth in our amended and restated bylaws and should be sent in writing to our Corporate Secretary at 8000 Towers Crescent Drive, Suite 1100, Vienna, Virginia 22182. To be timely for the 2025 annual meeting of stockholders, nominations must be received by our Corporate Secretary observing the same deadlines for stockholder proposals discussed above under “What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?—Stockholder Proposals.”

12

Communications with the Board of Directors

Interested parties wishing to communicate with non-management members of our board of directors may do so by writing and mailing the correspondence to our Chief Legal Officer or legal department at Spire Global, Inc., 8000 Towers Crescent Drive, Suite 1100, Vienna, Virginia 22182. Each communication should set forth (i) the name and address of the stockholder, as it appears on our books, and if the shares of our common stock are held by a broker, bank or nominee, the name and address of the beneficial owner of such shares, and (ii) the number of shares of our common stock that are owned of record by the record holder and beneficially by the beneficial owner.

Our Chief Legal Officer or legal department, in consultation with appropriate members of our board of directors as necessary, will review all incoming stockholder communications (except for mass mailings, product complaints or inquiries, job inquiries, business solicitations and patently offensive or otherwise inappropriate material) and, if appropriate, will route such communications to the appropriate member or members of our board of directors, or if none is specified, to the chairperson of our board of directors or the lead independent director if there is not an independent chairperson of our board of directors.

Our Chief Legal Officer or legal department may decide in the exercise of their or its judgment whether a response to any stockholder communication is necessary and shall provide a report to our nominating and corporate governance committee on a quarterly basis of any stockholder communications received for which the Chief Legal Officer or legal department has responded. This procedure for stockholder communications with non-management members of our board of directors is administered by our nominating and corporate governance committee.

This procedure does not apply to (i) communications to non-management directors from our officers or directors who are stockholders or (ii) stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act, which are discussed further in the section titled “What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?—Stockholder Proposals” above in this proxy statement.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Our board of directors has adopted Corporate Governance Guidelines that address items such as the qualifications and responsibilities of our directors and director candidates, including independence standards, and corporate governance policies and standards applicable to us in general. In addition, our board of directors has adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior financial officers, as well as contractors, consultants, agents, brokers, distributors or other intermediaries acting on our behalf. The full text of our Code of Business Conduct and Ethics is posted on our website at ir.spire.com. We will disclose any amendments to our Code of Business Conduct and Ethics or any waivers of the requirements of our Code of Business Conduct and Ethics for directors and executive officers on the same website or in filings under the Exchange Act.

13

Transactions in the Company’s Securities and Prohibition on Hedging and Pledging

Our insider trading policy prohibits all of our officers, directors and employees from trading in our securities (or securities of any other company with which we do business) while in possession of material nonpublic information, other than in connection with a Rule 10b5-1 plan adopted in compliance with the policy.

Under our insider trading policy, our officers, directors, and employees may not (i) trade in publicly-traded options, such as puts and calls, and other derivative securities with respect to our securities (other than stock options and other compensatory equity awards issued to such persons by Spire), including any hedging or similar transaction designed to decrease the risks associated with holding our common stock, (ii) pledge our securities as collateral for loans, or (iii) hold our securities in margin accounts.

In addition, before any of our directors or executive officers engages in certain transactions involving our securities, such director or executive officer must obtain pre-clearance and approval of the transaction from a compliance officer of the Company.

Executive Compensation Recoupment Policy

Effective August 2, 2023, the compensation committee approved a Compensation Recovery Policy (the “Clawback Policy”), in compliance with the listing standards of the New York Stock Exchange. The Clawback Policy provides that promptly following an accounting restatement due to the material noncompliance of the Company with any financial reporting requirement under the securities laws (including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period), the compensation committee will determine the amount of the excess of the amount of incentive-based compensation received by Section 16 officers during the three completed fiscal years immediately preceding the required restatement date over the amount of incentive-based compensation that otherwise would have been received had it been determined based on the restated amounts, computed without regard to any taxes paid. The Company will provide each such officer with a written notice of such amount and a demand for repayment or return. If such repayment or return is not made within a reasonable time, the Clawback Policy provides that the Company will recover the erroneously awarded compensation in a reasonable and prompt manner using any lawful method, subject to limited exceptions as permitted by New York Stock Exchange listing standards. The applicable officer shall also be required to reimburse the Company for any and all expenses (including legal fees) reasonably incurred by the Company in recovering such erroneously awarded compensation.

