false0001816017Q1--12-31http://fasb.org/us-gaap/2024#LiabilitiesCurrenthttp://fasb.org/us-gaap/2024#LiabilitiesCurrenthttp://fasb.org/us-gaap/2024#LiabilitiesCurrenthttp://fasb.org/us-gaap/2024#LiabilitiesCurrent0001816017us-gaap:CashAndCashEquivalentsMember2025-03-310001816017us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberspir:CustomerAMember2024-01-012024-03-310001816017spir:MeasurementInputCommonStockFairValueMemberspir:ContingentEarnoutLiabilityMember2024-12-310001816017spir:CreditAgreementWarrantsMemberus-gaap:FairValueInputsLevel2Memberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017us-gaap:MachineryAndEquipmentMember2024-12-310001816017spir:KplerHoldingSaMember2024-12-310001816017us-gaap:CashMemberus-gaap:CashAndCashEquivalentsMember2025-03-310001816017us-gaap:LineOfCreditMemberspir:BlueTorchTermLoanFacilityMemberspir:ExitFeeMember2024-04-080001816017spir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017us-gaap:FairValueInputsLevel2Memberspir:ContingentEarnoutLiabilityMemberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017spir:SatelliteInServiceMember2024-12-310001816017us-gaap:LineOfCreditMemberspir:BlueTorchWarrantsMember2024-02-082024-02-080001816017us-gaap:SalesRevenueNetMemberspir:CustomerCMemberus-gaap:CustomerConcentrationRiskMember2025-01-012025-03-310001816017us-gaap:MeasurementInputPriceVolatilityMemberspir:ContingentEarnoutLiabilityMember2024-12-310001816017us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:EMEAMember2024-01-012024-03-310001816017us-gaap:CommonClassBMember2024-12-310001816017us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InvestmentsMember2024-12-310001816017us-gaap:FairValueInputsLevel2Memberspir:LongTermLiabilitiesMemberspir:ContingentEarnoutLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017us-gaap:SoftwareDevelopmentMember2024-12-310001816017us-gaap:MeasurementInputExpectedDividendRateMemberspir:CreditAgreementWarrantsMember2025-03-310001816017spir:TwoThousandTwentyOneEmployeeStockPurchasePlanMember2025-01-012025-01-010001816017us-gaap:LeaseholdImprovementsMember2024-12-310001816017srt:MaximumMemberspir:BlueTorchWarrantsMember2023-09-270001816017us-gaap:RetainedEarningsMember2024-12-310001816017spir:SecuritiesPurchaseAgreementMemberus-gaap:CommonClassAMember2024-02-082024-02-0800018160172024-03-310001816017us-gaap:CommonClassAMemberspir:SecuritiesPurchaseAgreementWarrantsMember2024-03-210001816017spir:CreditAgreementWarrantsMember2024-01-012024-03-310001816017us-gaap:FairValueInputsLevel3Memberspir:ContingentEarnoutLiabilityMemberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017us-gaap:LineOfCreditMemberspir:BlueTorchTermLoanFacilityMemberspir:ExitFeeMember2023-09-270001816017country:US2025-01-012025-03-310001816017us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310001816017spir:CustomerDMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-12-310001816017us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InvestmentsMember2024-12-310001816017us-gaap:CashMemberus-gaap:CashAndCashEquivalentsMember2024-12-310001816017spir:GroundStationsInServiceMember2024-12-310001816017us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017us-gaap:FairValueInputsLevel2Memberspir:SecuritiesPurchaseAgreementWarrantsMemberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017us-gaap:FairValueInputsLevel1Memberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017spir:TwoThousandTwentyOnePlanMember2025-01-012025-03-310001816017spir:CommonStockWarrantMemberspir:WarrantToUrgentCapitalLlcMember2022-06-130001816017spir:ExpectedTimeOfSatisfactionOverNextOneToTwelveMonthMember2025-03-310001816017us-gaap:PrivatePlacementMember2025-03-142025-03-140001816017us-gaap:MeasurementInputRiskFreeInterestRateMemberspir:ContingentEarnoutLiabilityMember2025-03-310001816017us-gaap:SalesRevenueNetMemberspir:CustomerBMemberus-gaap:CustomerConcentrationRiskMembersrt:MaximumMember2025-01-012025-03-310001816017us-gaap:PatentsMember2025-03-310001816017us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001816017us-gaap:LineOfCreditMemberspir:CommitmentFeeMemberspir:BlueTorchTermLoanFacilityMember2025-03-310001816017spir:FinishedSatellitesNotInServiceMember2025-03-310001816017spir:PreFundedWarrantsMember2025-03-122025-03-1200018160172021-11-012021-11-300001816017us-gaap:AdditionalPaidInCapitalMember2025-03-310001816017us-gaap:RetainedEarningsMember2025-03-310001816017spir:TwoThousandTwentyTwoBlueTorchWarrantsMembersrt:MinimumMember2023-09-270001816017spir:CreditAgreementWarrantsMemberus-gaap:FairValueInputsLevel2Memberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017spir:StockOptionsAndTwoThousandTwentyOneESPPToPurchaseClassACommonStockMember2025-01-012025-03-310001816017spir:EquityDistributionAgreementMemberus-gaap:CommonClassAMember2025-01-012025-03-310001816017us-gaap:MeasurementInputRiskFreeInterestRateMemberspir:ContingentEarnoutLiabilityMember2024-12-310001816017spir:CustomerEMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembersrt:MaximumMember2024-01-012024-12-310001816017spir:BlueTorchWarrantsMember2024-08-272024-08-270001816017us-gaap:MeasurementInputExpectedDividendRateMemberspir:CreditAgreementWarrantsMember2024-12-310001816017us-gaap:SalesRevenueNetMemberspir:NonSubscriptionBasedContractsMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310001816017us-gaap:CashAndCashEquivalentsMemberus-gaap:MoneyMarketFundsMember2024-12-3100018160172025-04-250001816017us-gaap:FurnitureAndFixturesMember2024-12-310001816017us-gaap:NotesReceivableMember2025-03-310001816017us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001816017spir:BlueTorchTermLoanFacilityMember2024-02-082024-02-080001816017spir:SatelliteLaunchAndGroundStationWorkInProgressMember2025-03-310001816017us-gaap:RetainedEarningsMember2024-03-310001816017us-gaap:CommonStockMember2025-01-012025-03-310001816017us-gaap:FairValueInputsLevel2Memberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017spir:CommonStockWarrantMemberspir:BlueTorchTermLoanFacilityMember2022-06-130001816017spir:PreFundedWarrantsMember2025-03-120001816017spir:ARL3HarrisAgreementMember2025-03-310001816017us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembersrt:AsiaPacificMember2025-01-012025-03-310001816017us-gaap:FairValueInputsLevel3Memberspir:ContingentEarnoutLiabilityMember2025-01-012025-03-310001816017us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017us-gaap:LeaseholdImprovementsMember2025-03-310001816017us-gaap:AdditionalPaidInCapitalMember2024-12-310001816017us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017srt:AffiliatedEntityMember2025-01-012025-03-310001816017srt:MinimumMemberspir:BlueTorchWarrantsMember2023-09-270001816017us-gaap:MeasurementInputPriceVolatilityMemberspir:ContingentEarnoutLiabilityMember2025-03-310001816017us-gaap:DevelopedTechnologyRightsMember2025-01-012025-03-310001816017us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberspir:CustomerAMember2025-01-012025-03-310001816017us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017us-gaap:PropertyPlantAndEquipmentMember2024-01-012024-03-310001816017us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2025-01-012025-03-310001816017us-gaap:ResearchAndDevelopmentExpenseMember2025-01-012025-03-310001816017us-gaap:FairValueInputsLevel1Memberspir:ContingentEarnoutLiabilityMemberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InvestmentsMember2024-12-310001816017country:GB2025-01-012025-03-310001816017us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001816017us-gaap:FairValueInputsLevel3Memberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017us-gaap:FairValueInputsLevel3Memberspir:ContingentEarnoutLiabilityMemberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017spir:BlueTorchWarrantsMember2024-08-270001816017spir:CustomerDMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembersrt:MaximumMember2025-01-012025-03-310001816017us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2025-03-3100018160172024-12-310001816017spir:ContingentEarnoutLiabilityMember2024-12-310001816017spir:CanaccordGenuityLlcMemberspir:EquityDistributionAgreementMemberus-gaap:CommonClassAMember2022-09-142022-09-140001816017spir:CreditAgreementWarrantsMemberspir:MeasurementInputCommonStockFairValueMember2025-03-310001816017spir:CreditAgreementWarrantsMembersrt:MaximumMemberus-gaap:MeasurementInputExpectedTermMember2025-03-310001816017srt:AmericasMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2025-01-012025-03-310001816017spir:StockOptionsAndTwoThousandTwentyOneESPPToPurchaseClassACommonStockMember2024-01-012024-03-310001816017spir:CreditAgreementWarrantsMemberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017spir:KplerHoldingSaMember2025-03-310001816017spir:BtcTermLoanMember2025-03-310001816017us-gaap:FairValueInputsLevel1Memberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017spir:CreditAgreementWarrantsMemberus-gaap:MeasurementInputExercisePriceMembersrt:MaximumMember2024-12-310001816017us-gaap:RestrictedStockUnitsRSUMember2024-12-310001816017spir:TwoThousandTwentyTwoBlueTorchWarrantsMember2022-06-1300018160172025-03-122025-03-120001816017us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-03-310001816017us-gaap:PropertyPlantAndEquipmentMember2025-01-012025-03-310001816017country:US2024-01-012024-03-310001816017spir:CreditAgreementWarrantsMembersrt:MaximumMemberus-gaap:MeasurementInputExpectedTermMember2024-12-310001816017spir:SharePurchaseAgreementLitigationMember2024-11-132024-11-130001816017us-gaap:SellingAndMarketingExpenseMember2024-01-012024-03-3100018160172024-01-012024-12-310001816017us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001816017us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-03-310001816017us-gaap:FairValueInputsLevel3Memberspir:CreditAgreementWarrantsMemberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017us-gaap:NotesReceivableMember2025-01-012025-03-310001816017us-gaap:LineOfCreditMemberspir:BlueTorchTermLoanFacilityMemberspir:ExitFeeMember2025-03-310001816017us-gaap:PrivatePlacementMember2025-03-120001816017us-gaap:RelatedPartyMember2024-12-310001816017spir:CreditAgreementWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2025-03-310001816017spir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberspir:SubscriptionBasedContractMember2024-01-012024-03-310001816017us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-03-310001816017spir:CreditAgreementWarrantsMemberus-gaap:MeasurementInputExercisePriceMembersrt:MinimumMember2024-12-310001816017us-gaap:CommonClassBMember2025-03-310001816017spir:CreditAgreementWarrantsMemberus-gaap:FairValueInputsLevel1Memberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017spir:BlueTorchTermLoanFacilityMember2022-06-130001816017spir:ContingentEarnoutLiabilityMemberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017us-gaap:MeasurementInputPriceVolatilityMemberspir:CreditAgreementWarrantsMember2024-12-310001816017us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