Forward-Looking Statements

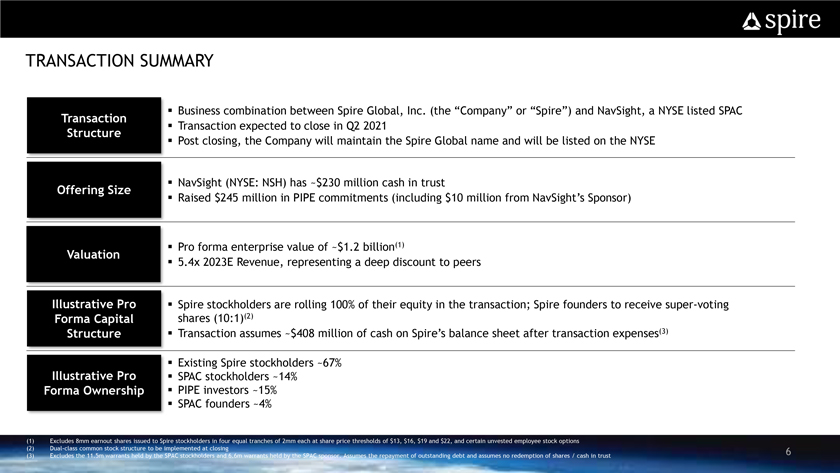

This document contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed business combination

transactions (the “Transactions”) between Spire Global, Inc. (“Spire”) and NavSight Holdings, Inc. (NavSight”), including statements regarding the benefits of the Transactions and the anticipated timing of the Transactions.

Forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,” “would” and similar expressions. These forward-looking statements include, but are not limited to, statements regarding estimates and

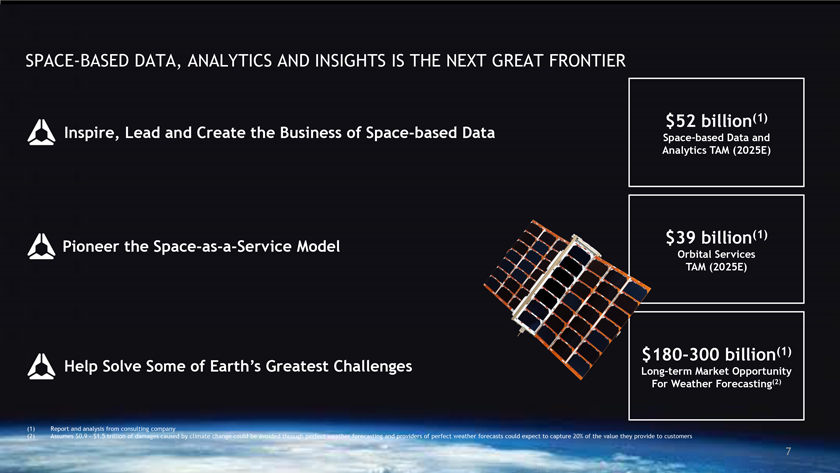

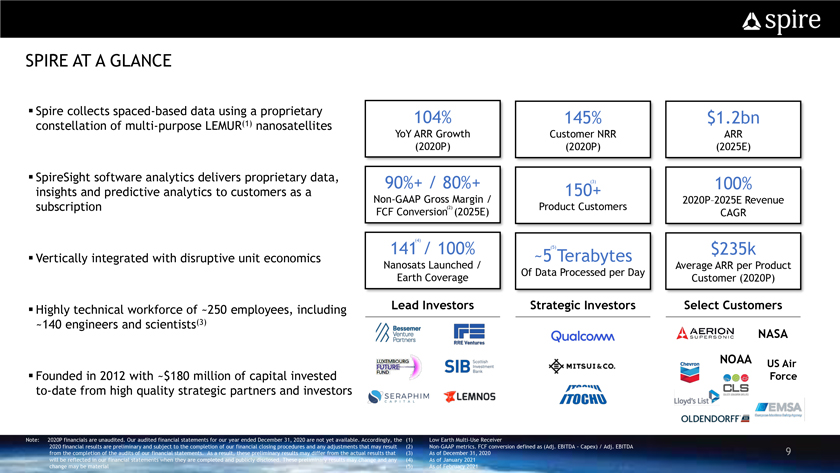

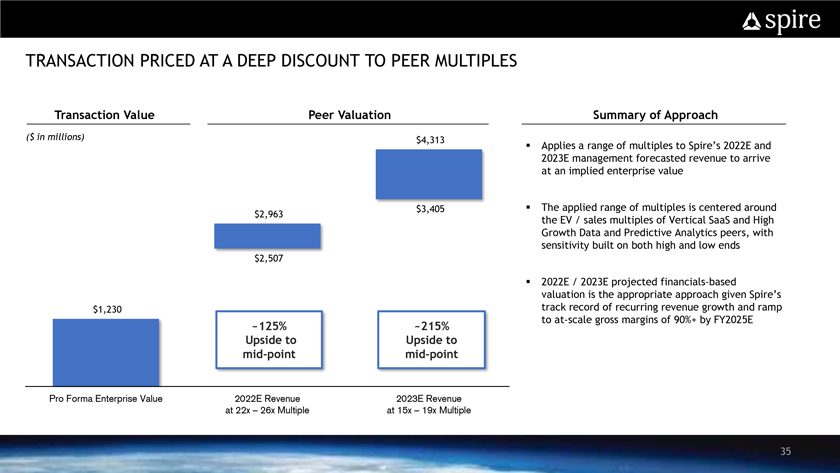

forecasts of financial and performance metrics, expectations of achieving and maintaining profitability, projections of total addressable markets, market opportunity and market share, net proceeds from the Transactions, potential benefits of the

Transaction and the potential success of Spire’s market and growth strategies, and expectations related to the terms and timing of the Transactions. These statements are based on various assumptions and on the current expectations of

NavSight’s and Spire’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a

guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many factors could cause actual future events to differ

materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the Transactions may not be completed in a timely manner or at all, which may adversely affect the price of NavSight’s

securities, (ii) the risk that the Transactions may not be completed by NavSight’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by NavSight, (iii) the

failure to satisfy the conditions to the consummation of the Transactions, including the approval by the stockholders of NavSight, the satisfaction of the minimum trust account amount following redemptions by NavSight’s public stockholders and

the receipt of certain governmental and regulatory approvals, (iv) the inability to complete the PIPE investment in connection with the Transactions, (v) the risk that the proposed Transactions may not generate expected net proceeds to the

combined company; (vi) the occurrence of any event, change or other circumstance that could give rise to the termination of the Transactions, (vii) the effect of the announcement or pendency of the Transactions on Spire’s business

relationships, performance, and business generally, (viii) risks that the Transactions disrupt current plans of Spire and potential difficulties in Spire employee retention as a result of the Transactions, (ix) the outcome of any legal

proceedings that may be instituted against Spire or against NavSight related to the Transactions, (x) the ability to maintain the listing of NavSight’s securities on The New York Stock Exchange, (xi) volatility in the price of

NavSight’s securities, (xii) the ability to implement business plans, forecasts, and other expectations after the completion of the Transactions, and identify