Role of Board in Risk Oversight Process

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance, and reputational, in the pursuit and achievement of our strategic objectives. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day oversight and management of strategic, operational, legal and compliance, cybersecurity, and financial risks, while our board of directors, as a whole and assisted by its committees, has responsibility for the oversight of our risk management framework, which is designed to identify, assess, and manage risks to which our Company is exposed, as well as to foster a corporate culture of integrity. Consistent with this approach, our board of directors regularly reviews our strategic and operational risks in the context of discussions with management, question and answer sessions, and reports from the management team at each regular board meeting. Our board of directors also receives regular reports on all significant committee activities at each regular board meeting and evaluates the risks inherent in significant transactions.

In addition, our board of directors has tasked designated standing committees with oversight of certain categories of risk management. Our audit committee assists our board of directors in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting and disclosure controls and procedures and legal and regulatory compliance. Our audit committee also, among other things, discusses with management and the independent auditor guidelines and policies with respect to risk assessment and risk management, as well as potential conflicts of interest. Our compensation committee assesses risks arising from our compensation philosophy and practices applicable to all employees to determine whether they encourage excessive risk-taking and evaluates policies and practices that could mitigate such risks. Our nominating and corporate governance committee assesses risks relating to our corporate governance practices and the independence of the board.

14

Our board of directors believes its current leadership structure supports the risk oversight function of the board.

Director Compensation

Director Compensation Policy

We have an Outside Director Compensation Policy (the “director compensation policy”). The director compensation policy was amended effective June 14, 2023, with input from our independent compensation consultant, Compensia, Inc. (“Compensia”), regarding practices and compensation levels at the same group of peer companies used for executive compensation comparisons and is intended to attract, retain, and reward non-employee directors.

Under the director compensation policy, each non-employee director will receive the cash and equity compensation for board services described below. We also will reimburse our non-employee directors for reasonable, customary, and documented travel expenses to meetings of our board of directors or its committee and other expenses.

Maximum Annual Compensation Limit

Our director compensation policy provides that in any fiscal year, no non-employee director may be granted equity awards (based on grant date fair value determined in accordance with U.S. generally accepted accounting principles (“GAAP”)), and be provided any other compensation, including without limitation cash retainers or fees in amounts that, in the aggregate, exceed $750,000, provided that such amount is increased to $1,000,000 in the fiscal year of initial service as a non-employee director. Equity awards granted or other compensation provided to a non-employee director for services provided as an employee or consultant (other than a non-employee director) will not count toward this annual limit. The maximum limit does not reflect the intended size of any potential compensation or equity awards to our non-employee directors.

Cash Compensation

Under our director compensation policy as amended June 13, 2023, each non-employee director will be paid an annual cash retainer of $30,000, and the non-employee director who serves as the chairperson or the lead director, as applicable, of our board of directors will be eligible to earn an additional annual fee of $20,000. Moreover, each non-employee director who serves as a chair of one of our committees will be eligible to receive an additional annual fee as follows: $25,000 for the audit committee chair, $15,000 for the compensation committee chair and $10,000 for the nominating and corporate governance committee chair. Each non-employee director who serves as a member of one of our committees, excluding the chairs, will be eligible to receive an additional fee as follows: $15,000 for each audit committee member, $6,500 for each compensation committee member and $4,000 for each nominating and corporate governance committee member. Prior to the June 13, 2023 policy amendment, each non-employee director was paid an annual cash retainer of $30,000 and was eligible to earn one additional annual fee of $15,000 regardless of the number of leadership or committee positions served.

Cash retainers and fees to our non-employee directors are paid quarterly in arrears.

Equity Compensation

Initial Award. Pursuant to our director compensation policy, on the first trading day on or after the date that a person first becomes a non-employee director, such person will receive an initial award of RSUs with an aggregate grant date fair value, determined in accordance with GAAP, equal to $275,000 (with any fractional share rounded down) (the “Initial Award”). The Initial Award will be scheduled to vest in three, equal installments on each of the one-, two-, and three-year anniversaries of the Initial Award’s grant date, in each case subject to continued services to us through the applicable vesting date. If the person was a member of our board of directors and also an employee, then becoming a non-employee director due to termination of employment will not entitle the person to an Initial Award.

Annual Award. On the first trading day immediately after the date of each annual meeting of our stockholders, each non-employee director who has served as a non-employee director for at least six months through the date of such annual meeting will receive automatically an annual award of RSUs with an aggregate grant date fair value determined in accordance with GAAP, equal to $175,000 (with any fractional share rounded down) (the “Annual Award”). Each Annual

15

Award will be scheduled to vest in full on the earlier of the one-year anniversary of the grant date, or the date of the next annual meeting following the grant date, subject to continued services to us through the applicable vesting date.

Change in Control. In the event of a change in control, as defined in the 2021 Plan, each non-employee director’s then-outstanding equity awards covering shares of our Class A common stock that were granted to him or her while a non-employee director will accelerate vesting in full.