017us-gaap:AdditionalPaidInCapitalMember2024-03-310001816017us-gaap:CommonClassAMember2025-05-090001816017us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001816017spir:SecuritiesPurchaseAgreementWarrantsMember2024-03-210001816017us-gaap:RetainedEarningsMember2024-01-012024-03-310001816017us-gaap:CommonClassAMemberspir:SecuritiesPurchaseAgreementWarrantsMember2024-03-212024-03-210001816017srt:AffiliatedEntityMember2024-01-012024-12-310001816017spir:AnotherGovernmentAgencyMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembersrt:MaximumMemberspir:CustomerAMember2024-01-012024-03-310001816017us-gaap:SalesRevenueNetMemberspir:CustomerBMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310001816017us-gaap:PrivatePlacementMember2025-03-122025-03-120001816017us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017spir:CreditAgreementWarrantsMember2025-01-012025-03-310001816017srt:MaximumMember2025-01-012025-03-310001816017spir:ARL3HarrisAgreementMemberspir:ExcessRevenueMember2024-03-310001816017spir:CreditAgreementWarrantsMember2025-01-012025-03-310001816017us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2025-03-310001816017us-gaap:CostOfSalesMember2025-01-012025-03-3100018160172025-01-012025-03-310001816017spir:FinishedSatellitesNotInServiceMember2024-12-310001816017us-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberspir:BlueTorchTermLoanFacilityMember2025-03-310001816017spir:SecuritiesPurchaseAgreementWarrantsMember2024-01-012024-03-310001816017us-gaap:FairValueInputsLevel3Memberspir:ContingentEarnoutLiabilityMember2025-03-310001816017us-gaap:LineOfCreditMemberspir:AgencyFeeMemberspir:BlueTorchTermLoanFacilityMember2025-03-310001816017spir:SecuritiesPurchaseAgreementMemberus-gaap:CommonClassAMember2024-02-042024-02-040001816017spir:ContingentEarnoutLiabilityMember2025-03-3100018160172025-03-310001816017us-gaap:RetainedEarningsMember2025-01-012025-03-310001816017us-gaap:AccountsReceivableMemberspir:CustomerCMemberus-gaap:CustomerConcentrationRiskMembersrt:MaximumMember2025-01-012025-03-310001816017spir:BlueTorchWarrantsMember2022-06-130001816017spir:ExactEarthAcquisitionMember2025-03-310001816017us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InvestmentsMember2024-12-310001816017us-gaap:CashAndCashEquivalentsMemberus-gaap:MoneyMarketFundsMember2025-03-310001816017us-gaap:CommonClassAMember2025-03-310001816017us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:EMEAMember2025-01-012025-03-3100018160172023-09-270001816017spir:SharePurchaseAgreementLitigationMember2024-11-130001816017us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberspir:CustomerCMembersrt:MaximumMember2024-01-012024-03-310001816017spir:TwoThousandTwentyOnePlanMember2025-01-012025-01-010001816017us-gaap:RelatedPartyMember2025-01-012025-03-310001816017spir:WarrantToUrgentCapitalLlcMember2022-06-130001816017spir:LongTermLiabilitiesMemberspir:ContingentEarnoutLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310001816017spir:FccLicensesMember2025-01-012025-03-310001816017us-gaap:LineOfCreditMemberspir:BlueTorchTermLoanFacilityMember2023-10-020001816017us-gaap:DevelopedTechnologyRightsMember2024-12-310001816017spir:CreditAgreementWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-12-310001816017spir:BorrowedConvertibleNotesPayableMembersrt:AffiliatedEntityMember2021-11-300001816017us-gaap:TradeNamesMember2024-12-310001816017us-gaap:CommonStockMember2024-01-012024-03-310001816017us-gaap:CommonStockMember2025-03-310001816017us-gaap:CommonClassBMember2025-05-090001816017spir:WarrantToUrgentCapitalLlcMember2023-09-270001816017us-gaap:CreditConcentrationRiskMemberus-gaap:AccountsReceivableMemberspir:CustomerOneMember2025-03-310001816017spir:SecuritiesPurchaseAgreementMember2024-02-040001816017spir:PlacementAgencyAgreementMemberspir:AllianceGlobalPartnersMember2024-03-212024-03-210001816017us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberspir:CustomerOneMember2025-01-012025-03-310001816017spir:PurchaseAgreementMemberus-gaap:SubsequentEventMember2025-04-250001816017us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001816017us-gaap:RetainedEarningsMember2023-12-310001816017us-gaap:CashAndCashEquivalentsMember2024-12-310001816017us-gaap:RestrictedStockUnitsRSUMember2025-01-012025-03-310001816017us-gaap:AccountsReceivableMemberspir:CustomerOneMemberus-gaap:CustomerConcentrationRiskMember2025-03-310001816017us-gaap:RestrictedStockUnitsRSUMember2025-01-012025-03-310001816017us-gaap:AdditionalPaidInCapitalMember2025-01-012025-03-310001816017us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001816017spir:CreditAgreementWarrantsMemberus-gaap:FairValueInputsLevel1Memberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017spir:LongTermLiabilitiesMemberspir:SecuritiesPurchaseAgreementWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017spir:GroundStationsInServiceMember2025-03-310001816017spir:SatelliteLaunchAndGroundStationWorkInProgressMember2024-12-310001816017us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017spir:OtherLongTermDebtMember2024-12-310001816017us-gaap:FairValueInputsLevel2Memberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017spir:BtcTermLoanMember2024-12-310001816017us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembersrt:AsiaPacificMember2024-01-012024-03-310001816017us-gaap:TradeNamesMember2025-03-310001816017us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-03-310001816017us-gaap:ComputerEquipmentMember2025-03-310001816017spir:CustomerFMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2025-01-012025-03-310001816017us-gaap:SellingAndMarketingExpenseMember2025-01-012025-03-310001816017spir:FccLicensesMember2025-03-310001816017us-gaap:FairValueInputsLevel3Memberspir:CreditAgreementWarrantsMemberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-3100018160172024-01-012024-03-310001816017us-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017us-gaap:CostOfSalesMember2024-01-012024-03-310001816017us-gaap:DevelopedTechnologyRightsMember2025-03-310001816017spir:FccLicensesMember2024-12-310001816017spir:CreditAgreementWarrantsMembersrt:MinimumMemberus-gaap:MeasurementInputExercisePriceMember2025-03-310001816017us-gaap:WarrantMemberspir:IntroducingFeeMember2022-06-130001816017us-gaap:SoftwareDevelopmentMember2025-03-310001816017us-gaap:MachineryAndEquipmentMember2025-03-310001816017spir:MeasurementInputCommonStockFairValueMemberspir:ContingentEarnoutLiabilityMember2025-03-310001816017us-gaap:CommonStockMember2023-12-310001816017us-gaap:RelatedPartyMember2025-03-310001816017spir:ExactEarthAcquisitionMember2024-12-310001816017spir:SatelliteInServiceMember2025-03-310001816017spir:BorrowedConvertibleNotesPayableMembersrt:AffiliatedEntityMember2025-03-310001816017spir:ARL3HarrisAgreementMember2025-01-012025-03-310001816017us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017us-gaap:TradeNamesMember2025-01-012025-03-310001816017spir:BlueTorchTermLoanFacilityMember2025-01-012025-03-310001816017us-gaap:RestrictedStockUnitsRSUMember2025-03-310001816017us-gaap:FairValueInputsLevel3Memberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017spir:PurchaseAgreementMember2024-11-130001816017spir:SecuritiesPurchaseAgreementMemberus-gaap:CommonClassAMember2024-03-210001816017us-gaap:MeasurementInputPriceVolatilityMemberspir:CreditAgreementWarrantsMember2025-03-310001816017us-gaap:RelatedPartyMember2024-01-012024-03-310001816017us-gaap:AdditionalPaidInCapitalMember2023-12-310001816017spir:TwoThousandTwentyTwoBlueTorchWarrantsMembersrt:MaximumMember2023-09-270001816017spir:CustomerFMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembersrt:MaximumMember2024-01-012024-12-310001816017spir:SecuritiesPurchaseAgreementWarrantsMemberspir:AllianceGlobalPartnersMember2024-03-212024-03-210001816017us-gaap:AccountsReceivableMemberspir:CustomerCMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-12-310001816017spir:CreditAgreementWarrantsMemberspir:MeasurementInputCommonStockFairValueMember2024-12-310001816017us-gaap:FairValueInputsLevel1Memberspir:LongTermLiabilitiesMemberspir:ContingentEarnoutLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017spir:ExpectedTimeOfSatisfactionOverNextTwentyFiveToThirtySixMonthsMember2025-03-310001816017spir:ARL3HarrisAgreementMemberspir:ExcessRevenueMember2025-03-310001816017spir:BlueTorchTermLoanFacilityMember2024-04-082024-04-080001816017spir:ARL3HarrisAgreementMember2024-01-012024-03-310001816017spir:CreditAgreementWithFpCreditPartnersLpMemberspir:BlueTorchTermLoanFacilityMember2022-06-132022-06-130001816017us-gaap:CommonStockMember2024-03-310001816017us-gaap:LineOfCreditMemberspir:BlueTorchWarrantsMember2023-10-022023-10-020001816017spir:OtherLongTermDebtMember2025-03-310001816017us-gaap:AccountsReceivableMemberspir:CustomerEMemberus-gaap:CustomerConcentrationRiskMember2025-01-012025-03-3100018160172024-11-130001816017spir:ExpectedTimeOfSatisfactionOverNextThirteenToTwentyFourMonthsMember2025-03-310001816017us-gaap:LineOfCreditMemberspir:BlueTorchTermLoanFacilityMember2023-09-270001816017spir:ARL3HarrisAgreementMember2025-04-252025-04-250001816017us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberspir:SubscriptionBasedContractMember2025-01-012025-03-310001816017spir:CreditAgreementWarrantsMemberus-gaap:MeasurementInputExercisePriceMembersrt:MaximumMember2025-03-310001816017us-gaap:CommonClassAMember2024-12-310001816017spir:ExpectedTimeOfSatisfactionOverNextThirtySevenToFortyEightMonthsMember2025-03-310001816017us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberspir:CustomerAMembersrt:MaximumMember2025-01-012025-03-3100018160172023-12-310001816017spir:ContingentEarnoutLiabilityMember2025-01-012025-03-310001816017spir:CreditAgreementWarrantsMembersrt:MinimumMemberus-gaap:MeasurementInputExpectedTermMember2024-12-310001816017country:CA2024-01-012024-03-310001816017us-gaap:FairValueInputsLevel3Memberspir:ContingentEarnoutLiabilityMember2024-12-310001816017spir:CreditAgreementWarrantsMemberspir:LongTermLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001816017srt:AmericasMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310001816017spir:TwoThousandTwentyOneEmployeeStockPurchasePlanMember2025-01-012025-03-310001816017spir:ExpectedTimeOfSatisfactionOverNextRemainingMember2025-03-310001816017us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001816017us-gaap:PatentsMember2024-12-310001816017us-gaap:SalesRevenueNetMemberspir:NonSubscriptionBasedContractsMemberus-gaap:CustomerConcentrationRiskMember2025-01-012025-03-310001816017us-gaap:GeneralAndAdministrativeExpenseMember2025-01-012025-03-310001816017spir:CreditAgreementWarrantsMembersrt:MinimumMemberus-gaap:MeasurementInputExpectedTermMember2025-03-310001816017us-gaap:ComputerEquipmentMember2024-12-310001816017us-gaap:CommonStockMember2024-12-310001816017us-gaap:FurnitureAndFixturesMember2025-03-31xbrli:purexbrli:sharesspir:Segmentspir:Installmentsiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2025

