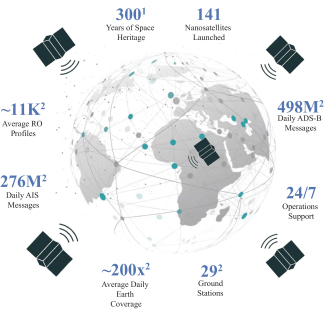

(“ADS-B”), aviation stakeholders were blind to the vast majority of global aerospace activity, as terrestrial-based solutions were unable to track aircraft over oceans. This occasionally resulted in tragedies like that of Malaysia Airlines Flight 370, which disappeared in March 2014 while flying a routine route from Kuala Lumpur to Beijing. In March 2021, our sensors covered the entirety of the globe over 200 times per day on average, including remote areas where terrestrial AIS, ADS-B, and atmospheric weather information are out of reach. We believe we are the only player that collects satellite AIS data, satellite ADS-B data and radio occultation weather data globally and simultaneously, both allowing us to combine them into our solutions as well as granting us unique insights and the opportunity to cross-sell to customers.

Our Solution Offerings

Our proprietary constellation of LEMUR nanosatellites collects and transmits data to our proprietary global ground station network. The data is then autonomously moved from ground stations to proprietary data warehouses for cleansing, standardization, fusion, and analysis. Via the SpireSight API, our customers receive proprietary data, analysis, and predictive solutions delivered seamlessly in near real time.

We collect data from space once and can sell it an unlimited number of times without added cost. The three forms of data we monetize are:

| • | Clean data: Clean and structured data directly off our proprietary nanosatellites; |

| • | Smart data: Clean data fused with third-party datasets and proprietary analysis to enhance value and provide insights; and |

| • | Predictive solutions: Big data, AI, and ML algorithms applied to fused data sets to create predictive analytics and insights. |

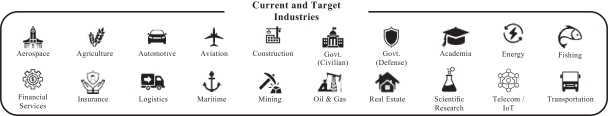

We monetize our proprietary solutions across a broad and growing range of current and target industries including agriculture, logistics, financial services, and real estate, among others. The largest industries we currently serve include maritime, aviation and government (civilian and defense).

Maritime

We provide precise space-based data, insights and predictive analytics for highly accurate ship monitoring, ship safety and route optimization. We leverage the International Maritime Organization AIS standard, which is an automatic tracking system that uses transceivers on ships to provide geographic location data with minimal latency through historical or live satellite AIS (“S-AIS”) data as observed by our satellites and terrestrial AIS (“T-AIS”) data from third party sensor stations. Our AIS-based maritime solutions increase global maritime domain awareness, facilitate coastline policing, and provide greater visibility of the poles. Key applications include:

| • | Tracking vessels globally: Precise vessel tracking using AIS data helps owners and operators know where vessels are located. Using Vessels API, customers can run queries by Maritime Mobile Service Identity (MMSI), vessel name, call signs, AIS class type, and more; |

| • | Optimizing fuel efficiencies: Smart route planning, identification of busy shipping lanes, and port selection enable customers to effectively manage fuel costs; |

210