Other Award Terms. Each Initial Award and Annual Award will be granted under the 2021 Plan (or its successor plan, as applicable) and form of award agreement under such plan.

Stock Awards in Lieu of Cash Retainers. Our director compensation policy allows non-employee directors to elect to convert 100% of their cash retainer fees with respect to services to be performed in the next fiscal year of ours into an award of shares of our Class A common stock (each, a “Retainer Award”) in accordance with the election procedures under our director compensation policy. Retainer Awards will be granted automatically on the first trading day immediately following each of the four fiscal quarters in the applicable fiscal year, subject to the non-employee director’s continued service with us through such date. The number of shares subject to a Retainer Award will be determined by dividing the amount of cash retainer fees otherwise payable for the most recently completed fiscal quarter described above applicable to the non-employee director, by the closing sales price of a share of our Class A common stock on the grant date of the Retainer Award (or, if no closing sales price was reported on that date, on the last trading day such closing sales price was reported), with the number of shares subject to the Retainer Award, if any fractional share results, rounded down to the nearest whole share.

Stock Option in Lieu of Restricted Stock Units and Cash Retainers. Our director compensation policy also allows non-employee directors to elect to receive their Initial Award or Annual Award, as applicable, in the form of stock options to purchase shares of our Class A common stock, in accordance with the election procedures under our director compensation policy. In the case of Annual Awards, any election by the non-employee director will be required to be made for the next calendar year, and in the case of Initial Awards, any election by the non-employee director will be required to be made within a specified period in connection with such individual first becoming a non-employee director. Each stock option award will cover that number of shares of our Class A common stock that results in a grant date fair value, determined in accordance with GAAP, that is equal to the value of the Initial Award or Annual Award as described above (with the number of shares subject to such award, if any fractional share results, rounded down to the nearest whole share), and have the same vesting schedule that applies to the Initial Annual or Annual Award, as applicable, as described above.

Further, any non-employee director who has both an election in place to receive stock options in lieu of RSUs for the Annual Award and an election in place to receive cash retainer fees in the form of a Retainer Award, automatically will receive Retainer Awards in the form of stock options. The number of shares of our Class A common stock subject to each such stock option award will be determined as such number of shares, based on the closing sales price of a share of our Class A common stock on the date of the grant of the Retainer Award (or, if no closing sales price was reported on that date, on the last trading day such closing sales price was reported), that would result in a grant date fair value, determined in accordance with GAAP, of the stock option being equal to the cash retainer fees otherwise payable for the most recently completed fiscal quarter described above applicable to the non-employee director (with the number of shares subject to the Retainer Award, if any fractional share results, rounded down to the nearest whole share). Each such Retainer Award granted as stock options will be fully vested and exercisable on its grant date.

Each stock option described above granted under our director compensation policy will have a per share exercise price equal to 100% of the fair market value of a share of our Class A common stock on the award’s grant date, and a maximum term to expiration of 10 years from the grant date.

16

Director Compensation Table for Fiscal Year 2023

The following table provides information regarding compensation of our non-employee directors for service as directors, for the year ended December 31, 2023. Directors who are also our employees receive no additional compensation for their service as directors. During 2023, our employee directors, Mr. Platzer and Ms. Condor, did not receive any compensation for their services as directors. See “Executive Compensation” for additional information regarding Mr. Platzer’s and Ms. Condor’s compensation.

Name |

|

Fees Earned or |

|

|

Stock Awards (2) |

|

|

Option Awards (3) |

|

|

Non-Equity Incentive Plan Compensation |

|

|

Non-Qualified Deferred Compensation Earnings |

|

|

All Other Compensation |

|

|

Total |

|

|||||||

Joan Amble |

|

$ |

45,000 |

|

|

$ |

174,997 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

219,997 |

|

Dirk Hoke |

|

$ |

45,000 |

|

|

$ |

- |

|

|

$ |

174,998 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

219,998 |

|

Stephen Messer |

|

$ |

47,198 |

|

|

$ |

174,997 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

222,195 |

|

William Porteous |

|

$ |

71,152 |

|

|

$ |

174,997 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

246,149 |

|

Jack Pearlstein (4) |

|

$ |

10,000 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

10,000 |

|

(1) |

The amounts reported represent the cash retainer amounts received and, for those directors who elected to receive all or a portion of their cash retainers in the form of stock or option awards, the value of the equity award on the date of grant. |

(2) |

The amounts reported represent the aggregate grant-date fair value of the RSUs awarded to the director in 2023, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Stock Compensation (“ASC 718”), disregarding forfeiture assumptions. These amounts do not reflect the actual economic value that may be realized by the non-employee directors, and there can be no assurance that these amounts will ever be realized by the non-employee directors. |