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from______ to______

Commission File Number: 001-39493

SPIRE GLOBAL, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

Delaware |

85-1276957 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer

Identification No.) |

8000 Towers Crescent Drive Suite 1100 Vienna, Virginia 22182 |

(Address of principal executive offices) (Zip Code) |

(202) 301-5127

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Class A common stock, par value of $0.0001 per share |

|

SPIR |

|

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

Emerging growth company |

|

☒ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The registrant had outstanding 31,076,659 shares of Class A common stock and 1,507,325 shares of Class B common stock as of May 9, 2025.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “would,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” “seek” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this Quarterly Report on Form 10-Q include, but are not limited to, statements about:

•the sufficiency of our working capital in the future;

•significant political, trade, regulatory developments, and other circumstances beyond our control, including as a result of recently announced tariffs, could have a material adverse effect on our financial condition or results of operations;

•changes in our growth, strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, and plans;

•our ability to remedy identified material weaknesses;

•the ability to develop new offerings, services, solutions and features and bring them to market in a timely manner and make enhancements to our business;

•the quality and effectiveness of and advancements in our technology and our ability to accurately and effectively use data and engage in predictive analytics;

•overall level of customer demand for our products and services;

•expectations and timing related to product launches;

•expectations of achieving and maintaining profitability;

•projections of total addressable markets, market opportunity, and market share;

•our ability to acquire data sets, software, equipment, satellite components, and regulatory approvals from third parties;

•our expectations concerning relationships with third parties;

•our ability to acquire or develop products or technologies we believe could complement or expand our platform or to expand our products and services internationally;

•our ability to obtain and protect patents, trademarks, licenses and other intellectual property rights;

•our ability to utilize potential net operating loss carryforwards;

•developments and projections relating to our competitors and industries, such as the projected growth in demand for space-based data;

•our ability to acquire new customers and partners or obtain renewals, upgrades, or expansions from our existing customers;

•our ability to compete with existing and new competitors in existing and new markets and offerings;

•our ability to retain or recruit officers, key employees or directors;

•our future capital requirements and sources and uses of cash;

•our business, expansion plans, and opportunities;

•our expectations regarding regulatory approvals and authorizations;

•the expectations regarding the effects of existing and developing laws and regulations, including with respect to regulations around satellites, intellectual property law, and privacy and data protection; and

•global and domestic economic conditions, including currency exchange rate fluctuations, inflation, rising interest rates and geopolitical uncertainty and instability, and their impact on demand and pricing for our offerings in affected markets.

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Quarterly Report on Form 10-Q. You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Quarterly Report on Form 10-Q primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations, and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, and other factors, including those described in Part I, Item 1A “Risk Factors” of our Annual Report on Form 10-K/A for the year ended December 31, 2024 and in Part II, Item 1A “Risk Factors” of this Quarterly Report on Form 10-Q. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Quarterly Report on Form 10-Q. We cannot assure you that the results, events, and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.

Neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Moreover, the forward-looking statements made in this Quarterly Report on Form 10-Q relate only to expectations as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Quarterly Report on Form 10-Q to reflect events or circumstances after the date of this Quarterly Report on Form 10-Q or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Quarterly Report on Form 10-Q, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

PART I—FINANCIAL INFORMATION

Item 1. Unaudited Condensed Consolidated Financial Statements

Spire Global, Inc.

Condensed Consolidated Balance Sheets

(In thousands, except share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2025 |

|

|

2024 |

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

35,931 |

|

|

$ |

19,206 |

|

Accounts receivable, net (including allowance of $245 and $148 as of

March 31, 2025 and December 31, 2024, respectively) |

|

|

10,172 |

|

|

|

11,926 |

|

Contract assets |

|

|

2,221 |

|

|

|

785 |

|

Other current assets |

|

|

3,570 |

|

|

|

3,278 |

|

Assets classified as held for sale |

|

|

56,455 |

|

|

|

56,963 |

|

Total current assets |

|

|

108,349 |

|

|

|

92,158 |

|

Property and equipment, net |

|

|

63,166 |

|

|

|

63,338 |

|

Operating lease right-of-use assets |

|

|

10,903 |

|

|

|

11,074 |

|

Goodwill |

|

|

14,759 |

|

|

|

14,735 |

|

Other intangible assets |

|

|

9,801 |

|

|

|

10,161 |

|

Other long-term assets |

|

|

1,868 |

|

|

|

2,109 |

|

Total assets |

|

$ |

208,846 |

|

|

$ |

193,575 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

7,287 |

|

|

$ |

11,592 |

|

Long-term debt, current portion |

|

|

100,075 |

|

|

|

93,936 |

|

Contract liabilities, current portion |

|

|

25,523 |

|

|

|

22,037 |

|

Other accrued expenses |

|

|

21,985 |

|

|

|

16,361 |

|

Liabilities associated with assets classified as held for sale |

|

|

6,860 |

|

|

|

7,667 |

|

Total current liabilities |

|

|

161,730 |

|

|

|

151,593 |

|

Contract liabilities, non-current |

|

|

22,163 |

|

|

|

23,489 |

|

Warrant liability |

|

|

9,054 |

|

|

|

13,641 |

|

Operating lease liabilities, net of current portion |

|

|

9,055 |

|

|

|

9,598 |

|

Other long-term liabilities |

|

|

1,289 |

|

|

|

6,941 |

|

Total liabilities |

|

|

203,291 |

|

|

|

205,262 |

|

Commitments and contingencies (Note 10) |

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

Common stock, $0.0001 par value, 1,000,000,000 Class A and 15,000,000 Class

B shares authorized, 30,967,114 Class A and 1,507,325 Class B shares issued

and outstanding at March 31, 2025; 25,711,165 Class A and 1,507,325 Class B

shares issued and outstanding at December 31, 2024 |

|

|

3 |

|

|

|

3 |

|

Additional paid-in capital |

|

|

576,758 |

|

|

|

536,184 |

|

Accumulated other comprehensive loss |

|

|

(12,445 |

) |

|

|

(9,770 |

) |

Accumulated deficit |

|

|

(558,761 |

) |

|

|

(538,104 |

) |

Total stockholders’ equity (deficit) |

|

|

5,555 |

|

|

|

(11,687 |

) |

Total liabilities and stockholders’ equity |

|

$ |

208,846 |

|

|

$ |

193,575 |

|

The accompanying notes are an integral part of these unaudited Condensed Consolidated Financial Statements.

Spire Global, Inc.

Condensed Consolidated Statements of Operations

(In thousands, except share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2025 |

|

|

2024 |

|

Revenue |

|

$ |

23,876 |

|

|

$ |

34,825 |

|

Cost of revenue |

|

|

15,092 |

|

|

|

25,596 |

|

Gross profit |

|

|

8,784 |

|

|

|

9,229 |

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

|

8,509 |

|

|

|

6,037 |

|

Sales and marketing |

|

|

4,735 |

|

|

|

5,118 |

|

General and administrative |

|

|

15,810 |

|

|

|

9,844 |

|

Loss on decommissioned satellites |

|

|

5,160 |

|

|

|

178 |

|

Allowance for current expected credit loss on notes receivable |

|

|

— |

|

|

|

40 |

|

Total operating expenses |

|

|

34,214 |

|

|

|

21,217 |

|

Loss from operations |

|

|

(25,430 |

) |

|

|

(11,988 |

) |

Other income (expense): |

|

|

|

|

|

|

Interest income |

|

|

20 |

|

|

|

454 |

|

Interest expense |

|

|

(5,730 |

) |

|

|

(5,053 |

) |

Change in fair value of contingent earnout liability |

|

|

1,038 |

|

|

|

(45 |

) |

Change in fair value of warrant liabilities |

|

|

5,837 |

|

|

|

(4,202 |

) |

Issuance of stock warrants |

|

|

— |

|

|

|

(2,399 |

) |

Foreign exchange gain (loss) |

|

|

3,826 |

|

|

|

(1,786 |

) |

Other expense, net |

|

|

(224 |

) |

|

|

(534 |

) |

Total other income (expense), net |

|

|

4,767 |

|

|

|

(13,565 |

) |

Loss before income taxes |

|

|

(20,663 |

) |

|

|

(25,553 |

) |

Income tax benefit |

|

|

(6 |

) |

|

|

(9 |

) |

Net loss |

|

$ |

(20,657 |

) |

|

$ |

(25,544 |

) |

Basic and diluted net loss per share |

|

$ |

(0.77 |

) |

|

$ |

(1.17 |

) |

Weighted-average shares used in computing basic and diluted net loss per share |

|

|

26,787,097 |

|

|

|

21,813,045 |

|

The accompanying notes are an integral part of these unaudited Condensed Consolidated Financial Statements.

Spire Global, Inc.

Condensed Consolidated Statements of Comprehensive Loss

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2025 |

|

|

2024 |

|

Net loss |

|

$ |

(20,657 |

) |

|

$ |

(25,544 |

) |

Other comprehensive loss: |

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

(2,675 |

) |

|

|

(1,560 |

) |

Net unrealized loss on investments

(net of tax) |

|

|

— |

|

|

|

(2 |

) |

Comprehensive loss |

|

$ |

(23,332 |

) |

|

$ |

(27,106 |

) |

The accompanying notes are an integral part of these unaudited Condensed Consolidated Financial Statements.

Spire Global, Inc.