(3) |

The amounts reported represent the aggregate grant-date fair value of stock options awarded to the director in 2023, computed in accordance with ASC 718. For discussion of the assumptions used in calculating the dollar amount recognized for financial statement reporting purposes of the awards reported in this column, see Note 10 to our consolidated financial statements in the Annual Report on Form 10-K for the year ended December 31, 2023. |

(4) |

Mr. Pearlstein resigned from the Board of Directors effective March 13, 2023. As a result, his cash retainer amount is proportionate to the duration of his service as a director during 2023, and he did not receive an equity award in 2023. |

The following table lists all outstanding equity awards held by our non-employee directors as of December 31, 2023:

|

|

|

|

Option Awards |

|

Stock Awards |

|||||||||||

Name |

|

Grant Date |

|

Number of Securities Underlying Unexercised Options |

|

|

Option Exercise Price Per Share ($) |

|

|

Option Expiration Date |

|

Number of Securities Underlying Unvested Stock Awards |

|

|

|||

Dirk Hoke |

|

11/15/2021 |

|

|

12,246 |

|

(1) |

|

43.20 |

|

|

11/15/2031 |

|

— |

|

|

|

|

|

6/2/2022 |

|

|

22,389 |

|

(2) |

13.92 |

|

|

6/2/2032 |

|

— |

|

|

||

|

|

6/14/2023 |

|

|

61,446 |

|

(3) |

|

5.37 |

|

|

6/14/2033 |

|

— |

|

|

|

Stephen Messer |

|

4/1/2019 |

|

|

762 |

|

(2) |

|

14.80 |

|

|

3/31/2029 |

|

— |

|

|

|

|

|

2/18/2021 |

|

|

22,852 |

|

(4) |

|

26.32 |

|

|

2/17/2031 |

|

— |

|

|

|

|

|

6/14/2023 |

|

— |

|

|

— |

|

|

— |

|

|

32,600 |

|

(5) |

||

William Porteous |

|

6/14/2023 |

|

— |

|

|

— |

|

|

— |

|

|

32,600 |

|

(5) |

||

Joan Amble |

|

8/11/2022 |

|

— |

|

|

— |

|

|

— |

|

|

15,076 |

|

(6) |

||

|

|

6/14/2023 |

|

— |

|

|

— |

|

|

— |

|

|

32,600 |

|

(5) |

||

(1) |

The shares of our Class A common stock underlying this option vest as to 1/3rd of the total shares annually commencing November 15, 2022, subject to Mr. Hoke's continued role as a service provider to us. |

(2) |

The shares of our Class A common stock underlying this option are fully vested and immediately exercisable. |

(3) |

The shares of our Class A common stock underlying this option fully vest on the earlier of the one-year anniversary of the grant date or the date of the 2024 annual meeting, subject to Mr. Hoke's continued role as a service provider to us. |

(4) |

This option is subject to an early exercise provision and is immediately exercisable. The shares of our Class A common stock underlying this option vest as to 1/48th of the total shares monthly commencing March 3, 2021, subject to Mr. Messer's continued role as a service provider to us. |

(5) |

The service-based vesting condition will be satisfied as to all of the RSUs on the earlier of the one-year anniversary of the grant date or the date of the 2024 annual meeting, subject to the holder's continued role as a service provider to us. |

17

(6) |

The service-based vesting condition will be satisfied as to all of the RSUs on August 20, 2025, subject to Ms. Amble's continued role as a service provider to us. |

18

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Our board of directors is currently composed of six members. We have a classified board of directors consisting of three classes, each serving staggered three-year terms.

At each annual meeting of stockholders, directors of a specific class of our board of directors will be elected to hold office until the expiration of the term for which they are elected and until their successors have been duly elected and qualified or until their earlier death, resignation, or removal.

Nominees for the Board of Directors

Our nominating and corporate governance committee has recommended, and our board of directors has approved, Theresa Condor and Dirk Hoke as the nominees for election as directors at the Annual Meeting. If elected, Ms. Condor and Mr. Hoke will serve as directors until the 2027 annual meeting of stockholders and until their successors are duly elected and qualified. Ms. Condor and Mr. Hoke are currently directors of our Company. For information concerning the relevant experiences, qualifications, attributes, and skills of Ms. Condor and Mr. Hoke that led our board of directors to recommend them as the nominees for directors, please see the section titled “Board of Directors and Corporate Governance.” Each of Ms. Condor and Mr. Hoke have consented to being named as a nominee in the proxy statement and to continue to serve as a director, if elected; however, in the event that he or she is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by our board of directors to fill such vacancy.