Condensed Consolidated Statements of Changes in Stockholders’ Equity

(In thousands, except share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Additional

Paid in |

|

|

Accumulated

Other

Comprehensive |

|

|

Accumulated |

|

|

Total

Stockholders' |

|

|

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Loss |

|

|

Deficit |

|

|

Equity |

|

Balance, December 31, 2024 |

|

|

|

27,218,490 |

|

|

$ |

3 |

|

|

$ |

536,184 |

|

|

$ |

(9,770 |

) |

|

$ |

(538,104 |

) |

|

$ |

(11,687 |

) |

Release of Restricted Stock Units

and Performance Stock Units |

|

|

|

339,059 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Exercise of stock options |

|

|

|

73,140 |

|

|

|

— |

|

|

|

640 |

|

|

|

— |

|

|

|

— |

|

|

|

640 |

|

Stock compensation expense |

|

|

|

— |

|

|

|

— |

|

|

|

3,887 |

|

|

|

— |

|

|

|

— |

|

|

|

3,887 |

|

Issuance of common stock under the

Securities Purchase Agreements, net |

|

|

|

4,843,750 |

|

|

|

— |

|

|

|

36,047 |

|

|

|

— |

|

|

|

— |

|

|

|

36,047 |

|

Net loss |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(20,657 |

) |

|

|

(20,657 |

) |

Foreign currency translation

adjustments |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,675 |

) |

|

|

— |

|

|

|

(2,675 |

) |

Balance, March 31, 2025 |

|

|

|

32,474,439 |

|

|

$ |

3 |

|

|

$ |

576,758 |

|

|

$ |

(12,445 |

) |

|

$ |

(558,761 |

) |

|

$ |

5,555 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Additional

Paid in |

|

|

Accumulated

Other

Comprehensive |

|

|

Accumulated |

|

|

Total

Stockholders' |

|

|

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Loss |

|

|

Deficit |

|

|

Equity |

|

Balance, December 31, 2023 |

|

|

|

22,604,676 |

|

|

$ |

2 |

|

|

$ |

477,624 |

|

|

$ |

(4,556 |

) |

|

$ |

(435,286 |

) |

|

$ |

37,784 |

|

Release of Restricted Stock Units

and Performance Stock Units |

|

|

|

204,511 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Exercise of stock options |

|

|

|

37,536 |

|

|

|

— |

|

|

|

267 |

|

|

|

— |

|

|

|

— |

|

|

|

267 |

|

Stock compensation expense |

|

|

|

— |

|

|

|

— |

|

|

|

3,628 |

|

|

|

— |

|

|

|

— |

|

|

|

3,628 |

|

Issuance of common stock under

Securities Purchase Agreements, net |

|

|

|

2,976,191 |

|

|

|

1 |

|

|

|

37,881 |

|

|

|

— |

|

|

|

— |

|

|

|

37,882 |

|

Net loss |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(25,544 |

) |

|

|

(25,544 |

) |

Foreign currency translation

adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,560 |

) |

|

|

— |

|

|

|

(1,560 |

) |

Net unrealized loss on

investments (net of tax) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2 |

) |

|

|

— |

|

|

|

(2 |

) |

Balance, March 31, 2024 |

|

|

25,822,914 |

|

|

$ |

3 |

|

|

$ |

519,400 |

|

|

$ |

(6,118 |

) |

|

$ |

(460,830 |

) |

|

$ |

52,455 |

|

The accompanying notes are an integral part of these unaudited Condensed Consolidated Financial Statements.

Spire Global, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2025 |

|

|

2024 |

|

Cash flows from operating activities |

|

|

|

|

|

|

Net loss |

|

$ |

(20,657 |

) |

|

$ |

(25,544 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

4,413 |

|

|

|

6,837 |

|

Stock-based compensation |

|

|

3,887 |

|

|

|

3,628 |

|

Amortization of operating lease right-of-use assets |

|

|

746 |

|

|

|

809 |

|

Amortization of debt issuance costs |

|

|

851 |

|

|

|

900 |

|

Change in fair value of warrant liabilities |

|

|

(5,837 |

) |

|

|

4,202 |

|

Change in fair value of contingent earnout liability |

|

|

(1,038 |

) |

|

|

45 |

|

Issuance of stock warrants |

|

|

— |

|

|

|

2,399 |

|

Loss on decommissioned satellites and disposal of assets |

|

|

5,160 |

|

|

|

432 |

|

Other, net |

|

|

778 |

|

|

|

228 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable, net |

|

|

2,584 |

|

|

|

(2,564 |

) |

Contract assets |

|

|

(1,619 |

) |

|

|

(642 |

) |

Other current assets |

|

|

(188 |

) |

|

|

8,095 |

|

Other long-term assets |

|

|

451 |

|

|

|

516 |

|

Accounts payable |

|

|

(3,819 |

) |

|

|

(1,508 |

) |

Accrued wages and benefits |

|

|

663 |

|

|

|

343 |

|

Contract liabilities |

|

|

1,958 |

|

|

|

(7,157 |

) |

Other accrued expenses |

|

|

3,825 |

|

|

|

1,003 |

|

Operating lease liabilities |

|

|

(579 |

) |

|

|

(872 |

) |

Other long-term liabilities |

|

|

(8 |

) |

|

|

— |

|

Net cash used in operating activities |

|

|

(8,429 |

) |

|

|

(8,850 |

) |

Cash flows from investing activities |

|

|

|

|

|

|

Purchases of short-term investments |

|

|

— |

|

|

|

(10,920 |

) |

Maturities of short-term investments |

|

|

— |

|

|

|

10,800 |

|

Purchase of property and equipment |

|

|

(8,901 |

) |

|

|

(7,059 |

) |

Net cash used in investing activities |

|

|

(8,901 |

) |

|

|

(7,179 |

) |

Cash flows from financing activities |

|

|

|

|

|

|

Proceeds from Securities Purchase Agreements, net |

|

|

37,297 |

|

|

|

37,881 |

|

Proceeds from exercise of stock options |

|

|

640 |

|

|

|

267 |

|

Net cash provided by financing activities |

|

|

37,937 |

|

|

|

38,148 |

|

Effect of foreign currency translation on cash, cash equivalents and restricted cash |

|

|

(3,828 |

) |

|

|

465 |

|

Net increase in cash, cash equivalents and restricted cash |

|

|

16,779 |

|

|

|

22,584 |

|

Cash, cash equivalents and restricted cash |

|

|

|

|

|

|

Beginning balance |

|

|

19,684 |

|

|

|

29,633 |

|

Ending balance |

|

$ |

36,463 |

|

|

$ |

52,217 |

|

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

Cash paid for interest |

|

$ |

3,862 |

|

|

$ |

3,983 |

|

Income taxes paid |

|

$ |

— |

|

|

$ |

15 |

|

Noncash operating, investing and financing activities |

|

|

|

|

|

|

Property and equipment purchased but not yet paid |

|

$ |

964 |

|

|

$ |

2,135 |

|

Right-of-use assets obtained in exchange for lease liabilities |

|

$ |

378 |

|

|

$ |

353 |

|

The accompanying notes are an integral part of these unaudited Condensed Consolidated Financial Statements.

Spire Global, Inc.

Notes to Condensed Consolidated Financial Statements

(In thousands, except shares and per share data, unless otherwise noted)

(Unaudited)

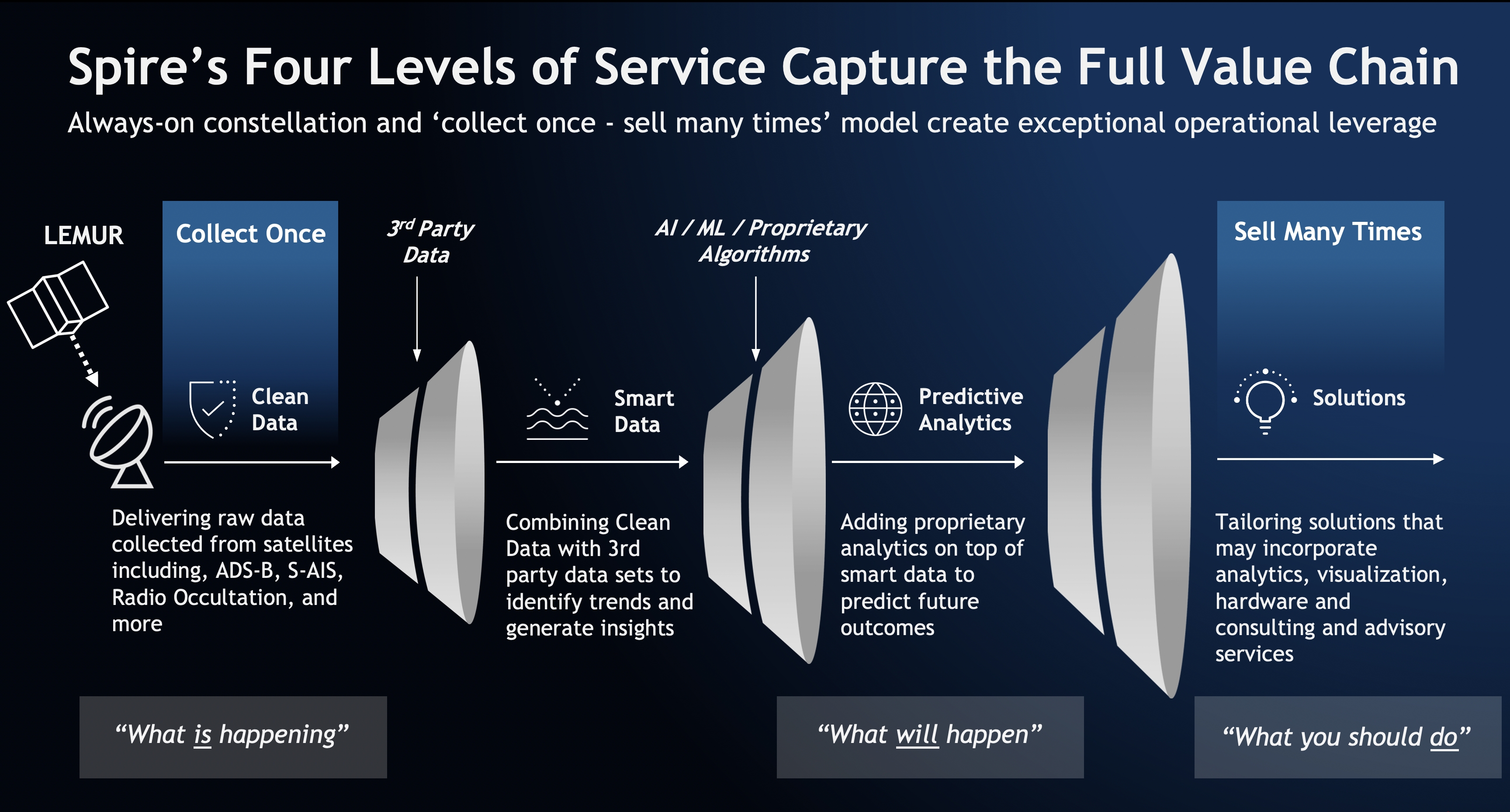

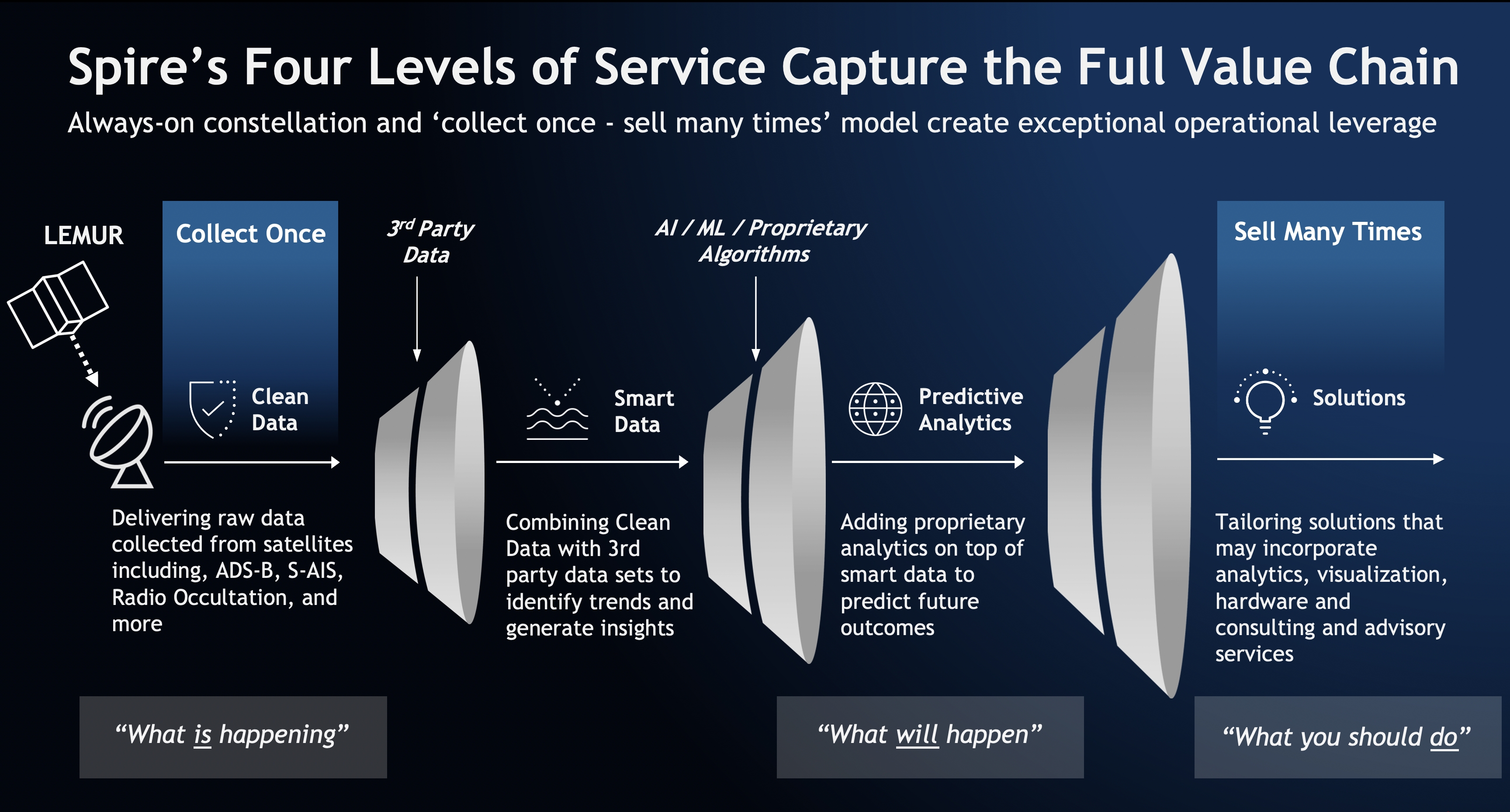

Spire Global, Inc. (“Spire” or the “Company”), founded in August 2012, is a global provider of space-based data and analytics that offers its customers unique datasets and insights about earth from space. The Company collects this space-based data through its proprietary constellation of multi-purpose nanosatellites. The Company designs, manufacturers, integrates, and operates its own satellites and ground stations to deliver unique end-to-end comprehensive solutions. The Company offers the following three data solutions to customers: Maritime, Aviation, and Weather and Climate. As a fourth solution, the Company is providing “space-as-a-service” through its Space Services solution.

The Company is headquartered in Vienna, Virginia and has wholly owned operating subsidiaries in the United States, United Kingdom, Luxembourg, Singapore, Australia, Germany, and Canada.

On August 16, 2021, Spire Global Subsidiary, Inc. (formerly known as Spire Global, Inc.) (“Legacy Spire”) closed its previously announced merger with NavSight Holdings, Inc. (“NavSight”), a special purpose acquisition company. As a result, Legacy Spire continued as the surviving corporation and a wholly owned subsidiary of NavSight (the “Merger,” and such consummation, the “Closing”). NavSight then changed its name to Spire Global, Inc. and Legacy Spire changed its name to Spire Global Subsidiary, Inc.

On September 14, 2022, the Company entered into an Equity Distribution Agreement (the “Equity Distribution Agreement”) with Canaccord Genuity LLC, as sales agent (the “Agent”). In accordance with the terms of the Equity Distribution Agreement, the Company may offer and sell its Class A common stock, having an aggregate offering price of up to $85,000 from time to time through the Agent pursuant to a registration statement on Form S-3, which became effective on September 26, 2022. Under the Equity Distribution Agreement, the Company sold 2,166,389 shares of its Class A common stock as of March 31, 2025 and no shares during the three months ended March 31, 2025 and 2024. Because of the late filings of the Company’s Quarterly Reports on Form 10-Q for the quarters ended June 30, 2024 and September 30, 2024, the Company is unable to make sales pursuant to the Equity Distribution Agreement until the Company regains its eligibility to use Form S-3.

On February 4, 2024, the Company and Signal Ocean Ltd (“Signal Ocean”) entered into a securities purchase agreement for the issuance and sale of 833,333 shares of the Company’s Class A common stock to Signal Ocean at a price of $12.00 per share (the “2024 Private Placement”). The 2024 Private Placement closed on February 8, 2024, resulting in net proceeds to the Company of $9,825, after deducting offering expenses.

On March 21, 2024, the Company entered into a Securities Purchase Agreement (the “2024 Securities Purchase Agreement”) with institutional investors (the “Investors”), pursuant to which the Company issued and sold in a registered direct offering (the “Offering”), (i) an aggregate of 2,142,858 shares of Class A common stock and (ii) warrants exercisable for an aggregate of 2,142,858 shares of Class A common stock (“Securities Purchase Agreement Warrants”) to the Investors. Each share of Class A common stock and accompanying Securities Purchase Agreement Warrant to purchase one share of Class A common stock was sold at an offering price of $14.00. The aggregate net proceeds to the Company from the Offering totaled $28,056, after deducting offering expenses. The Securities Purchase Agreement Warrants had an exercise price equal to $14.50 per share of Class A common stock, were exercisable for a term beginning on March 25, 2024, and expired on July 3, 2024, with no warrants exercised.

On March 21, 2024, the Company entered into a placement agency agreement with Alliance Global Partners (“A.G.P” or the “Placement Agent”), pursuant to which the Company engaged A.G.P as the exclusive placement agent in connection with the Offering. The Company paid A.G.P a cash fee equal to 6% of the gross proceeds from the sale of shares and Securities Purchase Agreement Warrants to the Investors, or $1,800, in March 2024. The Company agreed to pay a cash fee equal to 4% of the gross exercise price paid in cash with respect to the exercise of the Securities Purchase Agreement Warrants, which are now expired.

On November 13, 2024, the Company entered into a Share Purchase Agreement (the “Purchase Agreement”) with Kpler Holding SA, a Belgian corporation (“Buyer”), pursuant to which the Company agreed to sell its maritime business to Buyer and enter into certain ancillary agreements (the “Transactions”). The maritime business sold pursuant to the Transactions did not include any part of the Company’s satellite network or operations. On April 25, 2025, the Company completed the sale of its

Spire Global, Inc.

Notes to Condensed Consolidated Financial Statements

(In thousands, except shares and per share data, unless otherwise noted)

(Unaudited)

maritime business to Buyer for approximately $233,500, before adjustments. On April 25, 2025, the Company and L3Harris Technologies, Inc. (“L3Harris”), entered into the Confidential Settlement Agreement and Mutual Release (the “Settlement Agreement”) (as defined in Note 14) among the Company, exactEarth Ltd. (“exactEarth”) and L3Harris, pursuant to which, upon the closing of the Transactions, Buyer paid L3Harris $17,000 for full and complete resolution and release of all disputes asserted in connection with the A&R L3Harris Agreement between the Company and L3Harris. The Company and Buyer further agreed that the Company would contribute $7,000 of the Settlement in the form of a reduction to the cash paid by Buyer to the Company at the closing of the Transactions. Refer to Note 2, Summary of Significant Accounting Policies, and Note 14, Subsequent Events, for a detailed discussion.

On March 12, 2025, the Company entered into a Securities Purchase Agreement (the “2025 Securities Purchase Agreement”) with the purchasers named therein for the private placement (the “2025 Private Placement”) of (i) 4,843,750 shares of Class A common stock at a purchase price of $8.00 per share and (ii) pre-funded warrants (the “Pre-Funded Warrants”) to purchase 156,250 shares of Class A common stock at a purchase price of $7.9999 per Pre-Funded Warrant. The Pre-Funded Warrants have an exercise price of $0.0001 per share of Class A common stock, are exercisable immediately, and will terminate when exercised in full. The aggregate net proceeds for the 2025 Private Placement were $37,297, after deducting offering expenses. The 2025 Private Placement closed on March 14, 2025.

2.Summary of Significant Accounting Policies

Basis of Presentation

The condensed consolidated financial statements and accompanying notes are unaudited and have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and regulations of the U.S. Securities and Exchange Commission (the “SEC”) for interim financial reporting.

Certain information and footnote disclosures normally included in consolidated financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to rules and regulations applicable to interim financial reporting. The unaudited condensed consolidated financial statements were prepared on the same basis as the audited consolidated financial statements and, in the opinion of management, contain all adjustments, consisting of normal recurring adjustments, necessary for a fair statement of its financial position, results of operations and cash flows for the periods indicated. These condensed consolidated financial statements should be read in conjunction with the consolidated financial statements included within the Company’s Annual Report on Form 10-K/A for the year ended December 31, 2024.

The information as of December 31, 2024, included on the condensed consolidated balance sheets was derived from the Company’s audited consolidated financial statements. All intercompany accounts and transactions have been eliminated in consolidation.

Results of operations for the three months ended March 31, 2025, are not necessarily indicative of the results that may be expected for any other interim period or for the year ending December 31, 2025.

Reclassifications

Certain prior periods amounts have been reclassified to conform with the current period's presentation. These reclassifications had no impact on previously reported net loss.

Liquidity Risks and Uncertainties

The Company has a history of operating losses and negative cash flows from operations since inception. During the three months ended March 31, 2025, net loss was $20,657, cash used in operations was $8,429 and the Company received net proceeds of $37,297, after deducting offering expenses, from the 2025 Private Placement. The Company held cash and cash equivalents of $35,931, excluding restricted cash of $532, as of March 31, 2025.

Spire Global, Inc.

Notes to Condensed Consolidated Financial Statements

(In thousands, except shares and per share data, unless otherwise noted)

(Unaudited)

On November 13, 2024, the Company entered into the Purchase Agreement with Buyer, pursuant to which the Company agreed to complete the Transactions. The maritime business sold pursuant to the Transactions did not include any part of the Company’s satellite network or operations. The purchase price agreed to be paid by Buyer to the Company at the closing of the Transactions was a cash payment based upon an enterprise value of $233,500, subject to certain adjustments. The Transactions also included a twelve-month transition service and data provision agreement for $7,500.

On March 12, 2025, the Company entered into the 2025 Securities Purchase Agreement with the purchasers named therein for the 2025 Private Placement of (i) 4,843,750 shares of Class A common stock at a purchase price of $8.00 per share and (ii) Pre-Funded Warrants to purchase 156,250 shares of Class A common stock at a purchase price of $7.9999 per Pre-Funded Warrant. The Pre-Funded Warrants have an exercise price of $0.0001 per share of Class A common stock, are exercisable immediately, and will terminate when exercised in full. The aggregate net proceeds for the 2025 Private Placement were $37,297, after deducting offering expenses. The 2025 Private Placement closed on March 14, 2025.

On April 25, 2025, the Company completed the sale of its maritime business to Buyer for approximately $233,500, before adjustments. On April 25, 2025, the Company and L3Harris, entered into the Settlement Agreement among the Company, exactEarth and L3Harris, pursuant to which, upon the closing of the Transactions, Buyer paid L3Harris $17,000 for full and complete resolution and release of all disputes asserted in connection with the A&R L3Harris Agreement between the Company and L3Harris. The Company and Buyer further agreed that the Company would contribute $7,000 of the Settlement in the form of a reduction to the cash paid by Buyer to the Company at the closing of the Transactions.

On April 25, 2025, the Company repaid with a portion of the proceeds of the Transactions all obligations and all amounts borrowed, and all obligations have terminated, under the Blue Torch Financing Agreement (as defined below) and SIF (as defined below) loan agreement. Following the closing of the Transactions, the Company believes that it will have sufficient working capital to operate for a period of at least one year from the issuance of the March 31, 2025 condensed consolidated financial statements based on the Company’s current cash and cash equivalents balance of $35,931 and expected future financial results.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosures of contingent assets and liabilities at the dates of the condensed consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Management’s significant estimates include assumptions for revenue recognition, which requires estimates of total costs used in measuring the progress of completion for the cost-based input method, allowance for current expected credit losses, realizability of deferred income tax assets, and fair value of equity awards, contingent earnout liabilities, and warrant liabilities. Actual results could differ from those estimates.

Cash, Cash Equivalents and Restricted Cash

The Company considers all highly liquid investments with an original maturity of three months or less to be cash equivalents. Restricted cash included in other long-term assets, including restricted cash on the condensed consolidated balance sheets, represents amounts pledged as guarantees or collateral for financing arrangements and lease agreements, as contractually required.

The following table shows components of cash, cash equivalents, and restricted cash reported on the condensed consolidated balance sheets and in the condensed consolidated statements of cash flows as of the dates indicated:

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2025 |

|

|

2024 |

|

Cash and cash equivalents |

|

$ |

35,931 |

|

|

$ |

19,206 |

|

Restricted cash included in other long-term assets |

|

|

532 |

|

|

|

478 |

|

|

|

$ |

36,463 |

|

|

$ |

19,684 |

|

Spire Global, Inc.

Notes to Condensed Consolidated Financial Statements

(In thousands, except shares and per share data, unless otherwise noted)

(Unaudited)

Concentrations of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist of cash, cash equivalents and restricted cash, notes receivable, and accounts receivable. The Company typically has cash accounts in excess of Federal Deposit Insurance Corporation insurance coverage limits. The Company has a $4,500 note receivable and a $744 accrued interest balance outstanding relating to one customer and the Company has an allowance for current expected credit loss on the note receivable and accrued interest balance for the full amount as of each of March 31, 2025 and December 31, 2024 (Note 10).

The Company has a concentration of contractual revenue arrangements with various government agencies.

The following customers represented 10% or more of the Company’s total revenue for each of the following periods:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

Revenue: |

|

2025 |

|

|

2024 |

|

Customer A (1) |

|

|

15 |

% |

|

|

17 |

% |

Customer B |

|

* |

|

|

|

28 |

% |

Customer C |

|

|

10 |

% |

|

* |

|

|

|

|

|

|

|

|

Accounts Receivable: |

|

March 31, 2025 |

|

|

December 31, 2024 |

|

Customer C |

|

* |

|

|

|

13 |

% |

Customer D |

|

* |

|

|

|

13 |

% |

Customer E |

|

|

14 |

% |

|

* |

|

Customer F |

|

|

13 |

% |

|

* |

|

* Revenue from customer was less than 10% of total revenue during the applicable period or accounts receivable from customer were less than 10% of total accounts receivable during the applicable period.

(1) Consists of multiple U.S. government agencies, of which no government agency represented greater than 10% of total revenue for the three months ended March 31, 2025 and one government agency represented greater than 10% of total revenue for the three months ended March 31, 2024.

Related Parties

In conjunction with the Company’s acquisition of exactEarth (the “Acquisition”) in November 2021, Myriota Pty Ltd (“Myriota”), an existing Spire customer, became a related party as a result of exactEarth’s approximately 13% ownership of Myriota at the time of acquisition. As of March 31, 2025, the Company had 7.9% ownership of Myriota. The investment in Myriota of $622 and $858 was included in other long-term assets, including restricted cash on the condensed consolidated balance sheets as of March 31, 2025, and December 31, 2024, respectively. The Company accounts for this investment using the equity method of accounting due to its representation on Myriota’s board of directors. The Company’s share of earnings or losses on the investment is recorded on a one month lag, due to the timing of receiving financial statements from Myriota, as a component of other expense, net in the condensed consolidated statements of operations. The Company generated $72 in revenue from Myriota for the three months ended March 31, 2025, and had no accounts receivable, from Myriota, as of March 31, 2025. The Company generated $217 in revenue from Myriota for the three months ended March 31, 2024, and had $52 of accounts receivable from Myriota as of December 31, 2024.

Accounting Pronouncements Not Yet Adopted

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740) - Improvements to Income Tax Disclosures, which includes amendments that further enhance income tax disclosures, primarily through standardization and disaggregation of rate reconciliation categories and income taxes paid by jurisdiction. The guidance is effective for annual reporting periods beginning after December 15, 2024, with early adoption permitted, and should be applied prospectively or retrospectively. The Company is currently evaluating the impact that the adoption of ASU 2023-09 will have on its consolidated financial statements and disclosures.

In November 2024, the FASB issued ASU 2024-03, Income Statement-Reporting Comprehensive Income-Expense Disaggregation Disclosures (Subtopic 220-40). Additionally, in January 2025, the FASB issued ASU 2025-01 to clarify the effective date of ASU 2024-03. The standard provides guidance to expand disclosures related to the disaggregation of income statement expenses. The standard requires, in the notes to the financial statements, disclosure of specified information about

Spire Global, Inc.

Notes to Condensed Consolidated Financial Statements

(In thousands, except shares and per share data, unless otherwise noted)

(Unaudited)

certain costs and expenses, which includes purchases of inventory, employee compensation, depreciation and intangible asset amortization included in each relevant expense caption. This guidance is effective for fiscal years beginning after December 15, 2026, and interim periods within annual reporting periods beginning after December 15, 2027, on a retrospective or prospective basis, with early adoption permitted. The Company is assessing the guidance, noting the adoption impacts disclosure only.

3.Revenue, Contract Assets, Contract Liabilities and Remaining Performance Obligations

Disaggregation of Revenue

Revenue from subscription-based contracts was $19,510, or 82% of total revenue, for the three months ended March 31, 2025, and was $18,166, or 52% of total revenue, for the three months ended March 31, 2024. Revenue from non-subscription-based contracts was $4,366, or 18% of total revenue, for the three months ended March 31, 2025, and was $16,659, or 48% of total revenue, for the three months ended March 31, 2024.

The following revenue disaggregated by geography, derived from billing addresses, was recognized:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2025 |

|

|

Three Months Ended March 31, 2024 |

|

Americas (1) |

|

$ |

13,580 |

|

|

|

57 |

% |

|

$ |

22,680 |

|

|

|

65 |

% |

EMEA(2) |

|

|

8,217 |

|

|

|

34 |

% |

|

|

9,959 |

|

|

|

29 |

% |

Asia Pacific |

|

|

2,079 |

|

|

|

9 |

% |

|

|

2,186 |

|

|

|

6 |

% |

Total |

|

$ |

23,876 |

|

|

|

100 |

% |

|

$ |

34,825 |

|

|

|

100 |

% |

(1)U.S. represented 50% and 34% of total revenue for the three months ended March 31, 2025, and 2024, respectively. Canada represented 30% of total revenue for the three months ended March 31, 2024.

(2)United Kingdom represented 14% of total revenue for the three months ended March 31, 2025.

Contract Assets

As of March 31, 2025, contract assets were $2,221, which was reported in contract assets on the Company’s condensed consolidated balance sheets. As of December 31, 2024, contract assets of $785 were reported in contract assets on the Company’s condensed consolidated balance sheets.

Changes in contract assets for the three months ended March 31, 2025 and 2024 were as follows:

|

|

|

|

|

|

|

|

|

|

|

2025 |

|

|

2024 |

|

Balance as of January 1 |

|

$ |

785 |

|

|

$ |

4,917 |

|

Contract assets recorded during the period |

|

|

2,126 |

|

|

|

4,696 |

|

Reclassified to accounts receivable |

|

|

(710 |

) |

|

|

(4,399 |

) |

Other |

|

|

20 |

|

|

|

(29 |

) |

Balance as of March 31 |

|

$ |

2,221 |

|

|

$ |

5,185 |

|

Contract Liabilities

As of March 31, 2025, contract liabilities were $47,686, of which $25,523 was reported in contract liabilities, current portion, and $22,163 was reported in other long-term liabilities on the Company’s condensed consolidated balance sheets. As of

Spire Global, Inc.

Notes to Condensed Consolidated Financial Statements

(In thousands, except shares and per share data, unless otherwise noted)

(Unaudited)

December 31, 2024, contract liabilities were $45,526, of which $22,037 was reported in contract liabilities, current portion, and $23,489 was reported in other long-term liabilities on the Company’s condensed consolidated balance sheets.

Changes in contract liabilities for the three months ended March 31, 2025 and 2024 were as follows:

|

|

|

|

|

|

|

|

|

|

|

2025 |